The rush into dividend-paying stocks has drawn many investors to utilities, whose 5%-plus dividend yields have helped the group produce market-beating returns over the last year.

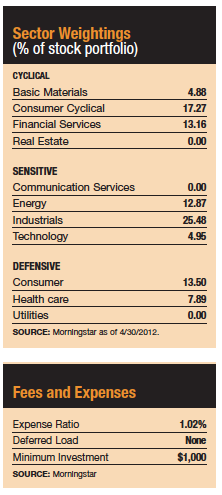

George Schwartz, who manages the Ave Maria Rising Dividend Fund with Richard Platte Jr., isn't one of those investors. He says utilities carry too much debt, and have too little growth potential. He also eschews real estate investment trusts, another high-yielding stock group that has seen an uptick in popularity for the same reason.

Instead, the 67-year-old founder and president of Bloomfield Hills, Mich.-based Schwartz Investment Counsel, which manages about $1 billion in mutual fund and separate account assets, typically seeks out stocks with somewhat lower yields issued by companies that have a long track record of above-average earnings and dividend growth, low-debt balance sheets and strong cash flow to support future dividend increases. He also looks for companies that he believes have a sustainable competitive advantage in the marketplace and a leading market position. Stocks of companies that pass those tests must sell at prices that are reasonable relative to their strong cash flow and potential for earnings growth.

Instead, the 67-year-old founder and president of Bloomfield Hills, Mich.-based Schwartz Investment Counsel, which manages about $1 billion in mutual fund and separate account assets, typically seeks out stocks with somewhat lower yields issued by companies that have a long track record of above-average earnings and dividend growth, low-debt balance sheets and strong cash flow to support future dividend increases. He also looks for companies that he believes have a sustainable competitive advantage in the marketplace and a leading market position. Stocks of companies that pass those tests must sell at prices that are reasonable relative to their strong cash flow and potential for earnings growth.

In this fund, though, candidates for investment must also measure up to more than its managers' financial criteria. In accordance with the Ave Maria fund family's mission to invest in line with Catholic religious principles, companies such as those in the health care and pharmaceutical industries involved with abortion, birth control and embryonic stem cell research are off limits. The same holds true of those companies with ties to the pornography industry. Unlike other members of the socially responsible investment crowd, Ave Maria does not screen out companies involved in alcohol, tobacco, defense or unfair labor practices.

The religious screens kick out some obvious candidates such as pharmaceutical company Pfizer, which makes birth control products. In their place are firms that do not violate religious tenets, such as Abbott Laboratories, which does not make abortion-related drugs or conduct embryonic stem cell research-but does have "a good new product pipeline, which lots of pharmaceutical companies lack, as well as an attractive 3.3% yield," says Platte.

The screens also put the kibosh on some surprising names such as Goldman Sachs, which contributes to Planned Parenthood, and Amazon, which distributes pornography as one part of its business. Insurance company Aetna, which covers tubal ligation, also gets the boot.

Many technology companies have been initiating and raising dividends over the last few years and have ample cash on their balance sheets, which would seem to make them good candidates for investment. Yet the fund typically treads lightly in that area, in part because many violate religious tenets by offering domestic partner benefits. These companies often don't appeal to the Ave Maria managers from a financial standpoint either-the rapid introduction of new products into this industry makes it difficult for one company to maintain a sustainable competitive advantage.

Schwartz says investors who worry that moral screens will diminish the potential investment universe to the detriment of shareholders should rest easy: In the Ave Maria funds, only 150 companies in the Russell 3000 Index are dropped for religious reasons. "That only takes 5% of companies off the table," Schwartz says. "And most of those companies would not fit our criteria from a financial point of view anyway."

Regardless of its moral stance, the fund's emphasis on companies' spotless balance sheets and low debt has been the major driver behind its market-beating total returns over the last several years. That was the case in 2008, when its minimal presence in leverage-laden sectors such as financials helped it limit its losses to 22.8% while the S&P 500 index took a 37% nosedive. From its inception in May 2005 through June 7, a $10,000 investment in the fund would have grown to $15,363, while the fund's large-blend peers in Morningstar's universe would have grown to an average of only $12,441.

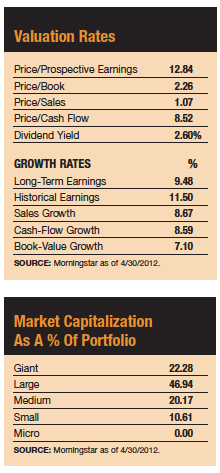

The fund has managed to beat most of its equity income competitors despite circumventing some higher-yielding areas, such as utilities. "Most of the stocks we own have yields in the 2% to 2.5% range," he says. "This is not a fund for high income seekers." After a 1% expense ratio is factored in, the fund's dividend yield clocks in at 1.4%. The S&P 500 index's is about 2%.

Ave Maria is one of about a dozen fund families that screen for religious beliefs, including those geared to Baptists, Catholics, Mennonites, Presbyterians and Muslims. According to a study by Schwartz Investment Counsel, such funds don't necessarily suffer just because their screens remove investment options. The study found that, on average, the 42 equity funds with religion-based screens outpaced the S&P 500 index over the 10-year period that ended December 31, 2011.

Schwartz, as well as the Catholic Advisory Board members who determine which companies are off limits, are practicing Catholics. They include Phyllis Schlafly, known for her leadership in pro-life and conservative causes; John Riccardo, a priest with the Archdiocese of Detroit; and Domino's Pizza founder Thomas Monaghan, a client of Schwartz's firm who suggested to him the idea for a family of Catholic mutual funds at a Christmas party 12 years ago.

An Economic Crossroads

For Schwartz and Platte, religious principles are just a small component of the investment process. While they focus mainly on an individual company's financial profile and prospects for future earnings growth, they also consider how the economy will affect their businesses going forward. Today, they see some encouraging signs of health in companies that have emerged from the economic crisis leaner and more profitable-and with lots of cash on their balance sheets. Some of these companies have been using that cash to increase their dividends and buy back shares.

At the same time, the continued recession in Europe and slower economic growth in China could create headwinds for the U.S. stock market for at least the rest of the year. Another worrisome sign is that profit growth is slowing down as companies try to dig up new ways to cut costs and boost productivity.

Schwartz lays much of the blame for sluggish economic growth on what he considers the misguided economic policies of the Obama administration. "The president's promotion of socialistic, anti-business policies have contributed to keeping unemployment at high levels, discouraged businesses from expanding and hiring and led to economic stagnation," he says.

The results of the upcoming elections will have a major impact on both the economy and the stock market. "In the 40 years I have been in the investment business, I have never seen an election more important than this one," Schwartz says. "We are at an economic crossroads with a fiscal cliff sitting in front of us. A Republican administration that would cut government spending and lower tax rates is critical for a return to the kind of pro-business environment that would benefit the economy and the stock market."

Whichever way the political winds blow in November, Schwartz and Platte believe economically sensitive stocks that could benefit from an upturn are selling at particularly cheap levels right now. Platte says building products retailer Lowe's, for example, has faced multiple challenges in a slow environment for home building and improvement, but has taken tough measures-closing some of its stores to improve profits. Despite the slowdown in business, it has managed to increase dividends and buy back some of its stock. "Home Depot is the one to beat, but Lowe's is on the comeback trail, and the stock is more attractively priced," Platte says.

Sysco Corp., a food service company that distributes meals to restaurants, educational facilities, lodging establishments, etc., has also taken a hit as food prices rise and cash-strapped consumers balk at eating out. But Platte believes the company will benefit when the economy improves and it is in a better position to pass through any increases in food prices to its customers. In the meantime, the company is selling at an attractive 14 times estimated 2013 earnings and has a dividend yield of nearly 4%.

Schwartz described Exxon Mobil Corporation, the fund's second-largest holding, as "well-known but underappreciated in the marketplace. It's a money machine that's gushing cash, increasing dividends, and buying back its stock at a rapid pace."

U.S. Bancorp, the sixth-largest bank in the U.S., has drawn the Ave Maria fund managers for its simple, effective business model. They like its plain vanilla business of gathering deposits and making loans, and its loan losses aren't nearly as severe as those suffered by larger banks.

Although the Ave Maria fund focuses mainly on large company stocks, it also has a smattering of smaller holdings such as Cato Corp., a women's specialty retailer based in North Carolina that has a 3.2% dividend yield. Schwartz and Platte like the company's steady dividend increases and low debt and the fact that management holds a lot of the stock.