If buttercups buzz’d after the bee

If boats were on land, churches on sea

If ponies rode men and if grass ate the cows

And cats should be chased into holes by the mouse

If the mamas sold their babies

To the Gypsies for half a crown

If summer were spring

And the other way ‘round

Then all the world would be upside down!

– 17th century English children’s song

“There are decades when nothing happens, and there are weeks when decades happen.”

– Vladimir Ilyich Ulyanov, alias Lenin

“For someone will say, ‘His [Paul’s] letters are severe and forceful, but his bodily presence is weak, and his speech contemptible.’”

– 2 Corinthians 10:1 and 10

The internet, mainstream media, and Twitter are burning 24/7 with talk of Brexit. I will offer a few thoughts on Brexit at the end of the letter, but I’ll reserve any serious look at the future implications of Britain’s leaving the EU for a later letter, after I’ve had some time for reflection and analysis. I think the implications are every bit as serious as most analysts and commentators suggest, and that means the subject deserves more than reflexive punditry.

Instead, I’m going to proceed to give you an updated version of my speech from one month ago at the Strategic Investment Conference. It actually has (as you will see) more relevance today than it did a month ago. We have edited the transcript so that the speech is much shorter and tighter; and of course, going back over it, I came up with a few thoughts here and there that I would like to have inserted in the original. I like this updated version better than the transcript. Like St. Paul, I guess taking the time to organize my thoughts and perform numerous edits does improve my message.

And speaking of transcripts, those of you who buy the Virtual Pass to SIC 2016 get the audio versions of the speeches from the Strategic Investment Conference, and you also get the PowerPoints and a complete transcript of each speech and panel, plus a highlights video. That’s a package that’s almost as good as being there.

Some people drive to work or have time and prefer to listen to audios. I am one of those who prefers to read. My partners at Mauldin Economics have made it so that you can have it both ways. Plus, there are about 1,000 slides in total. It’s a pretty cool package and well worth the price. You can get the Virtual Pass by clicking here. It will be available for only a short time. Actually, management had already taken it off the website, but I told them that I was uncomfortable with putting my speech there and then not making the other speeches available, so they extended the offer for a limited period. Don’t procrastinate. And now, let’s turn to my speech.

Thinking the Unthinkable

As many of you know, I am in the process of writing a book on what the world will look like in 20 years. Much of the book is about exciting new technologies, which I’m convinced will make the world of 2036 far more exciting and wonderful than it is today. Nobody will want to go back to the good old days of 2016. But the potential wealth humanity can create seems to be counterbalanced by the amount of wealth that governments and central banks can destroy.

For the last few years I’ve been talking about the exciting changes that lie ahead in what I call the Age of Transformation. Today, we’ll look at the Dark Side of that age. We are going to talk about government and the wealth destruction that governments have the potential to unleash. We begin with a poem:

If buttercups buzz’d after the bee

If boats were on land, churches on sea

If ponies rode men and if grass ate the cows

And cats should be chased into holes by the mouse

If the mamas sold their babies

To the Gypsies for half a crown

If summer were spring

And the other way ‘round

Then all the world would be upside down!

That was an English children’s song from the 1600s and 1700s. Click here to hear it. In ages past, it was traditional for a defeated army to walk through the ranks of the victorious army. It was also traditional for the losing army to play the song of the victors. When Cornwallis surrendered for the second time to the Americans, Washington refused to let the British play an American song, so they played the children’s song “When the World Was Turned Upside Down.” At least, that’s what the legends say.

In this case, the losing army was twice as big as the winning army. Most military strategists assume that you need an army three times the size of the defending army to attack a well-fortified position. It was unthinkable to the British officers and their soldiers that they could lose. And Cornwallis might have held out, even with heavy losses, had he known that just two weeks later General Clinton and the British Navy would arrive. He would have lost of few thousand soldiers, but the English would have won the war, and the US would now be Australia, albeit much bigger and without Vegemite.

Losing was unthinkable to the British, but lose they did; and that is what we are going to talk about today: thinking the unthinkable.

If I had come on to this stage four years ago and told you, my friends, that we were going to have 40% of the world’s governmental debt at negative interest rates, $10 trillion on central bank balance sheets, and $10 trillion worth of dollar-denominated emerging-market debt, and that global GDP growth would average only 2%, unemployment would be below 5%, and interest rates would be negative in much of the world and less than 50 basis points in the US, you would have laughed me out of the room. You would have all hit the unsubscribe button. Today’s world was unthinkable a mere four to five years ago.

But now, given what has happened and what I think is likely to happen, we have to start thinking the unthinkable. When I say this, I mean in the next 2–5–10 or 20 years, not next quarter. I have great news for you, too: we are going to get through this. Yes, we face potentially disastrous problems, but we’ll survive to be better than ever. Like my friend George Friedman said yesterday, “The world is going to hell… but we’re okay.”

(Sidebar: while editing this, I decided to Google the words thinking the unthinkable. I found numerous speeches and books and articles that either had that phrase as their title or contained the words. This quote from The Weekly Standard gave me pause:

As a futurist, Herman Kahn’s job was to think about the unthinkable. And the unthinkable subject in the 1960s was thermonuclear war. Kahn’s analysis struck a nerve; going beyond consideration of how to prevent a nuclear war, he assessed how the United States could survive and win one. This step proved more than most national defense experts could bring themselves to contemplate. The use of rationalist methods to study an event of such hideous proportions was nothing short of an outrage; in fact, it earned Kahn a place in the annals of film history as the inspiration for the mad title character of Stanley Kubrick’s Dr. Strangelove.

I certainly hope I don’t inspire such a response. And I’m sure there will be people who will find some of the ideas and scenarios I am considering implausible, but I am worried that we are on a slippery slope of ideas and actions with no real way to pull back. Back to the speech.)

The Weakest Link

Before we can contemplate what might happen in the future, we have to first examine what I think of as a global economic chain with a series of weak links. I am going to argue that there are five major weak links.

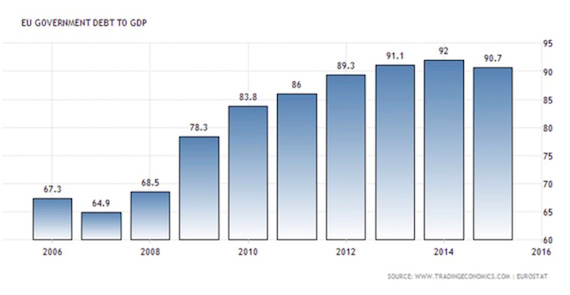

The first weak link is Europe and its debt. On average, across the continent, the debt-to-GDP ratio is about 90%. It is up to 135% and will soon be a 140% in Italy. Either Europe mutualizes all its debt and Germany says, “Ja, vee vill take it,” or the debt problem will continue to worsen. If they mutualize, they can put the debt on the balance sheet of the ECB, and then all the countries of the Eurozone will pinky swear to balance their budgets in the future, giving up their national sovereignty to Brussels.

A European treaty is actually what my teenage girls called a pinky swear. They mean it when they sign those treaties, but the problem is actually adhering to the treaty.

Today you heard Anatole Kaletsky tell us that Europe’s big problem is unfunded liabilities, and they will have to cut their pensions. Can anybody tell me how loud French pensioners will scream when their pensions are cut? Or what French farmers will get up to when their subsidies are cut?

I am suggesting to you that there might be some political problems brewing in Europe. (We will deal with the implications of Brexit and European cohesion at the end of the letter.) So Europe is a weak link – but maybe not the weakest. Remember the Weakest Link TV program? The lady would run through the questions, and then with that sharp British accent, she would say to a contestant, “You are the weakest link,” and the player had to walk off in shame. The weakest link could be Europe, but it could also be China.

Xi Jinping is the most powerful Chinese leader since Deng Xiaoping and will likely be compared by historians to Mao Zedong and Sun Yat-sen in his importance. He has taken China by the neck and is wringing it. He has at least five more years left in his term – and note my use of the words at least. This is a man who has decided, “I am going to take China into the next century. I have a vision, and we are going to do it.”

To succeed, Xi has to rid the Chinese system of endemic corruption and cronyism and build a consumer society. The problem is that you don’t create a consumer society from the top down; you have to do it from the bottom up. I could give you tons of research on that. It’s a basic economic axiom.

So, China has problems. Their debt has just ballooned. Depending on whom you want to listen to, 40% to 80% of the last $6 trillion the Chinese borrowed went to pay interest on the debt they already had. In less polite circles we would call that a Ponzi scheme.

Now, they do have a lot of money. Yes. Can they print more? Yes. Do they want to have a New Silk Road? Do they want to be the world’s reserve currency? Do they want to be the most powerful country in the world? Of course they do. You get into private conversations with Chinese who are hard-core Chinese, and you can see their dreams. Their vision is not unlike the spirit of “Manifest Destiny” that moved the United States westward in the 1800s. We saw ourselves building an empire. The Chinese see themselves rebuilding their own ancient empire.