Mortgage-backed securities (MBS) may provide opportunity in a challenging bond market environment. High-quality bond prices remain near 2016 highs, and yields on Treasuries, investment-grade corporate bonds, and municipal bonds remain near the low end of recent ranges. MBS are in a similar situation but offer attributes that may present incremental value.

The potential value of MBS in a low-return environment for bonds can be illustrated by yield per unit of duration (a measure of interest rate risk) and scenario analysis.

YIELD & DURATION: FAVORABLE FOR MBS

We expect intermediate- and long-term yields to remain largely range bound in the near term, but investors still need to make sure they are being compensated for potential interest rate risk. Yield received per unit of duration helps quantify this compensation, and based on this measure, MBS are attractive versus other high-quality options [Figure 1]. Receiving more income while keeping interest rate sensitivity low can provide a buffer should interest rates rise.

High-yield bonds and emerging markets debt (EMD) also score relatively high on maximizing yield per unit of duration but come with different risks. Both sectors are economically sensitive, and therefore, could witness price declines should economic growth slow. MBS are primarily issued by government entities; thus, they are high quality and not sensitive to growth fears. Both high-yield bonds and EMD have enjoyed a strong start to 2016, and further price gains seem unlikely absent an additional catalyst. Conversely, MBS lagged during the first quarter due to their reduced interest rate sensitivity, and valuations (as measured by the average yield spread) are slightly cheaper compared with the start of 2016, versus more expensive valuations across other bond sectors.

ASSESSING POTENTIAL VALUE

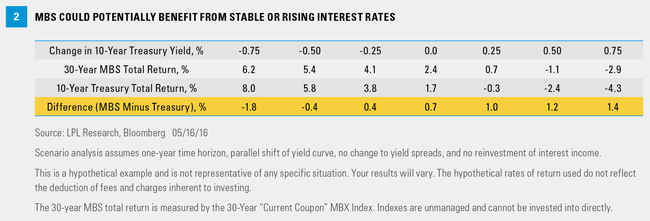

Scenario analysis can help assess the potential value of MBS under different interest rate paths. Specifically, what happens to MBS if yields move higher, stay stable, or resume moving lower? A hypothetical scenario analysis shows MBS outperforming Treasuries in two of the three scenarios: stable or higher interest rates [Figure 2].

If interest rates are unchanged, MBS might outperform Treasuries by 0.7% over the coming year. That difference may not seem like much, but it is notable in a low-yield world. Note that even if interest rates fall slightly (by 0.25% on the 10-year Treasury), “current coupon”[1] MBS may still manage slight outperformance before lagging if rates fall further. If the 10-year Treasury yield rises, the possible performance disparity is noteworthy and shows that MBS offer protection against rising rate risks.

However, MBS would likely underperform if rates fell, as prepayment risk would increase and keep a lid on price appreciation compared with Treasuries. Treasury yields already near the bottom of their recent range may help lower the risk of this scenario, but it highlights that investors seeking even greater protection in the event of an economic downturn may wish to consider more interest rate sensitive securities such as longer-term Treasuries.

TRADITIONAL VALUATION MEASURES ARE ONLY AVERAGE