Sterling investment grade corporate bonds have rallied by around 5% more than the equivalent UK gilts since the Brexit vote. While the quick gains may be over, we still see value – thanks to technicals as much as fundamentals.

UK corporate bonds spreads widened by almost 30 basis points after the surprise vote in late June to leave the European Union. But spreads tightened in July as the initial shock faded, and political stability returned. They got a further jolt in August when the Bank of England (BOE) said it would include corporate bonds, alongside gilts, in a new asset purchase programme. The BOE has stated it will look to buy up to £10 billion of corporate bonds over the next 18 months.

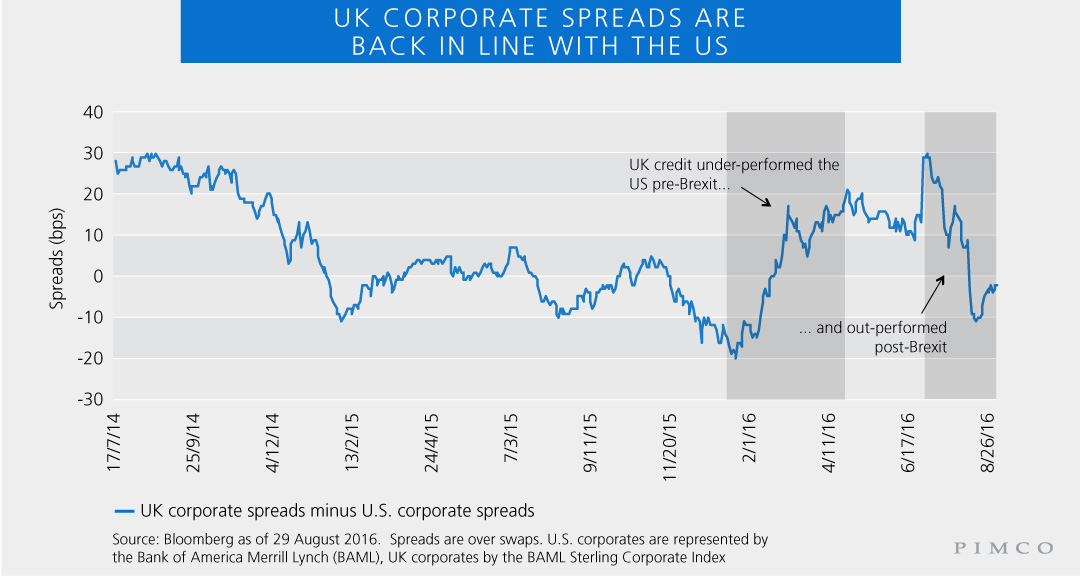

Without doubt, the tightening in spreads has now slowed and UK investment grade credit seems fairly valued, trading in line with U.S. investment grade credit benchmarks.

However we remain constructive on the asset class. Despite our expectation of a slowdown in UK growth over the next 12 months, corporate fundamentals remain intact with balance sheets healthy. Moreover, in what’s becoming a defining feature of markets today, sterling credit will join other markets where central bank actions are having a big effect.

Prior to the BOE announcement, market consensus was that net issuance in sterling credit would decline by £10-£15 billion in 2016, equivalent to 2%-3% of the BoA/Merrill UK Corporate Index. However, since then issuance has increased sharply, with UK-related companies taking advantage of low funding costs. As such, the expectation is that net issuance will now be positive in 2016 and 2017. Far from being overwhelming, however, we expect this new supply to be matched by new demand – from both the BOE and retail funds, where year-to-date flows have moved from net negative in June to marginally positive today.

All this points to a technical tailwind for UK credit, albeit one resulting in spreads grinding lower, rather than contracting sharply. On a sector basis, transport and utilities should benefit most from the BOE’s actions, as both contain a high portion of “UK-related issuers”, which the bank will target with its bond purchases. Financials also continue to look attractive on a fundamental basis and offer good relative value despite the sector not being on the BoE’s list of eligible issuers. Beyond this, security selection remains critical. As the BOE’s bond purchases dampen spread volatility within the sterling credit market, issuer selection based on strong credit analysis will be key to maximising return potential over the long term.

Ketish Pothalingam is an executive vice president in PIMCO's London office and a portfolio manager focusing on U.K. credit investing in the European portfolio management group.