High-quality bonds broadly have enjoyed a good start to 2016, but Treasury Inflation-Protected Securities (TIPS) have particularly benefited recently and, last week, received an added tailwind from the Federal Reserve (Fed). Fed Chair Janet Yellen stated the recent increase in core inflation measures may be temporary, a slight change from indicating low inflation was transitory. Additionally, by signaling a more gradual pace of future interest rate hikes, and more tolerance for rising inflation, the Fed gave TIPS a tailwind. The development of modest stagflation—inflation readings remaining near current levels coupled with sluggish economic growth—may benefit TIPS.

TRACKING INFLATION

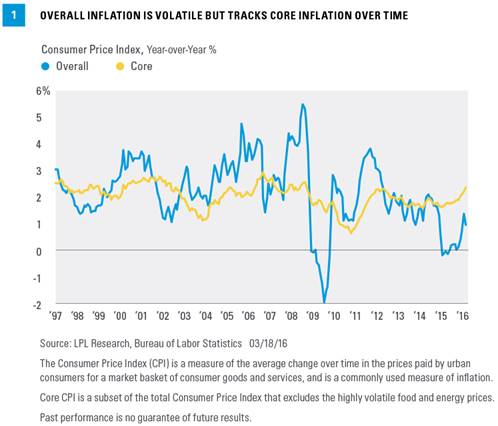

The Bureau of Labor Statistics reported last week that core Consumer Price Index (CPI), which excludes food and energy prices (read “oil”), increased to a 2.3% annualized rate in February 2016, continuing a move higher from late 2015. Overall CPI declined to 1.0% in February but has accelerated from 2015, as oil prices, which have a significant influence on overall CPI, have stabilized.

Over the long term, overall inflation has tended to follow core inflation as more volatile food and energy price swings even out over time [Figure 1]. Core CPI may signal where overall inflation is headed. Therefore, TIPS, which are indexed to overall, not core, inflation may continue to benefit as overall CPI moves closer to the core CPI reading. Yellen indicated the drivers of core inflation (such as apparel, up 1.6% in the latest report and not corroborated by industry reports) over the past couple of months may be unlikely to continue.

Still, investors have begun to focus on the merits of TIPS, in case core CPI fails to decelerate. Inflation-linked securities, such as TIPS, provide protection against unexpected inflation—exactly the case investors may want to protect against.

INFLATION EXPECTATIONS REMAIN LOW

Recent TIPS gains have been spurred by rising inflation expectations and increasing demand for inflation protection. Recall that TIPS performance is driven by conventional Treasury movements and inflation compensation (reflected in principal value and interest payments) via the CPI. If investors expect inflation to rise, TIPS typically benefit relative to conventional Treasuries, and the opposite generally holds when inflation expectations fall.

TIPS-implied inflation expectations remain low by historical context even after the recent increase. The rate of inflation implied by the current 10-year TIPS yield (calculated by subtracting the yield on a conventional Treasury from a comparable TIPS) is currently 1.6%, up from an overly pessimistic 1.2% in mid-February but still low by historical standards, leaving the potential for TIPS to benefit further from rising inflation protection [Figure 2]. Outside of an aberration during the financial crisis in late 2008, inflation expectations have rarely been lower than witnessed in mid-February 2016.