U.S. Treasury Secretary Steven Mnuchin has taken pains to stress that the Trump administration isn’t out to kill Americans’ beloved mortgage-interest tax deduction -- but a side effect of the plan could turn it into a perk for only the wealthy.

President Donald Trump has proposed rewriting the tax code to raise the standard federal deduction to a level where about 25 million homeowners would no longer take advantage of the century-old break. A married couple would need a home-loan balance of about $608,000 -- almost triple the mortgage on a median-priced U.S. home -- before using it would make sense, according to a new analysis by property-data provider Trulia. That would be up from about $322,000 today.

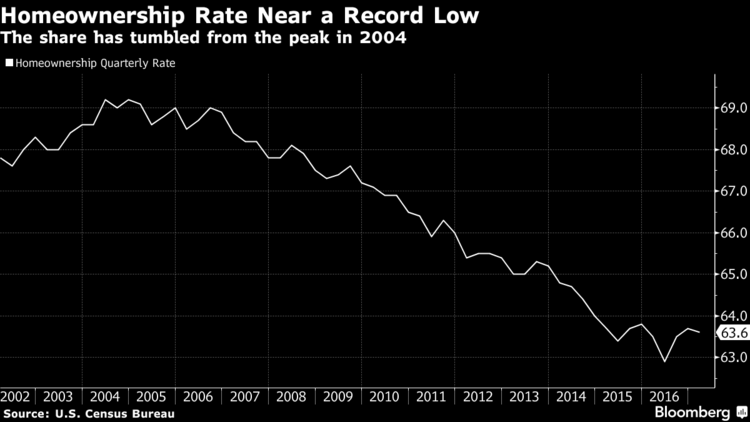

Without the incentives, along with a proposed end to local property-tax deductions, home sales may be hurt in cities where prices are rising quickly and buyers are stretching to afford their purchases, from Denver and Portland, Oregon, to Boston and Washington. Reduced demand would weigh on values, causing price declines nationwide, according to the National Association of Realtors, which opposes the change.

The proposal “is a backdoor way of rendering the mortgage interest deduction close to worthless,” said Mark Zandi, chief economist for Moody’s Analytics Inc.

Americans filing their taxes can either subtract a fixed amount from their incomes, called the standard deduction, or itemize write-offs, including mortgage interest as well as state and local taxes. The administration wants to raise the standard allowance -- to $24,000 from $12,700 for a married couple filing jointly -- and allow deductions for only home loans and charitable donations, greatly reducing the chances that itemizing would pay off for average taxpayers.

‘Apple Pie’

A White House spokeswoman, Natalie Strom, said average families would be better off under the proposal. Low- and middle-income households would effectively get a tax cut, “putting more disposable income in their pockets for them to invest in a home, purchase a car, save for their children’s college -- any other expense,” she said in an email.

Trump’s plan, outlined last month in a one-page proposal with few details and no provisions for how it might be paid for, amounts to a wish list. House Republicans came up with their own plan last June, which includes several controversial measures that have gotten a cool reception from the Senate as well as the White House.

Mnuchin called the mortgage break, which will cost the government an estimated $63.6 billion this year, “kind of like apple pie” and reiterated that Trump’s tax reforms wouldn’t touch it.

“Owning a home is something that’s been part of the American dream, and we want to keep it that way,” he said on May 1 at the Milken Institute Global Conference in Beverly Hills, California.