For 43 consecutive trading days this summer -- nearly two months -- U.S. stocks barely budged. The S&P 500’s one-day move never crept above 1 percent during that time, and the S&P 500’s average one-day move was just six basis points over that period.

That streak stopped when the S&P 500 tumbled 2.5 percent on Friday and then bounced back 1.5 percent on Monday.

It looks like investors expect the market’s newfound jitters to hang around for a while longer. The average value of the CBOE Volatility Index -- a widely followed barometer of expected volatility in U.S. stocks better known as the VIX –- was 12.5 during those 43 tranquil days. The VIX shot up to an average of 16.4 over the last two trading days.

Welcome back, volatility.

Investors are used to the turbulence by now. After all, U.S. stocks have battered investors on three recent occasions -- in August of 2015, in the early days of 2016 and yet again during the tense days that followed Brexit.

Given those bumpy episodes, many investors want to sidestep volatility by piling into so-called "low-volatility strategies" -- funds that invest in stocks that have historically been less volatile than the broader market.

The only problem is that low-volatility funds were anything but that during Friday’s market rout. As Bloomberg News reported, both the PowerShares S&P 500 Low Volatility fund and the iShares Edge MSCI Min Vol USA fund -- two popular low-volatility funds -- were down more than the S&P 500 on Friday.

Oops.

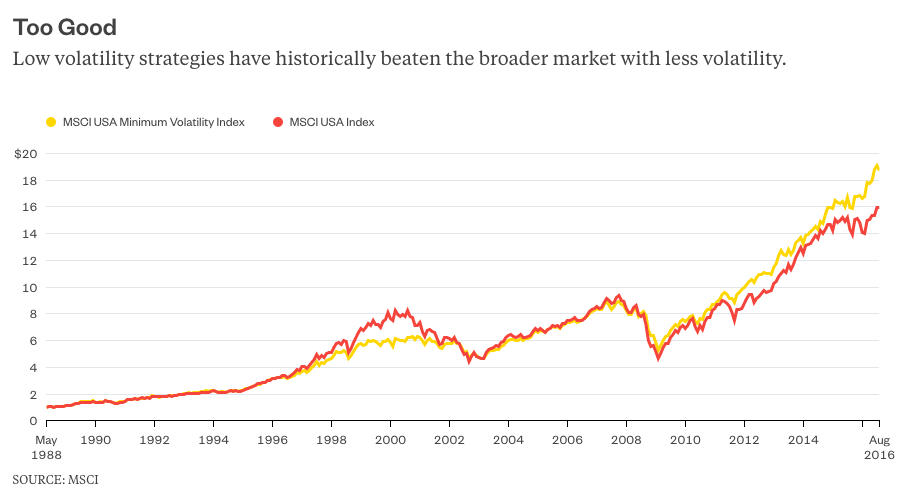

Still, it’s easy to understand investors’ faith in low-volatility strategies because low volatility has achieved investing’s version of nirvana: a higher return than the market with, well, lower volatility.

The MSCI USA Minimum Volatility Index returned 10.9 percent annually from June 1988 to August 2016, including dividends, with a standard deviation of 11.4 percent (the longest period for which data is available). The MSCI USA Index returned just 10.3 percent annually over the same period, with a standard deviation of 14.5 percent.