Bond indices’ limitations as investable strategies are evident when taking a closer look at a key proxy for global investment-grade bonds—the global aggregate index.

Bond indices’ limitations as investable strategies are evident when taking a closer look at a key proxy for global investment-grade bonds—the global aggregate index.

Fixed-income indices can provide useful snapshots of fixed-income markets. But they have big limitations as investment strategies. There are shortcomings even in global, multisector and multicurrency indices that, in theory, effectively blend interest-rate and credit exposure to prove good diversification to the ups and downs of equity markets.

The global aggregate index—usually known as the global agg—comprises more than 15,000 securities across 70 countries and spans investment-grade government, corporate and mortgage-backed bonds. As such, it’s widely viewed as a one-stop shop for global fixed-income exposure. Lots of index funds and exchange-traded funds try to replicate the performance of the agg—and many actively managed strategies are closely tethered to it. But how will agg-centric investment strategies hold up when global bond markets face their next big jolt—higher US interest rates? And how might they perform if there’s further significant equity market volatility?

The Seven-Year Itch

In our view, the answer is: much less robustly than in the past. Big changes in global bond markets in the years following the global financial crisis (GFC) in 2008 have significantly altered the make-up of many global fixed-income indices, including the agg. Three big trends have unfolded:

1. Bond markets have broadened and deepened, but the agg has become more homogeneous. In the bond world, tracking a market-weighted index like the agg gives investors greatest exposure to whoever issues the most debt. Since governments around the world have significantly upped their debt issuance in the wake of the crisis, government and quasi-government bonds (like US mortgage-backed securities) now make up around 70% of the index. This exposes agg-hugging investors to potential concentration risks, while also meaning they hold lots of government bonds, which offer some of the lowest yields in the global bond universe.

It also means they miss out on bonds absent from the agg. The global bond universe has got much richer since the agg’s inception back in 1999, but many geographies and sectors are missing from it. This is a shame since some of them have a track record of performing well when interest rates move higher—notably, high-yield bonds.

2.Duration has drifted. As interest rates have fallen post-crisis, governments and companies have sought to lock in cheap borrowing costs by extending the maturity of the debt they issue. This push to borrow for longer has increased the duration of the agg from around 5.3 years pre-crisis to around 6.5 years today. Duration drift matters because the prices of longer-duration bonds are particularly sensitive to changes in interest rates—a clear worry ahead of the upcoming liftoff in US interest rates.

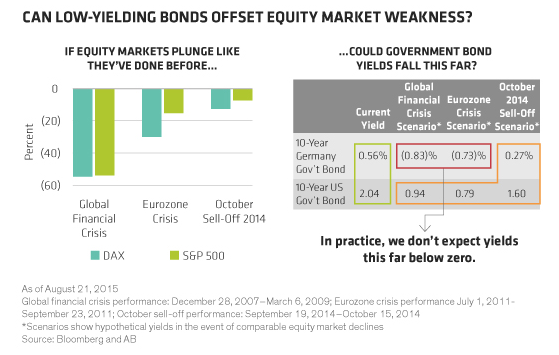

3.Yields have compressed, while government bonds are less effective diversifiers. In the post-crisis world of low interest rates and quantitative easing (QE) programs, government bond yields have been compressed to record lows (Display).

Indeed, in Europe, yields on 65% of government bonds are now well below 1%. Our analysis suggests that when bond yields fall below 1%, they become much less sensitive to broader financial market dynamics since they provide hardly any income cushion to protect against price volatility. This makes ultra-low-yielding government bonds much less effective shock absorbers.

This shock absorption capacity is further strained by the fact that as government bond yields have fallen, the yield differential—or spread—between government and corporate bonds has stayed about the same. This upsets the traditional lack of correlation between government and credit markets,ensuring that government bonds are now less effective diversifiers.

Where’s the Bond Ballast?

When global equity markets plunged at the height of the global financial crisis and then again in 2011 as worries about the future of the euro area peaked, government bonds rallied sharply, with yields falling by around 120-140 basis points. But this negative correlation was much less apparent when equity markets sold off in October 2014. German bund yields, in particular, were already so low that they simply couldn’t drop much further.

As ultra-low-yielding government bonds make up a sizeable chunk of the agg, agg-centric investors could be in for a nasty surprise if they’re relying on their government bond allocations to provide effective ballast against equity-market volatility.

Building a Better Alternative

The flaws inherent in the agg aren’t unique to this index. Greater concentration, longer duration and lower yields have crept into many bond indices since 2008. These trends present challenges to many index-oriented investors who are now holding long-duration, low-yielding portfolios of bonds issued by the most highly-indebted countries and companies.

So what can investors do? Start by recognizing the extent to which strategies wedded to the agg may be both under-diversified and also over-exposed to the impact of higher US rates. It may be possible to discover more rewarding return opportunities, while also securing a more attractive risk profile, by ditching the bond benchmark.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

John Taylor is a senior vice president and portfolio manager for fixed income, and serves as co-head of the Absolute Return Fixed Income team. He is lead Portfolio Manager for the Diversified Yield Plus strategy and is also a member of the Global Fixed Income and Emerging-Market Debt portfolio-management teams.

Time To Ditch The Bond Benchmark?

September 11, 2015

« Previous Article

| Next Article »

Login in order to post a comment