For

those of you who read everything in the financial-oriented media, you

know there is ongoing speculation about the investment products of

choice for wealthy clients. Like most things, investment products cycle

in and out of favor. Some of this is due to market conditions-remember

the backlash against growth-style investing after the burst of the tech

bubble and the subsequent flood of interest in fixedincome and "safer"

equity strategies? Other times it's in response to environmental

factors; after the sustained period of economic and geopolitical

uncertainty in the early 2000s, the lack of market correlation offered

by certain hedging techniques was appealing to many investors. And

often it's simply media hype that drives investor behavior, or the

availability of something new and different that prompts a change in

portfolio holdings-two of the reasons behind the surge in popularity of

exchange-traded funds.

Recently, a handful of studies have been

released on similar subjects that garnered a fair amount of attention,

principally due to the mistaken belief that highnet-worth investors no

longer own or use mutual funds. Having studied the wealthy and their

finances for more than a decade, it's clear that the portfolios of

these individuals hold a wide variety of assets in an even broader

array of structures-and this makes sense given their use of multiple

advisors, the impact of aging on financial priorities, the established

role of certain products in specific platforms and offerings, and the

continued introduction of new financial techniques and strategies to

address complex issues such as tax management or wealth transfer. We

are, however, more interested in where the affluent plan to invest

their assets moving forward, as that information is frequently an

indication of how advisors can better help their clients and where

growth will occur.

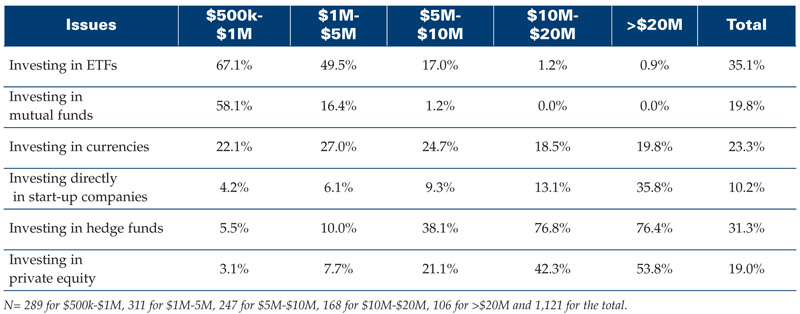

In a series of studies conducted between 2004-2006, we surveyed more than 1,100 wealthy investors about the importance of, and their interest in, specific investment products. As it turns out, there are several other things (in addition to those factors listed previously) that can contribute to how an investment product is perceived and embraced by the investing population, and our research with affluent investors reveals that a compelling and influential factor is an individual's overall level of wealth. To understand the role net worth plays in this process, we segmented the survey respondents into the following five groups:

Net worth between $500,000 - $1 million

Net worth between $1 million - $5 million

Net worth between $5 million - $10 million

Net worth between $10 million - $20 million

Net worth above $20 million

Key Findings

Not surprisingly, products that are broadly available and have low investment minimums such as mutual funds and ETFs are more appealing to lowernet-worth individuals (those with under $5 million in net worth) than they are to wealthier investors. One reason may be the heavy product coverage in media outlets that target this segment of investors. Another may be the widely accepted role that mutual funds and ETFs can play in retirement planning and college savings, two issues of little concern to wealthier individuals.

Simply put, mutual funds are no longer on the radar screens of investors with more than $5 million in net worth. Funds had their heyday in the latter part of last century, but most wealthy investors have had their fill and have since found other, more customized vehicles to meet their core investing needs.

ETFs have replaced mutual funds as the product

du jour for the segment with less than $5 million. Both the number of

ETFs and the total assets invested in them have risen sharply in the

past few years, underscoring support for a structure that looks, smells

and feels like an indexed mutual fund with stock-like

features.

Fittingly, hedge funds (and hedge fund-of-funds) are of the greatest interest to the crowd with more than $10 million in net worth. Most hedge-related products are private placements and, as such, have net worth requirements for their investors and high minimums designed to preclude unqualified individualsfrom investing. The complementary effect a hedge fund can have on a portfolio has been, and will continue to be, valued by sophisticated investors as long as results are delivered. It's worth nothing that despite the frequent media coverage blasting the structure and size of hedge fund expenses, the superwealthy are willing to pay for a product or service as long as it has perceived value and delivers on expectations.

Direct investments and private equity have gotten traction only with the highest-net-worth investors. Both are complex (and often speculative) investments with low liquidity that are most appropriate for investors with higher levels of wealth, knowledge and risk tolerance. Additionally, these types of investment opportunities must often be sourced through an advisor or firm that works exclusively with sophisticated investors. Interestingly, currency investing was ranked similarly by investors at all levels of wealth, appealing to roughly one-quarter of investors. Arbitrage is a specialized investment technique that carries unique risks. As such, it will likely have a finite audience of potential investors now and in the future.

Finding The Right Fit

It's

safe to say that, despite their intangible nature, investments are no

different from many consumer products in that distinct segments of

buyers respond in different ways to each product. And it is those

reactions that help marketers identify potential target markets for

their products. For instance, products with smaller price tags will

always have a larger audience of potential purchasers. In the consumer

world, this means that many more people can (and probably will) buy a

$10 bottle of wine than one with a $160 price tag. When translated into

the realm of investment products, this means that many more people can

(and probably will) buy an ETF with a $1,000 minimum initial investment

than a hedge fund that requires $10 million to invest. Furthermore,

buyers with specific needs will gravitate toward products that meet

those needs. A family of six is more likely to buy a minivan or an SUV

that can comfortably seat everyone simultaneously than a sports car

without a backseat. And individuals who need to harvest tax losses

probably won't spend much time evaluating investments that create

short- or long-term gains.

Simply put, mutual funds are no longer on the radar screens of investors with more than $5 million in net worth.

The

varying levels of interest expressed by the respondents of our survey

are neither an indictment nor an endorsement of specific investment

products, but rather a reinforcement that wealthy individuals,

especially very wealthy individuals, have different interests,

preferences and needs than less wealthy people. Advisors and other

providers to the ultrawealthy can use the products and services that

pique curiosity as a dooropener, and once a relationship is established

find the products and services that truly address the problems a client

has and provide the solutions a client lacks.