Holding Back On IPOs

Investors are more cautious as well. While the “hot” IPO defined the tech market of the late 1990s, public offerings are fewer and less frenzied than they were 15 years ago. Moreover, the proliferation of venture capital and private equity in recent years has given startup companies more access to alternative forms of capital. As a result, there have been far fewer big IPOs that garner widespread attention, as today’s growth companies have a clearer path to profitability. Companies such as Snapchat, Dropbox, Spotify and Pinterest, for example, are planning to go public and are expected to command market values of tens of billions of dollars, far higher and at a much later stage than newcomers in the 1990s.

Across the tech landscape, there are groupings of companies based on valuation, accentuating the split between smaller, high-growth companies and larger, legacy ones. Most of the large-cap legacy companies are trading at 12 to 14 times earnings, while many of the growth companies are trading on revenue multiples because they are growing rapidly and have not generated significant earnings yet. That doesn’t mean they are imitating their 1990s counterparts. Most are cash-flow positive, generating significant revenue—a billion dollars or more—and in many cases, their customers are Fortune 500 companies.

Many of these newer growth companies have 5 percent to 10 percent operating margins, compared with 30 percent to 50 percent for the more established players. Identifying the growth companies that can achieve legacy operating margins amid the shifting dynamics of the marketplace is the challenge for investors.

The Shifting Tech Landscape

The rise of tablets and smartphones, however, began to erode this demand for PCs, and current PC growth is essentially flat on a year-over-year basis. Much of the PC market demand shifted to tablets, but now, even that growth is slowing. Tablet makers are still selling about 200 million units a year, but it’s not clear that those sales will increase, because most customers who planned to switch from PCs to tablets have already done so. Next-generation tablets have, for the most part, represented incremental advances that haven’t convinced customers to replace older models.

Similarly, as recently as a few years ago, the market for mobile phones had a compound annual growth rate of 30 percent to 40 percent. Just as with PCs, though, market penetration has plateaued, leaving less room for growth. Today, the smartphone market is growing at about a 10 percent annual rate. Tech investors are focused on equipment makers who can capture and maintain market share, while smaller companies are getting pushed to the sidelines.

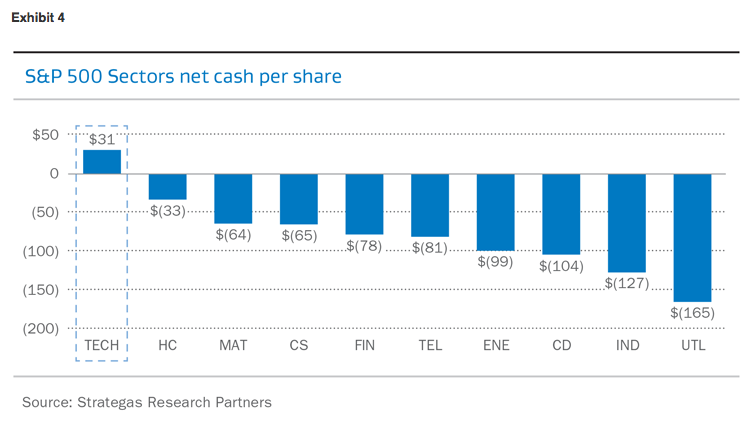

Hardware makers are looking for new ways to help customers stay connected, including via wearable devices such as the Apple Watch. These devices, however, are unlikely to replicate the growth from tablets and smartphones. Massive companies like Apple, which already are confronting the law of large numbers, might struggle to find growth. Instead, maturing tech giants are beginning to return their growing cash stockpiles to investors. Companies that a decade ago refused to consider such measures are now paying dividends.

Technology Migrating To The Cloud

Rather than racing to the public markets as a primary source of financing, tech companies today are waiting longer to file initial offerings. By the time Facebook went public in May 2012, for example, it was worth $104 billion and had been in business for almost a decade. Other highly valued companies are choosing to stay private and forego the public markets completely.

Prior to the introduction of tablets and mobile computing, the technology market was largely driven by hardware demand, and PC sales were watched as closely as rig counts are in the oil and gas sector. In the 1990s, Microsoft spurred increased demand for PCs because each generation of its Windows operating system required faster PCs with more memory to run it. In the 2000s, such demands eased, as new PCs leaped far ahead of software specifications, enabling PC owners to keep their machines longer. However, the PC market continued to grow at a healthy annual rate of 10 percent to 15 percent.

The shift during the past 15 years from hardware to software is now being followed by a more subtle migration from traditional software to companies that specialize in cloud computing and mobile apps. Once high-flying software companies such as Oracle, Microsoft and SAP are losing market share to newcomers such as Salesforce.com, which makes customer resource management software, and Workday, which specializes in cloud-based human resources software. Salesforce, with a market cap of roughly $46 billion, and Workday, with a market cap of less than $16 billion, are far smaller than the old-guard software giants, but they are growing and gaining market share at a much faster rate.

Tech Market: Not A Replay Of The Dotcom Bubble

September 10, 2015

« Previous Article

| Next Article »

Login in order to post a comment