“If you say this time is different and you are bullish, then people think you are foolish. But, if you say this time is different and you are bearish, then people think you are very insightful.”

– Anonymous

At RBA, our work on cycles has rarely identified a period which was truly unique. We study cycles all around the world, and profit fundamentals typically drive stocks. The exceptions have subsequently proven to be financial bubbles like the technology bubble in the late-1990s or the housing bubble during the mid- 2000s. We invest by the rule that “it’s not different this time”.

We search for gaps between perception and reality when investor expectations differ from the objective reality of the cycle. Some of our best success stories have originated by identifying such gaps. Our avoidance of emerging markets and MLPs and our enthusiasm for the US consumer are recent examples when our disciplined investment strategy led to one-of-a-kind portfolios.

Our recent views have been similarly out of consensus. The profits cycle seems to be in the process of forming a trough and the Fed may be more cautious when raising rates than investors expect. That combination is not at all unusual (it’s normally called an earnings-driven stock market), and we think it may be the fuel behind the next leg of the bull market.

The Fed is a lagging indicator

RBA spends considerable time determining whether indicators are leading, lagging, or coincident. However, as investors, we don’t really care whether indicators lead or lag the economy. Rather, we care whether they lead or lag the financial markets. With that in mind, investors may be paying too much attention to the Fed. Of course, the Fed is hugely important for the economy and the markets, but it is critical to remember that the Fed is actually a lagging indicator. We expect that to be the case throughout this cycle as well.

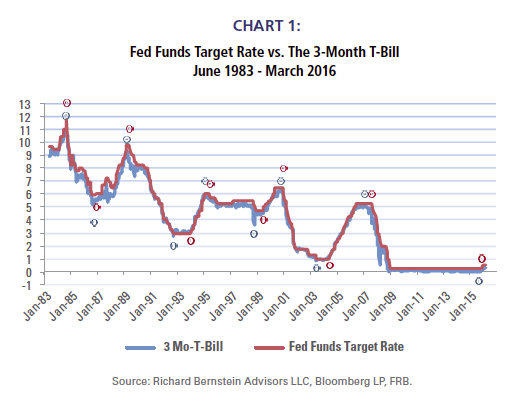

Since the Fed began to target the Fed Funds rate in the early- 1980s, the Fed has never led the markets either when raising rates or lowering rates (Chart 1). The chart marks the peaks and troughs in the Fed Funds Rate and the 3-month T-bill rate. There have been a couple of instances when one could argue that the Fed’s moves were coincident with the markets’, but the Fed typically lags the markets. Sometimes, the lag is as long as a year or more.

The Fed’s recent guidance seems to be following the historical norm. The uncertainty surrounding the US and global economies is preventing the Fed from being the leading indicator that some would like them to be. Recent comments indicate that the Fed may prefer lagging. If the Fed tightens monetary policy too early or too quickly, then they feel they may put the global economy at risk. However, if they tighten too late or too slowly, they feel they can always react to inflation and increase the pace and magnitude of rate increases.

The current Fed’s perceived risk and return seems similar to those of past Fed regimes. With the exception perhaps of the Volker Fed, the Federal Reserve has historically responded to economic conditions rather than set them. The current Fed’s “data dependency” is really nothing new.

The profits cycle appears to have troughed

Profits cycles, rather than economic cycles, are central to our positioning because history shows well that financial markets generally react more to profits cycles than they do to economic cycles. Accordingly, our outlook for corporate profits is more important than is our outlook for the overall economy.

Our forecast for corporate profits suggests that the profits cycle is in the process of troughing. Chart 2 highlights our expectations for the profits cycle over the next year or so. It appears to us that 4Q15 earnings season was probably the weakest of the cycle, and that the profits cycle will gradually improve through 2016. Although we don’t expect the absolute level of profits to trough, history suggests that the improvement in the profits cycle could initiate leadership changes with the stock markets.

Nothing unique going on: it’s still interest rates and profits The combination of the Fed’s hesitancy to tighten monetary policy and the profits cycle’s potential trough indicates two things to us: 1) this cycle isn’t different and 2) the odds are the bull market continues. Of course, if one wanted to posit that the Fed will be aggressive and the trough in the profits cycle is several quarters away, then we’d be very wrong because that would be a terrible environment for equities (i.e., the Fed tightening into a deepening profits recession). However, that combination would be highly unusual relative to history, and we think it is an unlikely outcome.

This cycle isn’t unique. It’s still all about interest rates and profits.

If you’d like a deeper understanding about how RBA incorporates these ideas into our portfolios, please contact your RBA product specialist. http://www.rbadvisors.com/images/pdfs/Portfolio Specialist_Map.pdf

INDEX DESCRIPTIONS: The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website. The past performance of an index is not a guarantee of future results. Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: Standard & Poor’s (S&P) 500® Index.

The S&P 500® Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad US economy through changes in the aggregate market value of 500 stocks representing all major industries.

3-Mo T-Bill: Yield on the Generic United States

3-Month Government Bill (GB3)

Fed Funds Target Rate: The federal funds rate is the short-term interest rate targeted by the Federal Reserve's Federal Open Market Committee (FOMC) as part of its monetary policy. In December 2008, the target "fed funds" level was replaced by a target range, and this represents the upper bound of that range.

Richard Bernstein is CEO and chief investment officer at Richard Bernstein Advisors.