Pre-IPO investments can amplify a fund's relative performance because they are not included in a comparison benchmark index and some have far outpaced the stock market.

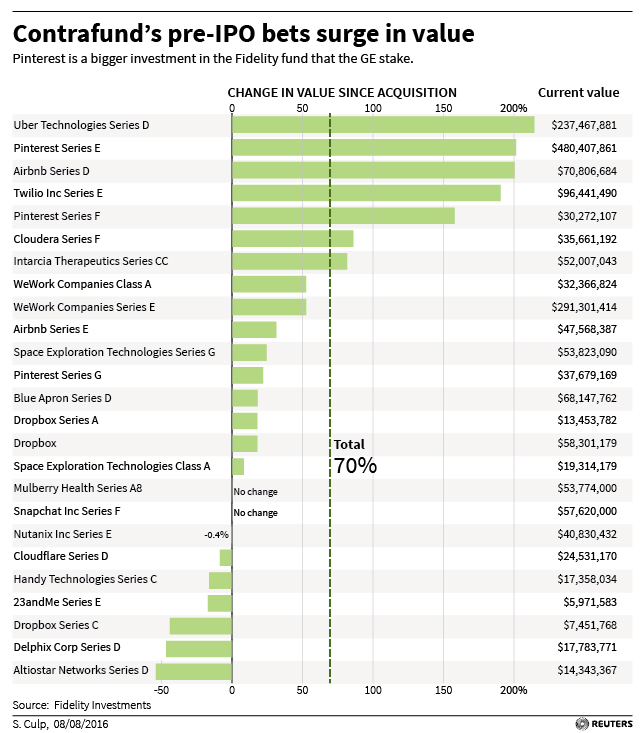

Fidelity Investments' valuation of Contrafund's Series E stake in content sharing company Pinterest has tripled to $480 million since an initial investment in October 2013, compared to the S&P 500's 25 percent rise.

In a statement, Fidelity said such investments were "very small positions in the relatively few Fidelity funds that make such investments."

Over the long term, the impact of those stakes on performance may be less significant in a fund as large as the $109 billion Contrafund, than in some smaller peers.

Outsized Effect

Mutual fund investments, however, have measurable effect on companies' valuations. Those that received such financing last year saw their valuations more than double over their previous funding round. In contrast, valuations of companies that raised cash without mutual fund investors grew 1.5 times, according to PitchBook, a private equity, M&A and venture capital database.

The Securities and Exchange Commission (SEC) has been asking mutual fund companies how they value their stakes in companies like Uber, Pinterest Inc and Airbnb.

The regulator is worried investors could get hurt in case of a sharp tech downturn, according to two people familiar with the SEC's queries. They were not authorized to speak publicly about the matter.

Pre-IPO investments can have an outsized negative impact when marked down, which happened to startups such as cloud storage firm Dropbox or software startup Zenefits.

Facing a tough challenge from index-tracking funds, actively-managed mutual funds led by Fidelity Investments, BlackRock, T. Rowe Price and Wellington Management, began piling into pre-IPO tech companies in 2014, according to venture capital database CB Insights.