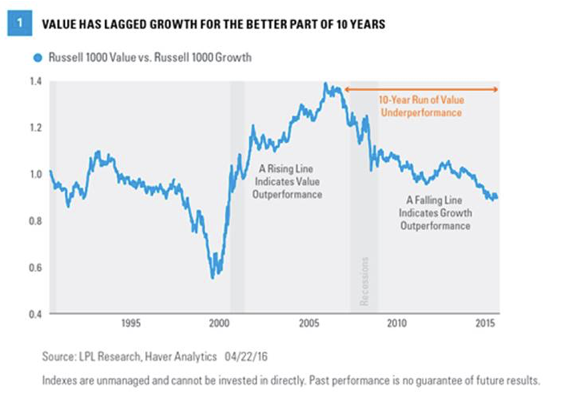

Value stocks have staged a comeback versus growth after a long losing streak. Based on the Russell 1000 style indexes, growth has outpaced value for the better part of the last decade. Other than the period between April 2012 and July 2013, it’s been all growth all the time since 2006 [Figure 1]. But value has shown signs of life recently, causing some to speculate that we are at the beginning of a sustainable reversal in trend. The Russell 1000 Value Index has outperformed the Russell 1000 Growth Index by 2.6% year to date. Here we discuss whether the value comeback is sustainable.

Evaluating Values Vs. Growth: Sector Mix

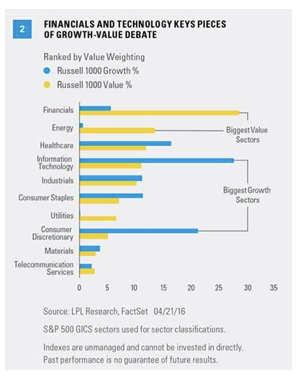

When looking at the growth value question, we like to start by comparing the largest value sector (financials) to the largest growth sector (technology). (We identify growth and value sectors by taking the difference between weights in the growth index and the value index.) Financials is the biggest value sector, carrying 23% more weight in the Russell 1000 Value Index than its growth counterpart (energy is second at 12.9%). On the growth side, technology (16.5%) and consumer discretionary (16%) carry the biggest weight differentials. If you get these sectors right, you stand a very good chance at getting the growth versus value decision right (sector weightings for these indexes shown in Figure 2).

We currently like the technology sector more than financials, which favors growth, in large part due to the financial sector’s struggles with low interest rates (more on that later). We are starting to warm up to energy as global oil production has fallen and oil prices have rebounded; and we have cooled some on consumer discretionary as the business cycle matures. Put all that together and the scales tilt slightly toward growth.

Financials And Interest Rates Are Key

Financials have struggled in recent years for many reasons, but one big reason, at least since the Federal Reserve (Fed) lowered its target federal funds rate to zero and embarked on multiple rounds of quantitative easing (QE), has been low interest rates. Low interest rates impair bank profitability by reducing returns on loans, and hurt other financial firms by reducing returns on cash and bonds (think insurers and brokerage firms). The strain on banks and financial firms is a detriment to the sector overall, and, as a result, contributes to underperformance in value. This connection explains why the drop in interest rates has closely mirrored relative performance of value versus growth [Figure 3].