As more investors look beyond the traditional 60/40 stock/bond portfolio and toward private markets for investment opportunities, a key question arises: How do alternative investment managers create value? It is clear from historical returns that they do; according to Cambridge Associates, private equity had outperformed major public indices by at least 300 basis points (3%) over 10; 15- and 20-year periods on a net basis as of December 31, 2015. But the ways private equity and venture capital funds add value to their portfolio companies differ significantly, reflecting the differing stages of the corporate life cycle at which they invest.

Private Equity

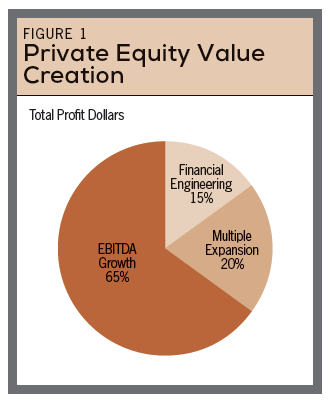

As shown in Figure 1, private equity creates value in three key ways: First, it optimizes the capital structure with leverage or debt restructuring, also known as “financial engineering.” Second, it makes operational improvements in a company, both with growth initiatives and cost cutting. And third, it offers a “multiple expansion,” allowing a company to be sold at a higher revenue or EBITDA multiple than the one at which it was acquired.

Multiple expansion is difficult to accurately time and cannot be viewed as a reliable value creation lever because it is largely outside the control of the fund manager. It is also worth noting that debt restructuring and financial engineering are no longer proprietary value creation levers for PE firms as they were when junk bonds and inexpensive debt first emerged in the 1980s.

This has forced the industry to focus on operational improvement, which generally manifests as earnings or EBITDA growth, as the primary method of value creation. Many PE firms now have operating partners and professionals with industry expertise involved at each stage of the deal process, from target identification to post-acquisition management, so cost-cutting and growth initiatives can be thoroughly evaluated and planned before an acquisition. Some have even developed in-house consulting arms and portfolios of former CEOs to help run acquired companies, such as Bain Capital’s Portfolio Group and Cerberus’s Operations and Advisory Company. More than 900 operating partners now work in the industry globally, according to a May 4, 2015, story by the Financial Times, a near-doubling from 2013 to 2015.

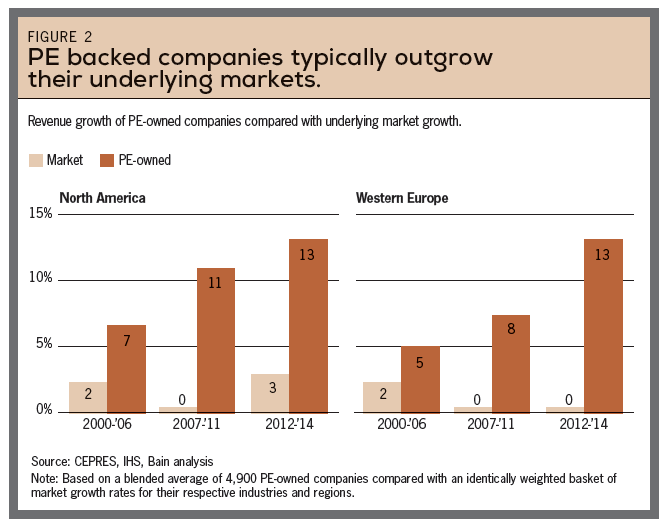

This value creation tool kit has allowed PE-backed companies to significantly outperform their underlying industries’ boom and bust periods over the past 15 years, as shown in Figure 2. A recent Bain analysis examined thousands of PE-owned operating companies and found that there has been a steady and significant increase in the average compound annual growth rate (CAGR) of their EBITDA since the financial crisis. Furthermore, the study found that the companies’ increase in valuation was driven more by EBITDA growth than in prior years. (See “Private Equity Is Adding Value To Companies, Says CEPRES,” from Private Equity Wire, September 9, 2016.)

Unlocking The Private Markets

December 19, 2016

« Previous Article

| Next Article »

Login in order to post a comment