Market timing is generally known as the act of attempting to predict the future direction of the market. Attempts at market timing reflect the general desire to improve portfolio performance over a “buy-and-hold” portfolio. Yet, there is little evidence that market returns are predictable in the short term. How then might it be possible to improve portfolio performance over a buy-and-hold portfolio?

Research has shown that it is possible to predict not the magnitude of future market returns, which is difficult if not impossible, but the volatility of future market returns, which are more quickly visible. Focusing on the volatility dimension may enable performance that is superior over a buy-and-hold portfolio.

Is forecasting market volatility a form of timing? In a sense, yes, but it is a very different sort of timing and it can help inform the building of what we call “Volatility Managed Portfolios” (VMPs).

Forecasting Volatility is Possible and Practical

A large body of research documents the notable predictability of asset return volatility and the accuracy of volatility estimates as much higher than return estimates. For example, with 120 observations – 10 years of monthly data – the estimate for volatility is about 40% more accurate than the estimate for returns. Put another way, roughly speaking, it takes a year of returns to learn as much as we do from about two months of volatility calculations.

An intriguing implication of forecasting volatility is that the future direction of the market, not the magnitude of the move, is also forecastable. When volatility is very low, the returns are likely to be clustered around the positive expected return and most realizations are positive. On the other hand, when the volatility is very high, there are more occurrences of negative returns, but also of very positive returns as well.

An Example of Volatility Timing and Performance

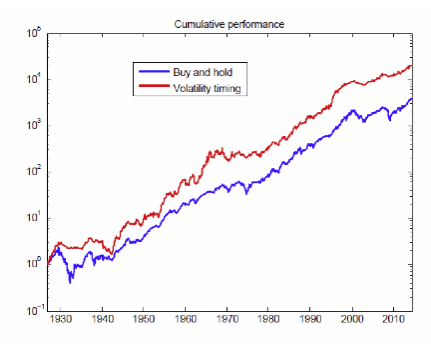

To see the implications of volatility timing for an investor, Tyler Muir and Alan Moreira (Muir and Moreira, 2015) compare a buy-and-hold portfolio with a portfolio that allocates capital to the market based on the variance of the market portfolio in the immediately preceding month. The dynamic portfolio adjusts so that, if the variance of the daily returns in the past month is higher, then the allocation to the market in the next month is reduced. As the graph below shows, this dynamic portfolio outperforms a buy-and-hold portfolio in a consistent manner from 1926 to 2015.

Source: Muir and Moreira

This research shows that the horizon of these two variables – volatility and future return - behave quite differently. Volatility tends to spike and recede quickly, whereas expected returns are more persistent and realized in a slower manner with a longer horizon. An investor may miss the first leg of the future returns while volatility decreases/normalizes, but returns tend to remain persistent allowing the investor a chance to participate even as they enter with a delay. On a risk-adjusted basis, this reaction generates superior performance and better downside protection.

Trading Costs

When taking into account practical considerations such as transaction costs, Muir and Moreira’s findings still stand. A strategy that trades only when last month volatility is higher than the historical average generates an average monthly turnover of 10% and an annual outperformance of 2.2% before trading costs.

For this outperformance to vanish, the transaction costs will have to be 1.83%. Current reasonable estimates of transaction costs are 10-15bps of traded value in retail platforms and lower in institutional settings so investors get a big chunk of the outperformance.

Volatility Timing and Portfolio Holdings

How can advisors and investors utilize volatility timing? First, they need to have portfolios that are truly diversified. If you can’t predict which markets will be up or down, you need to be in many asset classes (including alternatives), sub asset classes, multiple economies and regions to achieve a better investment outcome. With the broad range of ETFs available today, a well-diversified portfolio can be constructed with 100% ETFs.

Second, is a careful, systematic review of the movement of portfolio positions and how each movement impacts other parts of the portfolio. Then you need to make changes accordingly and consistently.

Third, is applying volatility management. Essentially, when volatility goes up, this approach decreases the exposure to the volatile position. This may seem counterintuitive to those with a value mindset who won’t sell or panic, but rather buy.

However, reducing drawdown is as valuable as prognosticating about the upside. Why? Volatility and future return behave quite differently. Volatility tends to spike and recede quickly, whereas expected returns are more persistent and realized in a slower manner with a longer horizon. This means that an investor may miss the first leg of the future returns while volatility decreases/normalizes, but returns tend to remain persistent allowing the investor a chance to participate even as they enter with a delay. On a risk-adjusted basis, this reaction using volatility management typically generates superior performance and better downside protection.

Vinay Nair, Ph.D., is co-chairman of 55 Capital and a visiting professor at The Wharton School.