Investors around the world face a dilemma of where to turn in today’s environment of low or in some cases even negative bond yields. For example, roughly 75% of the entire Japanese and German sovereign bond market is now trading at negative yields, according to Bloomberg. As a consequence, investors are forced to choose between on the one hand locking in potentially negative returns, or on the other hand allocating capital to riskier assets like equities, where valuations have become less attractive and earnings growth in many industries will likely be challenged by lower nominal global growth. This dilemma, combined with the reality that global monetary policy is losing effectiveness, should give investors reason to consider better risk-adjusted alternatives.

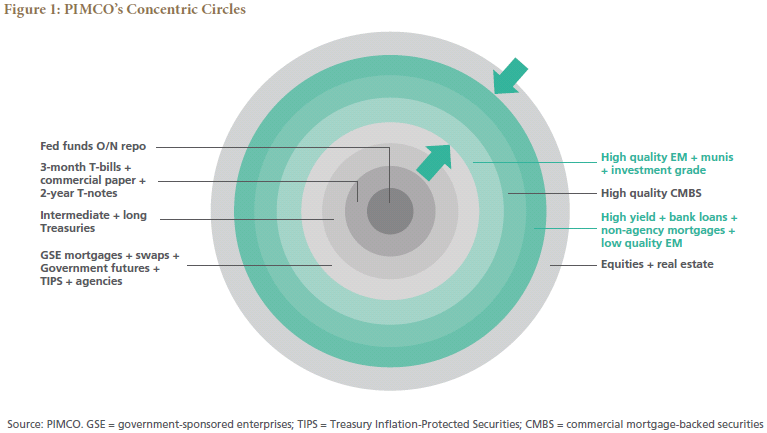

PIMCO believes that right now is the right time for investors currently focused either in the low-risk, low- to negative-yielding assets in the inner circle of PIMCO’s concentric circles of risk/reward (see Figure 1) or in the higher-risk assets of the outer perimeter to consider a move into higher-quality credit as well as select high yield and bank loan sectors: assets more in the intermediate zone of the circle diagram. Today, investment grade corporate bonds, select high yield bonds and select bank loans offer investors the potential to earn near equity-like returns with significantly less historical volatility than equities. Given absolute and relative valuations, credit offers a compelling balance between risk and reward potential – the potential solution to the dilemma. Credit, in our opinion, is in the “sweet spot” intermediate zone between lower-risk (inner circle) sovereign assets, which tend to outperform leading into recession, and higher-risk (outer perimeter) assets such as equities, which tend to outperform during the initial phases of economic expansion and monetary policy stimulus. PIMCO’s belief that the U.S. economy will avoid recession this year bolsters our view that it’s time to move into credit.

The case for credit remains compelling and our constructive view is grounded in an environment of 1) solid and stable fundamentals for most corporate issuers where managements are finally acting more bondholder-friendly, 2) market technicals that will increasingly favor capital flows into high-quality U.S. credit assets and 3) attractive valuations and all-in yields for corporate bonds, with credit spreads wider than where fundamentals and the economic cycle suggest they should be.

Based on discussions with investors around the world, we expect that capital will move into the U.S. credit market throughout 2016, particularly if the U.S. economy can avoid a recession and continue to grow at its current pace. This outlook bodes well for credit assets in industries and sectors supported by high barriers to entry, above-trend growth and pricing power, in addition to companies with management teams that act in the best interest of bondholders. By sector, we continue to find compelling value and opportunities in consumer and housing-related sectors as well as in building products, banking, airlines, high-quality real estate investment trusts (REITs), select media/cable, healthcare and specialty pharmaceuticals.

Mark R. Kiesel is global credit chief investment officer and a managing director in PIMCO's Newport Beach, Calif., office.

Fundamentals for most companies remain broadly intact outside of the metals and energy sectors, despite some signs of degradation of corporate balance sheets on the margin. We believe the U.S. economic expansion is right around mid-cycle, which should help keep defaults low (excluding the energy sector) and remain supportive for credit. Investor demand is also set to increase given the very low or negative yields across many developed market government bonds (see Figure 2). Importantly, gradually higher interest rates in the U.S. will likely lead to increased demand from foreign investors for U.S. financial assets, which in turn would lead to potential outperformance of credit given global investors’ need for stable income.