Key Points

1. We believe the Federal Reserve is overstating the importance of falling inflation expectations, which have become disconnected from the Fed’s target and shown to be poor predictors of CPI inflation.

2. We propose a bottom-up approach to forecasting that is independent of the expectation proxies. Our approach suggests that inflation will reach the 2% target by year-end 2016, a significantly higher forecast than what is currently expected by swap and TIPS markets.

3. Deflationary risks in the United States are minimal, and investors should anticipate that the Fed will achieve its inflation target sooner than otherwise suggested.

U.S. Federal Reserve officials have expressed concerns about falling inflation expectations, which according to their models should lead to a higher deflationary risk. Indeed, the macroeconomic models favored by the central bankers identify inflation expectations as a key driver of price dynamics and, as such, expectations have become a major target of monetary policy. Recent research suggests, however, the American public has little knowledge of the Fed and its policy goals. Fortunately, we do not find this cause for despair: precisely for this reason—that is, the disconnect between the American public and the Fed—we believe central bank officials should not be concerned about falling consumer inflation expectations, and calls for renewed monetary easing are unwarranted.

The Fed: Who?

The U.S. Federal Reserve is probably the most scrutinized and carefully followed institution in the financial industry. Yet, this popularity is in stark contrast with reality for most U.S. households, as explained in a paper recently presented at the American Economic Association meetings in San Francisco. Macroeconomist Yuriy Gorodnichenko and his coauthors (Kumar et al., 2015) document that the American public is largely unaware of the Fed and its leadership. Recent household surveys show that only about one-third of respondents could identify Janet Yellen as the chairwoman of the Fed, even when given her name as one of four possible choices. In addition, the respondents had difficulty accurately describing recent inflation dynamics as well as providing confident long-term forecasts, thus highlighting the divide between the U.S. monetary authority and the public.

As a Fed official, facing the reality of obscurity in the contemporary American experience must be heartbreaking. Since 2012, the Fed has been explicitly communicating its long-term inflation target of 2% in an effort to influence and direct public expectations. The Fed greatly relies on this policy tool to maintain “firmly anchored” expectations, which are viewed as a requisite means of avoiding potential deflationary and inflationary pressures such as those experienced, respectively, in Japan over the last 20 years and in the United States in the 1970s.

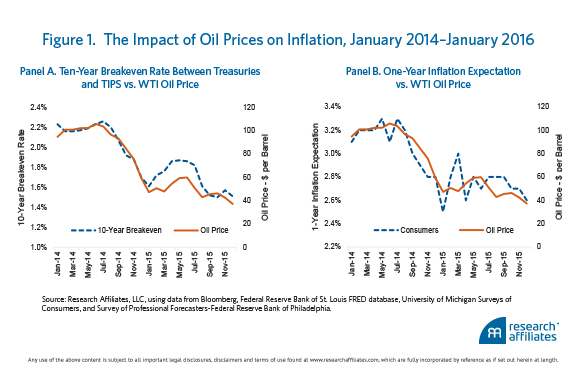

Officials, such as New York Fed President William Dudley (2016), are beginning to express concerns regarding the risk of expectations becoming unanchored with the continued fall in energy prices. Although the influence of the price of oil on inflation is known to be generally transitory in nature, some officials are concerned that a sustained fall in energy prices might lead to deflationary pressure. As Figure 1 shows, falling energy prices have depressed both market-based and consumer expectations about inflation at different horizons, a dynamic that could gain speed if consumers postpone purchases and businesses delay new investments.

The combination of low energy prices and a “low-visibility” central bank could increase investor uncertainty about both short-term and long-term U.S inflation rates. While the Fed worries about inflation expectations, the public pays little attention to the Fed’s goals and focuses on those items directly related to their daily experience, such as commuting costs. In our view, the Fed has no need to worry at the moment about the public’s expectations. Indeed, consumer and market-based forecasts have been inferior predictors of future inflation, a fact sufficient to cast doubt on the models evoked by some Fed officials.1

Unaligned Expectations

The theoretical rational behind the Fed’s interest in influencing inflation expectations is the expectations-augmented Phillips curve, or New-Keynesian Phillips curve, which links the realized inflation rate to expectations as well as to measures of real economic activity, such as the unemployment rate or the output gap. But although the modern Phillips curve provides an important theoretical benchmark, its empirical robustness is still debated.

U.S. Inflation: The Expectations Game

March 24, 2016

« Previous Article

| Next Article »

Login in order to post a comment