The profits cycle appears to have troughed

Profits cycles, rather than economic cycles, are central to our positioning because history shows well that financial markets generally react more to profits cycles than they do to economic cycles. Accordingly, our outlook for corporate profits is more important than is our outlook for the overall economy.

Our forecast for corporate profits suggests that the profits cycle is in the process of troughing. Chart 2 highlights our expectations for the profits cycle over the next year or so. It appears to us that 4Q15 earnings season was probably the weakest of the cycle, and that the profits cycle will gradually improve through 2016. Although we don’t expect the absolute level of profits to trough, history suggests that the improvement in the profits cycle could initiate leadership changes with the stock markets.

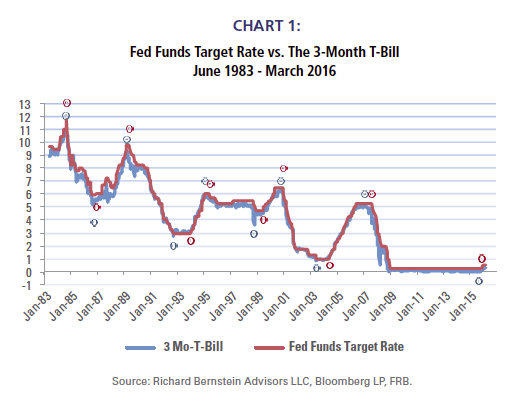

Nothing unique going on: it’s still interest rates and profits The combination of the Fed’s hesitancy to tighten monetary policy and the profits cycle’s potential trough indicates two things to us: 1) this cycle isn’t different and 2) the odds are the bull market continues. Of course, if one wanted to posit that the Fed will be aggressive and the trough in the profits cycle is several quarters away, then we’d be very wrong because that would be a terrible environment for equities (i.e., the Fed tightening into a deepening profits recession). However, that combination would be highly unusual relative to history, and we think it is an unlikely outcome.

This cycle isn’t unique. It’s still all about interest rates and profits.

If you’d like a deeper understanding about how RBA incorporates these ideas into our portfolios, please contact your RBA product specialist. http://www.rbadvisors.com/images/pdfs/Portfolio Specialist_Map.pdf

INDEX DESCRIPTIONS: The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website. The past performance of an index is not a guarantee of future results. Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: Standard & Poor’s (S&P) 500® Index.

This Time Isn’t Different

April 14, 2016

« Previous Article

| Next Article »

Login in order to post a comment