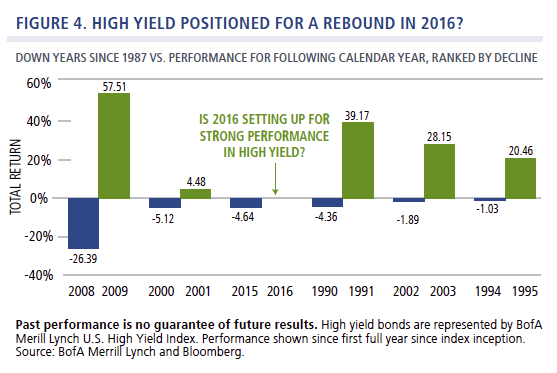

High Yield. Having benefited greatly from quantitative easing, the credit markets have faced formidable headwinds as monetary policy has become less accommodative. As the carry trade unwinds and market conditions normalize, high yield spreads have widened dramatically. We believe that absent a recession—which we don’t believe is imminent—the high yield market offers attractive value at current levels for accommodative. As the carry trade unwinds and market conditions normalize, high yield spreads have widened dramatically. We believe that absent a recession—which we don’t believe is imminent—the high yield market offers attractive value at current levels for risk-tolerant investors. While history does not always repeat, the high yield asset class has historically performed well during the years following its steepest declines (Figure 4).

Still, with defaults likely to rise (though remaining below long-term averages) and given the likely impact of low commodity prices on energy issuers, there will be winners and losers. In this environment, we have found opportunities to increase exposure to BB issues, while remaining selective regarding the most speculative credits. We are particularly focused on identifying “rising stars” (high yield issuers with

Lower-volatility equity and alternative strategies. We also believe that this is an environment where investors will be well served by maintaining sufficient diversification in their portfolios, including through less traditional approaches. Given the crosscurrents we see in the global market (equity market volatility, rising rates in the U.S., slow global growth), we believe the case is compelling for lower volatility equity strategies that combine equities and convertibles, as well as for select alternative strategies.

John P. Calamos Sr. is CEO and global co-CIO at Calamos Investments.

the best potential for an upgrade to investment grade), given the significant spread compression that accompanies such moves. From a sector perspective, we have a more constructive outlook for services, consumer goods, autos and health care, while underweighting financials, media, telecommunication services, energy and commodities.

Conclusion

Many are likely to find this volatile environment frustrating and possibly even scary. However, having invested through volatile markets before, we encourage investors to resist the temptation to chase the herd or panic out of the market. We believe strongly both that there are opportunities in 2016 and also that we are positioned to capitalize upon them through a selective and research-driven approach.

Wealth Inequality, Volatility Strong Themes In 2016

January 14, 2016

« Previous Article

| Next Article »

Login in order to post a comment