What should investors expect in the last quarter of the year? We see three themes that are likely to shape economies and markets in the months ahead as well as a number of key risks, as we write in our new Global Investment Outlook: Q4 2016.

1. Policy limits

Central banks are nearing the limits of extraordinary monetary easing, as monetary policy is becoming less effective in boosting growth and additional easing measures may have diminishing returns—and unintended consequences.

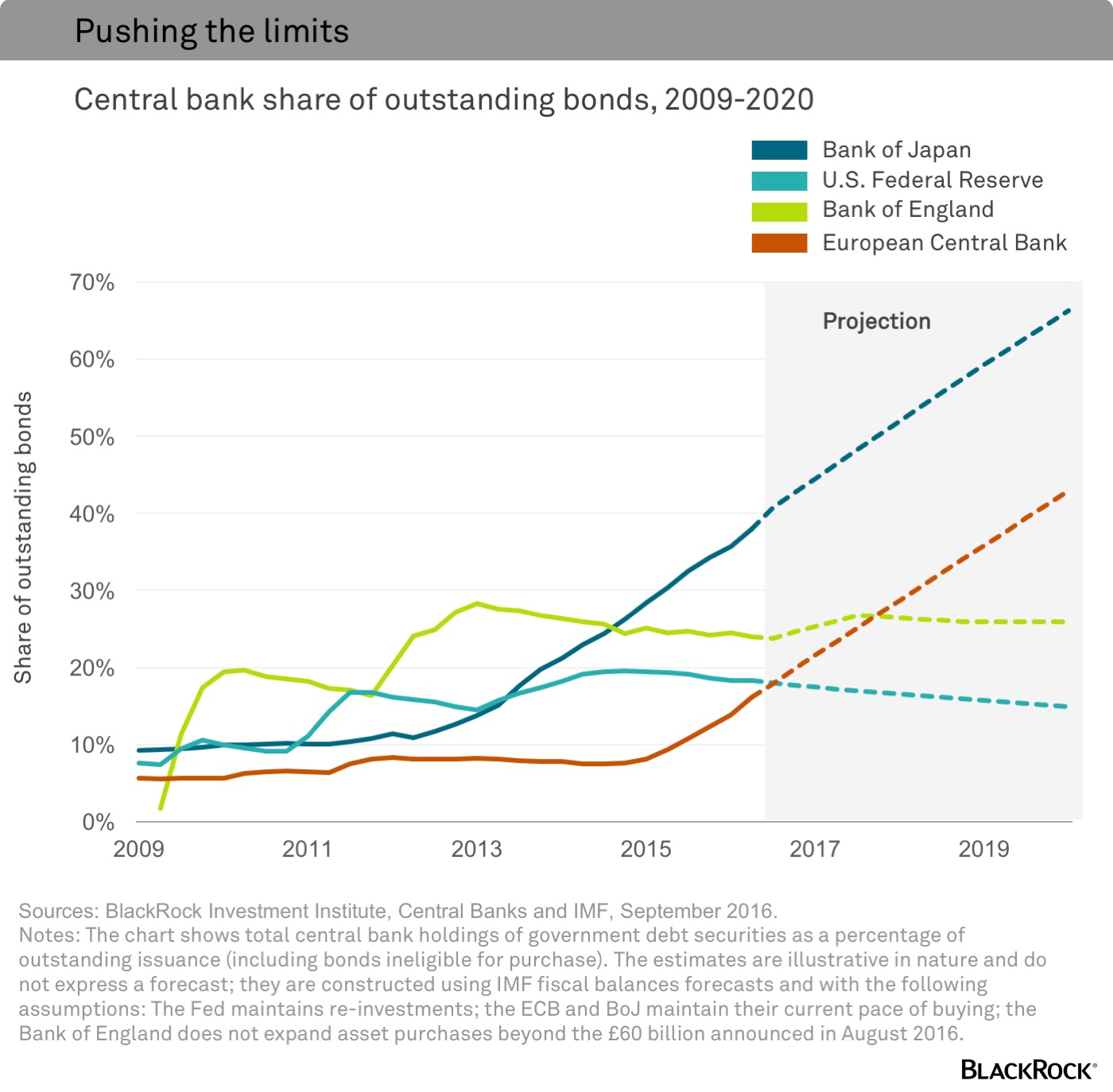

We expect the U.S. Federal Reserve (Fed) to press on with slow interest rate increases, while other major central banks start to approach limits of their easy policies. The Bank of Japan, for example, already owns about 40% of Japanese government bonds (JGBs). At its current pace of buying, it would hold two-thirds of the JGBs by 2020, we estimate. See the chart below.

As monetary policy reaches its limits, some major economies appear on the verge of relying more on fiscal policy to boost growth. It is too soon to expect a big economic growth boost, but the change in tone could support risk sentiment. We see early signs of a regime change for market returns due to U.S. reflation, an end to deflation in China and a global pivot from monetary stimulus to fiscal support, even if the immediate economic impact is limited.

2. Low returns

Our return expectations across most asset classes are at post-crisis lows, but we believe investors are getting compensated for taking on risk in equities, selected credit/emerging markets (EM) and alternatives.

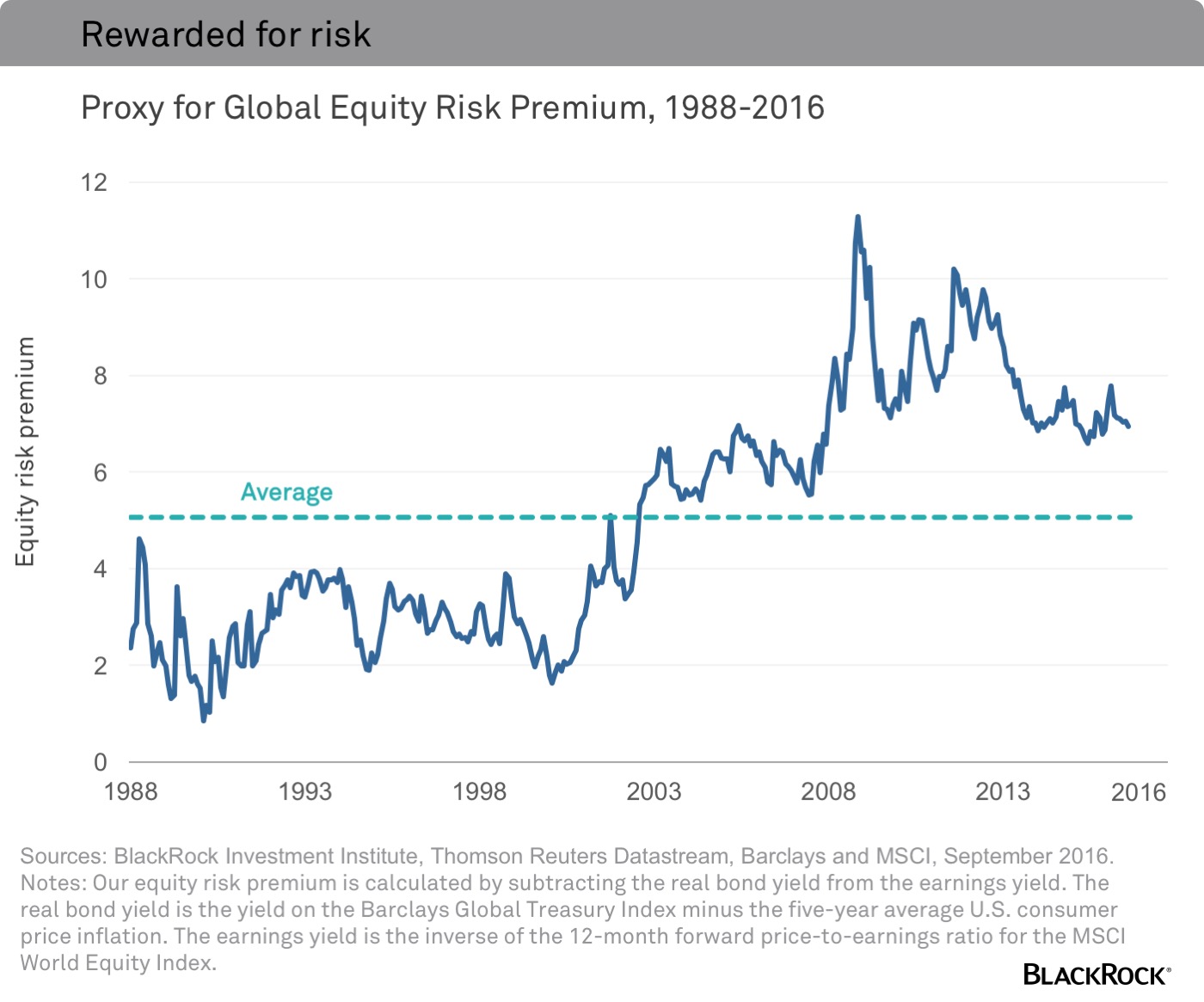

Equities still look cheap on a relative basis due to the precipitous drop in bond yields. Our measure of the gap between expected returns on global equities and real government bond yields—a proxy for the equity risk premium—has fallen from recent peaks, yet still sits well above its long-term average. In other words, investors are still compensated for taking on equity risk in an environment where we expect very low returns across asset classes in the next five years. See the chart below.

High valuations versus history point to more muted returns in the future across asset classes. Yet low nominal gross domestic product growth and aging populations argue for lower bond yields than in the past—and sustained demand for high quality bonds. This structural shift changes the prism of assessing today’s valuations. It makes risk assets such as equities and local EM bonds look attractive on a relative basis. We see relative valuations mattering more in today’s low-growth, low-interest world.

3. Volatility

Central bank asset purchases have smothered volatility and pushed investors to take greater risks, but we see potential for higher equity and bond volatility amid looming political risks and as the Fed presses ahead with higher rates. We expect volatility to pick up ahead of the U.S. presidential election in November, similar to previous elections. We also see bond market volatility heading higher. Rock bottom yields leave the potential for snapbacks.

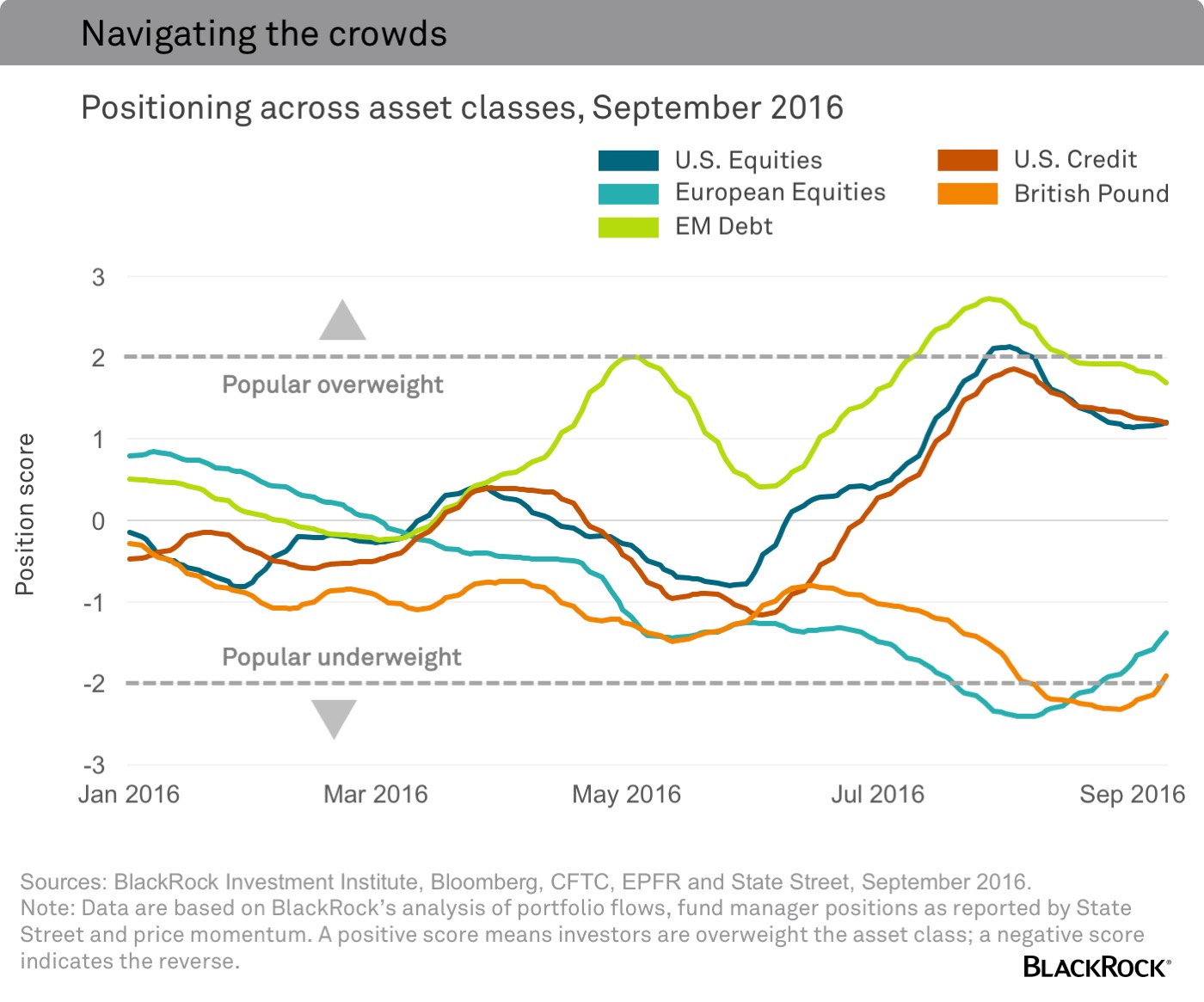

Years of suppressed volatility and the success of momentum strategies—betting on yesterday’s winners rising even further—have led many investors to pile into similar investments, as the chart below shows.

These positions may be vulnerable to a market shock or rising volatility, especially when combined with high valuations. It is important to be mindful of the short-term risks in consensus trades, and look for potential opportunities the crowds haven’t yet reached.

Key risks

There are other key risks to bear in mind as well, as we enter the last quarter of 2016. Stock and bond prices are becoming increasingly correlated, meaning equity and bond returns could fall in tandem. This poses challenges to traditional portfolio diversification. An unusually divisive U.S. presidential election highlights looming political risks in the near term. Other key risks this quarter include a referendum on reforms in Italy and policy surprises from central banks. China’s soaring debt burden and currency management, meanwhile, are medium-term risks. Gold and short duration bonds are attractive diversifiers in the current market environment, we believe.

Richard Turnill is BlackRock’s global chief investment strategist.