Some U.S. mutual funds are boosting their performance with relatively big bets on private companies such as Uber and Pinterest, which they have been marking up at a rate far greater than the broad stock market.

Relied upon by millions of Americans to save for their retirement, mutual funds emphasize that their investments in young tech companies ahead of their initial public offerings are relatively small.

A Reuters analysis of fund filings and other data shows, though, that some have taken a more aggressive approach, boosting the share of these companies to more than 5 percent of assets and awarding them rich valuations that in some cases have helped them beat their benchmarks and peers by a wider margin.

Mutual funds' involvement also helped boost the number of so-called unicorns - private companies valued at $1 billion or more.

These private investments come at a risk, though. Many are young companies that have yet to make a profit. They are also harder to price and to sell than publicly traded stocks.

That could hurt investors in a downturn because fund managers forced to meet investor redemptions may have to sell liquid public companies while marking down the unlisted ones, said Larry Swedroe, director of research at Buckingham Asset Management in St. Louis.

"Private companies typically trade at significant discounts for that reason," Swedroe said.

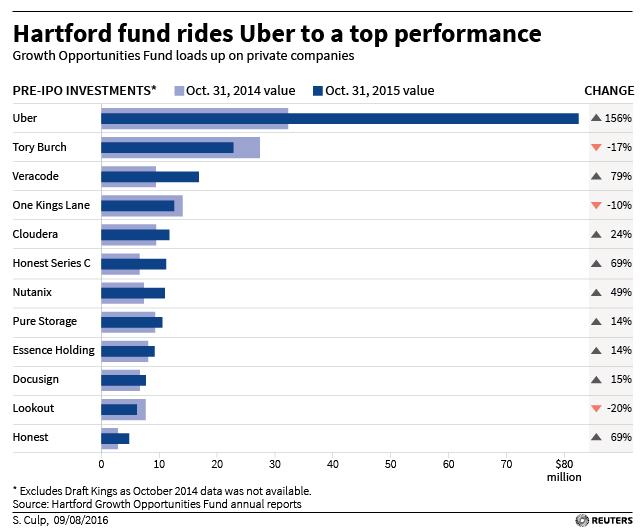

In a rising market, though, they help shore up performance. Bets on Uber Technologies and other unlisted companies, for example, helped the Hartford Growth Opportunities Fund deliver a 12.7 percent return in 12 months to Oct. 31 compared with a peer fund average of 5.2 percent, according to Lipper Inc.

The $4.5 billion fund cited Uber among top contributors to performance in its report for fiscal 2015, alongside Amazon.com Inc and Netflix Inc. The ride-services company's valuation in the fund surged 156 percent to $82.5 million, Hartford disclosures show.

Its pre-IPO stakes accounted for nearly 6 percent of net assets while most of its peers have kept their exposure below 1 percent, fund holdings show. Hartford declined to comment.