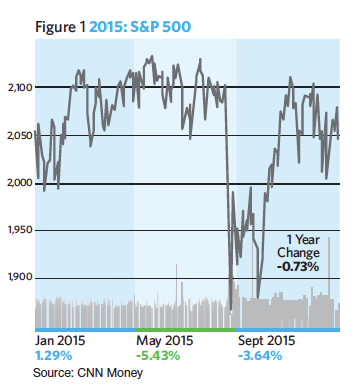

U.S. stock prices wandered indecisively between – 3% and +3% during the first half; no fun, but not scary. Things got more emotional between the Fourth of July and Halloween (see Figure 1). The index of large-company stocks slumped suddenly to -9% YTD in August, troubled by currency and economic weakness in China. A robust October rally boosted the index back to barely positive, then drifted to an inconclusive -0.7% for the year when the closing bell rang on December 31. (In the first week of 2016, stocks plunged another 6%.)

But weakness in U.S. stocks was deeper and more widespread last year than indicated by Figure 1. Late last year, the 10 largest stocks (by market value) had actually risen by +21% as a group, while the remaining 490 companies’ shares had lost -2.6%! That is the widest price performance advantage for the big ten since 1999, just before the market plunged into what is now labeled the “dot-com bust.”

Few believe we are witnessing a replay of that era. While it’s just one historical data point, it is a sobering one, suggesting little investor support for most stocks. Many investors like to focus on historical data but, in some instances, a top-down, big-picture perspective may be in order.

What’s the main reason for the recent instability in U.S. stock prices? The leading culprit is weakening corporate profits. Weak top-line revenue growth has characterized both the economic recovery and the bull market that began in 2009. Given the 2% GDP growth experienced in the U.S., companies have relied on cost controls and stock buybacks to engineer their profit rebounds. In recent years, though, rising cost pressures and a strong dollar have conspired to hamstring many firms’ profits, particularly the giant multinationals that represent a major share of the S&P 500.

A “No Place to Hide” Kind of Year

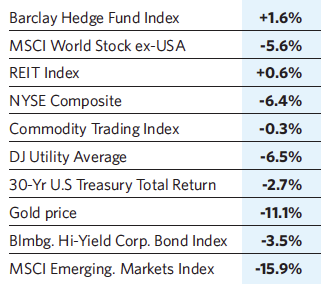

Often when U.S. stock returns disappoint, other asset classes (bonds, commodities, real estate, precious metals, foreign securities, even hedge funds) come to investors’ aid. That’s the underlying rationale for keeping portfolios diversified. But last year, soft returns were unusually widespread. Here’s a sampling of the 2015 disappointments:

Many hedge funds would have been delighted to match that Barclays index for their group. By all means, most investors in all of the above asset classes are glad to turn the page on the calendar.

Global Caution Still In Order; U.S. Best Positioned

“It ain’t what you don’t know that gets you into trouble,” Mark Twain opined. “It’s what you know for sure that just ain’t so.” Gazing into the midst of this new year, faced with such novelties as negative interest rates and an emerging “Caliphate,” a greater-than-usual amount of humility concerning likely future developments is apropos!

A cautious portfolio is certainly appropriate, for reasons we’ll mention in this memo. Still, our long-term view is that the U.S. private sector is best positioned among all the global economies to grow by putting investors’ savings to work productively. We enjoy here a culture of innovation, economic freedom and market transparency. And we believe that with some price corrections, perhaps even later this year, more attractive investment values will surface.

Meanwhile, if one wants to avoid missing opportunities from better-than-expected developments, remain invested—but guardedly and attentively.

Don’t Underrate Defense As A Strategy

Some of us Marylanders like to recall that the Baltimore Ravens won Super Bowl XXXV by 34-7 via one of the most dominant defenses in NFL history. Lesson: Defense can be very rewarding! The following are some of the ways to maintain a risk-reduced posture.

• Moderate equity exposure. Stocks are typically the most price-volatile of the major asset classes, but they are also the most productive class over time. Since no one can really know for sure what lies ahead (c.f. Mark Twain, above), our style is to always own stocks in portfolios, but to scale back our equity exposure when stocks are expensive and increase when they’re a bargain. Stock exposure is currently well below its upper limit in all of our portfolio profiles.

• Emphasize liquidity. If news turns unfriendly, we want a reasonable exit to be possible.

• This is no time to own mutual funds based on broad stock indexes. Rather, focus on the shares of companies with clear competitive advantages. If slow growth turns into no growth, every economic sector will turn intensely competitive—the weak players (which are included in index funds) will lose market share and profit margins will shrink. The most competitive firms will excel by gaining market share.

• Tactical Strategies. Own specialized mutual funds whose style is designed to be productive in weak markets. One example is Vanguard Market Neutral.

• Another defensive category is precious metals. It can attract frightened capital from around the world when the headlines feature terrorism, armed conflicts, currency wars or deflation. Our current position is modest, but that could change.

• Bonds are the classic defensive investment when stocks are in the doldrums. But the tricky aspect of today’s global bond market is that the central bank sponsors of major world currencies have suppressed interest rates dramatically. Some stand accused of cuurency manipulation. In Germany the four-year government bond actually has a negative yield-to-maturity of -0.25%; it makes a four-year U.S. Treasury at 1.5% look downright prodigious! Short-duration, high-quality bonds; a 2% yield from a seven-year U.S. Treasury can put a smile on clients’ faces during a bear market in stocks!

• Emerging markets do capture investor imagination. All that potential for springing from subsistence living to western-style prosperity! A contrary point of view says, “Emerging markets have the best potential in the world, and they always will!” As an asset class, their stocks had a negative total return for the past six years. Some emerging markets are evolving free-market economies, but many are a strange hybrid. Many others depend on China. For now, we think an underweight is prudent.

For Now, A U.S. Emphasis Is Attractive

Complaints about regulation and re-distribution of income are pervasive, but Americans enjoy more freedom, greater market transparency and better information flow than anywhere in the world. People and institutions all over the world with money to invest understand that our culture and our politics—as much as they may drive us nuts sometimes—are fertile ground for risk-taking-innovation, growth and good returns. These explain our envied standard of living. Global investors know it.

One financial trend that may well develop: As the Chinese Communist Party tries to revive its central-planning experiment; as Brazil, with the fifth-largest population in the world, tries to find its way out of a near-depression; as Japan, with the tenth-largest population, struggles to stabilize its currency without shrinking its stagnant economy; as the Middle East searches for a peaceful solution to the ancient rivalries that have heated up dramatically; and as Euroland grapples with its enormous immigration challenges, what might develop is that capital from all over the planet may begin to gravitate to our spacious skies and fruited plains as a sort of safe harbor.

If more money does begin to flow here from elsewhere, an early side effect would be rising prices for U.S. securities, even though both stock and bond valuations are rather high by historical standards.

J. Michael Martin is chairman of FAI Wealth Management, based in Columbia, Md.