The recent market downdraft and related uncertainty in China have led to many investor questions. The strong 6.5 percent rebound in the S&P 500 over the last three trading sessions (August 26, 27, 28, 2015) has cut the S&P 500’s losses from the 2015 peak (2130 on May 21, 2015) to 6.7 percent. In response to the S&P 500’s recent 12 percent correction—the first decline of more than 10 percent since 2011—we answer 12 investor questions. Bottom line, we do not expect the latest correction and China uncertainty to lead to the end of the U.S. economic expansion or the end of the six-and-a-half-year-old bull market. We reiterate our forecast for stocks to produce mid- to high-single-digit returns in 2015 on improving earnings over the second half of 2015 and into 2016. In-line with average stock market growth, our forecast is for a 5–9 percent gain, including dividends, for U.S. stocks in 2015 as measured by the S&P 500.

TWELVE QUESTIONS

1. Will the slowdown in the Chinese economy send the U.S. economy into recession? We do not think so, especially given our belief that China will continue to add stimulus, both monetary and fiscal, to shore up its economy and markets. The indicators that we watch—in particular the Leading Economic Index (LEI) discussed in the recent Weekly Economic Commentary, “Forecast for Clear Skies”—continue to point solidly toward U.S. economic expansion for at least the next 12–18 months, and we believe the next recession may be a good bit further out than that. (U.S. gross domestic product [GDP] grew 3.7 percent during the second quarter of 2015 and is on track to grow about 2.5 percent in the third quarter.)

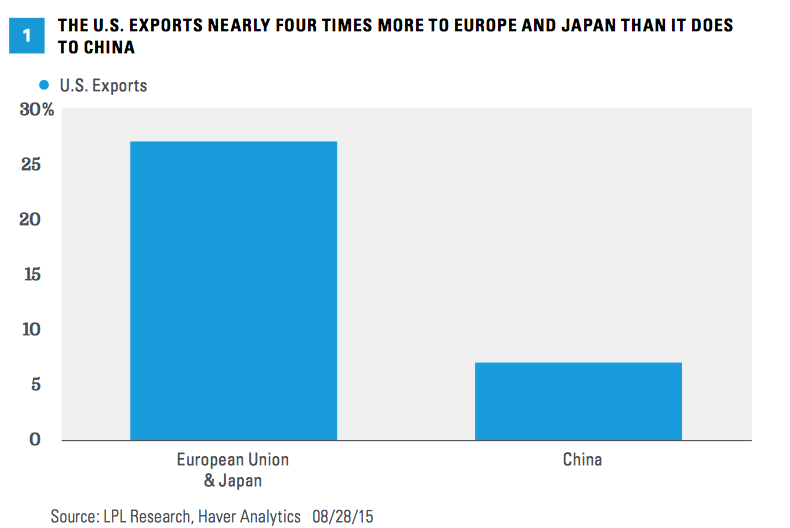

Putting China into economic perspective, the country is the destination for only about 7 percent of U.S. exports, about one-fourth the amount that goes to Europe and Japan [Figure 1], which means that the Chinese economy directly represents less than 1 percent of U.S. GDP. As a result, the overall impact on U.S. corporate profits from slower growth in China is likely to be limited (outside of the commodity-linked sectors). A weaker yuan may even result in cost savings for U.S. multinationals sourcing supplies in China. (China devalued its currency on August 11, 2015.)

2. Will the latest stock market correction lead to the end of the bull market? We do not think so. Bear markets are almost always accompanied by recession, which we do not expect for quite some time. We do not see evidence of the excesses in the U.S. economy or financial markets (e.g., in terms of leverage, confidence or spending) that have historically led to bear markets and recessions. We do not believe the slowdown we are seeing in China’s economy is enough to outweigh improving growth in the U.S., Europe and Japan in 2015 and 2016, and we expect global growth to continue to improve gradually over the next 18 months.

3. Are you sticking with your 5–9 percent total return forecast for the S&P 500 in 2015? Yes. We continue to expect improved U.S. economic growth and second half earnings gains to propel stocks to mid- to high-single-digit total returns in 2015. Other possible factors we expect to be supportive: 1) better growth in Europe and Japan (along with the potential for more stimulus), 2) low interest rates that make bonds relatively less attractive than stocks, 3) a Federal Reserve (Fed) that may keep rates “lower for longer,” 4) low but stable oil prices, 5) historically strong fourth quarter seasonality and 6) price-to-earnings multiples that have fallen to long-term average levels.

4. Do you expect China to do more to stimulate its economy and markets? Yes. But the bigger question is: Will it work? Efforts thus far have been met with mixed success; however, we expect the Chinese government to do more, including fiscal stimulus, to help stabilize its economy and markets, and we believe it will eventually be successful. Three things to keep in mind: 1) the Chinese stock market is disconnected from the Chinese and global economy, 2) stimulus works with a lag and 3) the Shanghai Composite A-share market (mainland Chinese stock market) is actually up year to date, despite dropping more than 40 percent from mid-June through late August [Figure 2]. The index rose about 160 percent in the 12 months leading up to the bear market decline that began June 15, 2015.