Key Points

• Returns on global stocks have never been negative over the 10 years that followed valuations similar to where they are today.

• International exposure offers increased diversification that can help buffer your portfolio against market downturns.

• The next investing megatrend may be the adoption of middle class lifestyles on a global scale with huge implications for global providers of goods and services.

The Brexit is another in a series of political, economic and financial shocks coming from outside the United States. So is it time for long-term investors to retreat from global diversification to the perceived relative safety of the U.S. stock market? We don’t think so for three main reasons:

Returns on global stocks have never been negative over the 10 years that followed valuations similar to where they are today.

International exposure offers increased diversification that can help buffer your portfolio against market downturns.

The next investing megatrend may be the adoption of middle class lifestyles on a global scale with huge implications for global providers of goods and services.

Attractive returns

Those who are worried about losses over the long-term from global diversification can take some comfort from history. In fact, returns on global stocks have never been negative over the 10 years that followed valuations similar to where they are today.

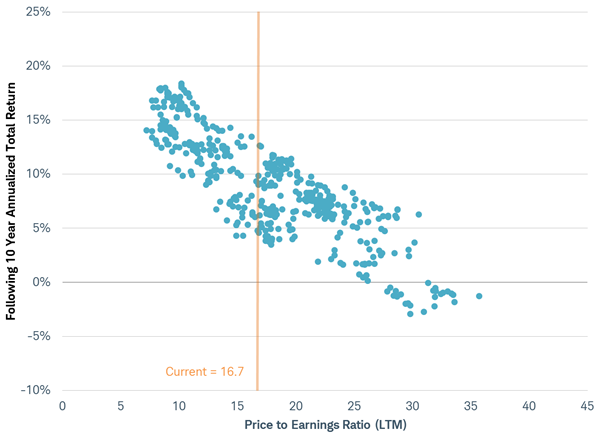

While there is no meaningful relationship between stock market valuations and short-term stock market performance, over a longer time span a powerful relationship emerges. Lower stock market valuations have preceded periods of higher future stock market total returns. The chart below illustrates this relationship using 10 year rolling returns and price-to-earnings ratios since 1969, the start of the widely-used MSCI indexes.

Global stock valuations and future returns

Source: Charles Schwab, Factset data as of 7/10/2016.

The current price-to-earnings ratio of 16.7 falls in a historical range of 4-14% future annualized 10 year total returns. Price-to-earnings ratios over 25 have preceded negative future returns.

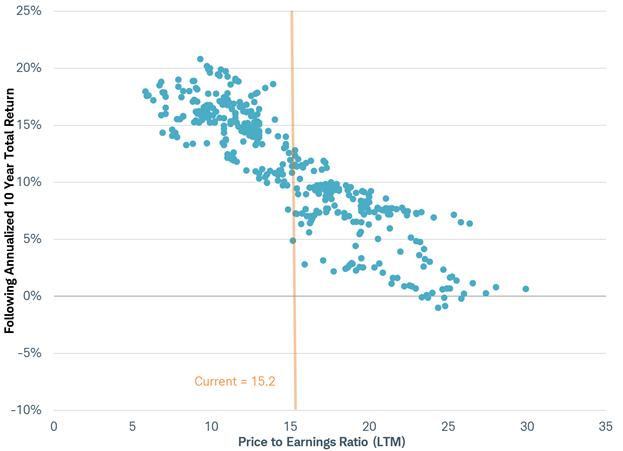

While the U.S. stock market is included in the MSCI World Index, the picture is much the same for non-U.S. developed market stocks as we can see in the chart below using the MSCI EAFE ex-Japan index.

International stock valuations and future returns

Excluding Japan from this analysis makes sense here since Japanese company earnings per share for the MSCI Japan Index have fallen below zero from time to time making it impossible to calculate a price-to-earnings ratio for Japanese stocks during those periods.

Source: Charles Schwab, Factset data as of 7/10/2016.

Experience fewer loses

International exposure offers increased diversification that can help buffer your portfolio against market downturns.

• The lesser frequency of losses for global stocks can be seen by examining 5-year rolling periods over the past 45 years of monthly data, which reveals that of the 540 periods there were 80 periods when the MSCI USA Index suffered a loss, but only 67 for the MSCI World Index.

• The lesser magnitude of losses for global stocks can be seen in the worst 10-year period for both indexes since 1969 which was from February 1999 to February 2009. During that period, the MSCI USA Index fell by over 40% (-4.2% annualized), while the developed-market international stocks measured by the MSCI EAFE Index lost just 10% (-1% annualized).

International exposure can help buffer your portfolio against market downturns

International = MSCI EAFE Index, World =MSCI World Index, United States = MSCI USA Index.

Source: Charles Schwab, Bloomberg data as of 7/10/2016.

While every time period is unprecedented in some way, since 1969 the global markets have experienced nine recessions in the G7 countries, nine bear markets in the MSCI World Index, 11 Fed rate hike cycles (and six different chairmen), and 12 presidential elections—not to mention the countless other challenges. This lengthy and varied history can offer some confidence that long-term returns on global stocks may be attractive suggesting global diversification is still warranted.

Participate in the next investing megatrend

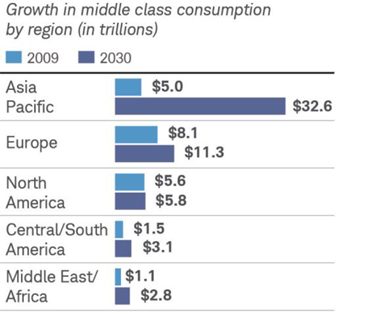

The middle class is going global. By 2030, 93% of the global middle class will be from emerging markets, according to World Bank estimates. Consumption by the global middle class is forecast to hit $55.7 trillion by 2030—that’s up more than 160% from $21.3 trillion in 2009. The adoption of middle class lifestyles on a global scale will likely have huge implications for providers of goods and services of all types. Makers of cars and other consumer discretionary goods stand to benefit, as do providers of financial and medical services.

The middle class is going global

Source: Charles Schwab, Bloomberg data as of 7/10/2016.

A lack of international exposure would mean missing out as this megatrend could provide new growth opportunities for companies around the globe.

The big picture

By abandoning international exposure now, you may miss out on attractive returns, experiencing fewer losses, and the next potential investing megatrend.

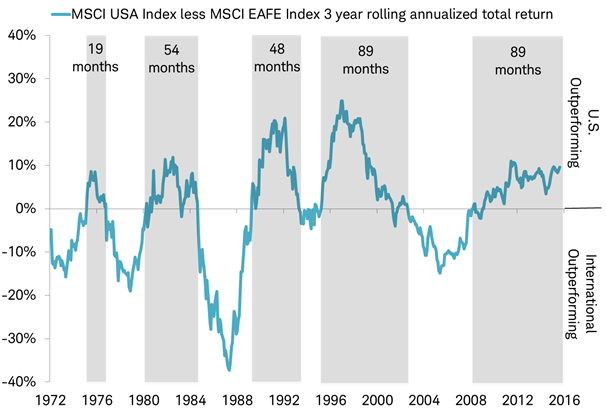

Over the past 45 years, there have been alternating periods of time when U.S. and international stocks consistently outperformed each other. The length of time on a three year rolling basis that U.S. stocks have outperformed international stocks is now tied for the longest ever at 89 months, as you can see in the chart below. While U.S. outperformance could continue, abandoning international stock exposure in your portfolio now as the duration of U.S. outperformance sets a new all-time record in July 2016 may turn out to be the worst time.

Duration of U.S. stock outperformance now tied for longest ever

Shaded areas represent periods of MSCI USA Index outperforming MSCI EAFE Index for rolling 3-year period.

Source: Charles Schwab, Bloomberg data as of 7/10/2016.

In general, allocating between 25% and 50% of your stock holdings (or more, depending on your risk and return objectives) to international equities could benefit your portfolio.