Not everyone wants to be immortal, though a lot of people find the idea appealing. Yet by talking about living a long life, people also likely mean that they want to have a healthy and enjoyable one: in which they are mentally acute and physically able to get around and enjoy the company of their great-great-grandchildren.

Throughout history, people have looked for ways to live forever. (Famous legends include explorer Ponce De Leon’s search for the Fountain of Youth and the Hungarian Countess Elizabeth Bathory de Ecsed’s supposed proclivity for bathing in the blood of female virgins to retain her youth.)

Those stories are based on myths and amusing, but what is serious is that a number of today’s billionaires are investing in a cure for death. Among them is venture capitalist Peter Thiel. Sergey Brin, a co-founder of Google, has also been involved in business looking to answer science’s great questions, including those about aging. Larry Ellison of Oracle fame has established the Ellison Medical Foundation to pursue ways to extend human life with the eventual goal of ending mortality. Peter Diamandis, the founder of the XPrize, founded a company called Human Longevity Inc., with a similar goal and he’s also offering a $10 million prize for those who find ways of extending life.

Immortality may be out of reach, but in the meantime, it may be possible to live longer and healthier—let’s say to age 120—as medicine advances at its current rate.

A Medical Revolution

As medicine undergoes a revolution, it could be that people grow much older, in part because we have cured them of diseases that are fatal today. More important, they will be able to enjoy those lives—be more mobile and astute.

According to Daniel Carlin, MD, the founder and CEO of WorldClinic, one of the foremost concierge health-care firms, “Medical treatments, such as immunotherapy to treat cancer, are likely to be revolutionary.”

Stem cell treatments are able to restore the cartilage surfaces of 55-year-old knees to the functional equivalent of a teenager’s, says Carlin (a treatment available for those who can afford it, anyway).

“Today,” he continues, “we are going all the way down into an individual’s genome to learn where their inherited risk for illness might lie, and then overlaying their acquired risk from their lifestyle choices to create a full spectrum plan to prevent serious illness.

“I suspect many people with the means and insight to realize its inherent value will adopt this approach. It is clear that medicine is fast evolving, but only those who know where to go and can afford the treatments are going to benefit, at least in the near term.”

The complication is that not everyone will be able to.

The Health-Care Divide

The wealthy tend to live longer and healthier lives than the less affluent, for a number of reasons, including their access to healthier foods and superior medical care. The wealth gap may be increasing, but it won’t compare with the health-care divide, in which the opportunity to live longer and better is limited to those with significant financial resources.

Medical tourism, in which people travel abroad for care, perhaps at lower costs, is one notable aspect of that divide, as it becomes an important way for the wealthy to access state-of-the-art treatments. For example, medical facilities in particular countries (such as the Isar Clinic in Munich, Germany) are providing the latest advances in stem cell therapies. To receive these therapies and other cutting-edge treatments, you must first know about them and then be able to access and afford them. They are not covered by traditional health insurance.

The rich and super-rich have always been very willing to commit resources to living longer, healthier lives. The economics are less workable for others. Although effective treatments not covered by health insurance will, in time, filter down to the general population, advances in the short term (10 years or so), will continue to be available only to the wealthy. Yet even the wealthy, if they fail to plan, will have fewer options unless they embrace comprehensive longevity planning.

Self-made millionaires tend to rely on themselves and feel a sense of control over their lives. And they obviously have the money to pay for health care (as long as their wealth is liquid). So until recently, they would tend to rely on traditional health insurance, augmented by high-end concierge medical care, and this care was in large part reactive, not preventative.

This has dramatically changed with new risk assessment and treatment technologies. The cost of these is considerable—think hundreds of thousands of dollars—and traditional health insurance covers few of them.

A growing number of wealthy families are taking a prospective approach by creating comprehensive health-care contingency plans that incorporate their financial plans. The process is to combine elite concierge health care and cutting-edge medicine with high-caliber wealth management. The marriage of these two disciplines is referred to as “comprehensive longevity planning.”

Working with an elite concierge medical practice, one focused on identifying potential future illnesses using biomarkers and related technology, will enable the wealthy to discern potential health-care catastrophes and even identify possible state-of-the-art medical solutions that will make life much more rewarding.

A number of leading wealth managers are addressing future health-care problems and treatments by working with leading concierge medical practices and related organizations to produce health-care contingency plans that would use the most advanced medical care in the world.

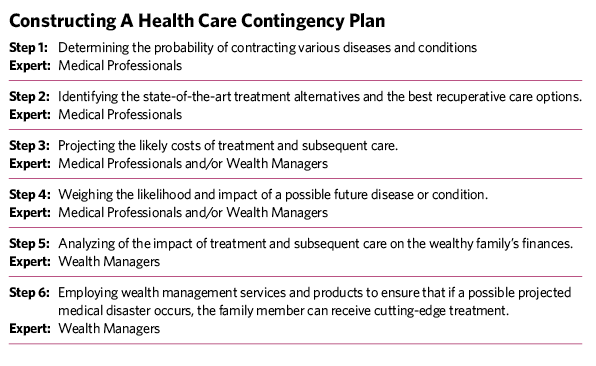

Constructing a health-care contingency plan involves a number of steps (see the chart). To start, medical professionals, using technologies like genome mapping, determine the probability of contracting various diseases and conditions. Then they identify the latest medical treatments available, and find out where they are located.

The medical professionals, often with the wealth managers, project the likely costs of treatment and subsequent care. At the same time, they determine what the impact of the disease on the individual and the family would be. That allows wealth managers to determine the financial repercussions. Lastly, the wealth managers specify the financial planning and the products and services they can bring to the table to ensure the wealthy family can afford the cutting-edge health care they desire.

Wealth Managers

It is important to realize that health-care contingency plans require constant updating. As the medical revolution progresses, as the world of high-end financial solutions evolves, there is a constant need to update a wealthy family’s health-care contingency plan.

This approach is, of course, less available to a prosperous family with illiquid wealth, maybe wealth primarily stored in a privately owned business or in investments that are difficult to exit. Such families may have difficulty coming up with the millions of dollars that will be required and will have to make very difficult choices about wealth allocation if a family member is stricken.

While immortality might forever be out of reach, living a highly productive and enjoyable life to age 120 (or beyond) is not. Advances in medicine over the next decade will certainly bring us closer and closer to this reality. The complication is that money matters.

Today and for the foreseeable future, traditional health insurance will not pay for all the various treatments available—especially the latest and most revolutionary treatments. This requires people to cover the costs themselves. Even in the world of multi-millionaires, without concerted and sophisticated planning, they too will not be able to have the health care to extend their lives.

Russ Alan Prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.