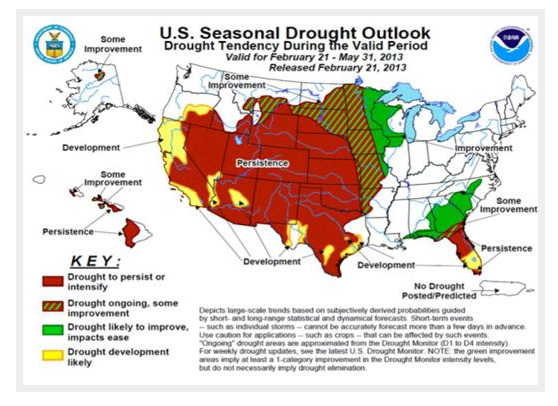

Water’s localization means great complexity and fragmentation for water sources and infrastructure. In California, according to the U.S. EPA, there are over 2,900 independent water systems, and over 6,700 water sources. There are over 700,000 miles of water pipe in the U.S., demonstrating how water is inextricably linked to local commerce. Water is also variable, with annual precipitation rates a direct determinant of global agricultural output. The severe drought in North America continues, as shown in the NOAA chart below, covering almost 60 percent of the U.S. Australia, Russia, and the Ukraine have also experienced sharp harvest declines due to drought, leading to low global wheat inventories and the potential for further soft commodity pricing pressures.

The opportunities in global, listed-equity water investing are varied across the water universe with hundreds of companies, although primarily in fragmented water utilities. Our GEOS water theme runs from water conservation to efficiency and recycling/re-use. Within conservation, we are invested in water metering, and industrial process enhancements. For efficiency, we favor irrigation techniques, infrastructure upgrades and industrial process controls. For re-use and recycling, we have exposure to desalination efficiencies, and treatment and purification. Our focus is on water technologies for their long-term, sustainable growth potential, versus owing lower-growth water utilities. The opportunities are favorable across this water vertical, from water system upgrades in the U.S. and other developed markets, to water access and purification in the non-OECD regions. Water stresses are not decreasing in the near or long terms. Given population growth, and density combined with associated secular changes to emerging market economies, water technologies and infrastructure development needs significant scale and investment. Our water theme is particularly attractive, as its growth is driven by new investment in the emerging markets, and a strong replacement cycle in developed economies.

In managing the Essex Global Environmental Opportunities Strategy (GEOS), we invest across nine clean technology themes. A key GEOS theme is water, which is a complex and precious resource. Water is localized, with its presence a critical catalyst to rates of economic growth. We learned alarming news from China this week, that, in addition to their air pollution travails, the water tables in every Chinese city are severely polluted. Economic growth rates in many emerging markets, previously achieved with little regard to environmental degradation, could slow as environmental regulations are finally enforced. China has had central government-led water regulations on the books for several years, and they will be enforced this year.

In managing the Essex Global Environmental Opportunities Strategy (GEOS), we invest across nine clean technology themes. A key GEOS theme is water, which is a complex and precious resource. Water is localized, with its presence a critical catalyst to rates of economic growth. We learned alarming news from China this week, that, in addition to their air pollution travails, the water tables in every Chinese city are severely polluted. Economic growth rates in many emerging markets, previously achieved with little regard to environmental degradation, could slow as environmental regulations are finally enforced. China has had central government-led water regulations on the books for several years, and they will be enforced this year.

Water is a paradox; it is omnipresent, but as was said in The Rime of the Ancient Mariner from 1798: “Water, water everywhere, Nor any drop to drink.” The world’s water distribution is a mere 2.5 percent fresh and only 30 percent of that is groundwater – with many sources polluted. Surface water makes up 1.3 percent, providing the bulk of potable water resources. One of the few details I recall from high school chemistry class is that water is an important solvent. Water is used across industrial and agricultural economies for the production of goods. 16,000 liters of water are required per kilogram of beef production, illustrating the water stresses caused in developing economies as consumers increase protein-related beef diets. In contrast, according to the Water Footprint Network, wheat production takes 900-2,000 liters per kg. China’s massive out-sourced contract manufacturing and related semiconductor industries, while contributing significantly to economic growth, are one primary reason for water table pollution, and water re-use and filtration technologies are finally being adopted per newly-enforced water regulations. Water is a requirement for economic development, with agriculture responsible for over 70 percent of global water use. However, industrial use of water is much greater in the emerging markets versus developed, with energy infrastructure highly dependent on water, whether the power generation is coal, natural gas or nuclear. Intermittent water supplies have caused unreliable power production in India and China, as experienced in last summer’s blackout in India, which affected the entire county for over 24 hours. China has been forced to initiate rolling brown and black outs given low water supplies for their dependent and primary coal-fired power.

William Page is a Senior Vice President and Portfolio Manager for the Essex Global Environmental Opportunities Strategy (GEOS).

Water: A Complex And Precious Resource

March 25, 2013

« Previous Article

| Next Article »

Login in order to post a comment