If your presupposition tells you that the Bible says there are four corners of the earth and therefore the earth must be flat, your presupposition is that the world is flat; and so if you sail far enough you will fall off the end of the ocean. So you don’t go exploring. That’s what a presupposition will do. A presupposition does not mean that you’re right, but it’s what you believe.

What will the Fed do? They are going to pray.

The Fed is not that different, by the way, from the Oral Roberts tent revivals of my youth. How many of you people went to a tent revival? There are a few of us, okay. The rest of you won’t admit it. Oral (or pick your favorite evangelist) would stand there and he would say, “You’ve got to believe!” And you believed.

The Federal Reserve is sitting there and they are reading a book by John Maynard Keynes called The General Theory Of Monetary Employment, Interest, and Money. Their core belief, their presupposition, is that consumption is the key driver of the economy. I want to borrow an idea from David Rosenberg, who says that this is not the case. He has made the case that the driver of the economy is income. We were having that discussion in a bar one time, God knows where, and I have never forgotten it. Maybe his explanation squared with my own presuppositions. Because for me, that’s it, that’s the truth: income and production are the drivers; they are the keys. You must have production and entrepreneurship. Keynes was right about animal spirits, but it is not debt and consumption that drive animal spirits; it is profits or at least the potential for profits. Income drives the animal spirits. If I borrow money as an entrepreneur, it is because I thi nk borrowing will help me make more money.

So what are these guys going to do? Their economically religious presupposition is that deflation is the worst thing in the world. When you become a central banker, they take you into the back room; they do a DNA swap on you; and you become genetically, viscerally, aggressively opposed to deflation. You do anything you can to make sure deflation never happens on your watch. If that means negative rates, you have to think the unthinkable. If that means more quantitative easing, you keep right at it: you keep printing. That is what is happening in Europe and Japan, and it’s what has happened in the US.

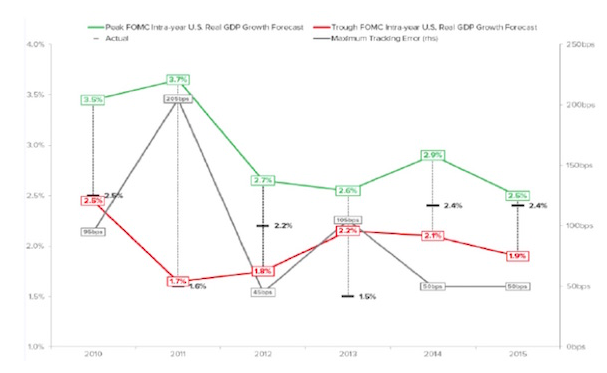

Now here is the problem. I am not going to try to take you through this chart, but basically it shows the Fed’s predictions and what really happened. If we go back for the last 100 quarters with their predictions, they are zero for 100. It is statistically impossible to be worse. They have changed their models in three fundamentally different ways over the last 40 years – and, dear gods, every time it made things worse, not better.

The Fed has the smartest people in the room, all the PhDs from Stanford and MIT. I have never met a Fed economist who was not ten times smarter than I am. We’ve had some on the stage here. I mean, their credentials are intimidating; they drip knowledge and history. Lacy Hunt is the most intimidating of the former central bankers I know. I love him, but he is intimidating. He remembers every single paper he ever read in his entire life, and he can quote from them ad hoc; and he reads everything, while I read just a little bit.

So what is the Fed going to do? They are going to fight deflation, which is a corollary, a by-product of a global recession. They will see the Dragon of Deflation, and like St. George they will set about to slay that dragon. So will every other central bank. This is not just the Fed; it’s all their fellow central bankers, too.

And now we come to thinking the unthinkable.

Because, whether we land in a Trump world or in a Clinton world, when the Fed is trying to manage a recession, will the US let the rest of the world devalue against the dollar? No. We are going to have to think the unthinkable: that the government and the central bankers of the world’s reserve currency will actually try to manage the valuation of the dollar down, in ways that will boggle your mind. Quantitative easing and negative rates are just the beginning. Purposely weakening the dollar may be the stupidest idea we have ever heard of, and I am mentioning it to you on this stage because it is unthinkable. Yet it is no more unthinkable than negative rates were four years ago, or having $10 trillion on central bank balance sheets.

We get into an unthinkable world, and my mind comes back to the Alamo. Click here and you can hear the “El Deguello.” This was a song that was brought from Spain, and General Santa Anna played it for 13 nights at the Alamo. The translation is roughly “slit throat.” It was the song your bugler played to announce that you would give no quarter to the vanquished.

For 13 nights, the men in the Alamo heard this song saying, “We are going to kill you tomorrow,” and for 13 nights 150 men held out against 5000. Eventually they ran out of bullets, and they fought with knives and swords against bullets. They lost. I think that emerging markets are like those beleaguered few trying to hold the Alamo. Emerging-market central banks will eventually lose, too, because they are coming to a gunfight with a knife.

How do we avoid such a debacle? We have got to do something with the debt.

We may just declare some kind of debt jubilee, which I said above was crazy and unthinkable. But then again, when our backs are to the wall and we are offered a last cigarette and a blindfold, we may start thinking about alternatives.

Could we, the major developed countries of the world, all monetize our debts together – not separately, together – and recognize that we all allowed debt to go too far? We have to rationalize the whole system. We need to do it in a coordinated fashion so that no one major country gets an advantage in terms of currency valuation. It’s a controlled currency war. The smaller, emerging markets will be on their own. Sadly, that is my attempt at an optimistic approach to thinking the unthinkable.

I have absolutely zero confidence in any idea I have proposed in the last seven minutes. But I am telling you that they are all possible. Central banks and their governments have painted themselves into the mother of all corners, and they are going to paint themselves into more corners because their belief system and their presuppositions are fundamentally wrong.

I think they will continue to make the system worse until they have to do something drastic. At that point the only thing they will be able to do collectively is rationalize the debt. One country cannot do that without every country doing it, too. One country doing it alone creates a massive dislocation and a preference for its own currency, which devalues its currency. Without a collective devaluation, we will have currency wars that make the ’30s look like a spring picnic. Back then they were at least devaluing against something: they devalued against gold. Today there is no tether on our currencies.