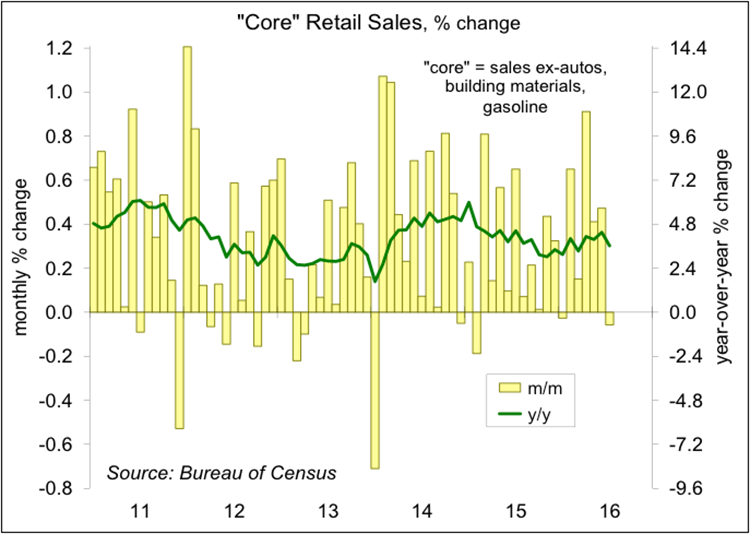

The soft retail sales results for July, combined with a lower-than-expected Producer Price Index, added to concerns that the economy may be flagging. One month does not make a trend and monthly changes in retail sales are normally erratic. Details suggest a mixed bag, with some sectors gaining over the last year, while others have softened. The bigger concern remains the slowdown in productivity growth.

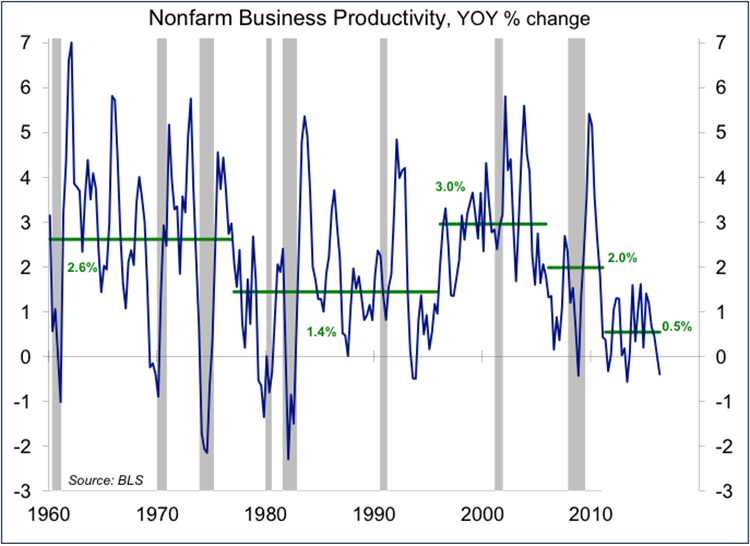

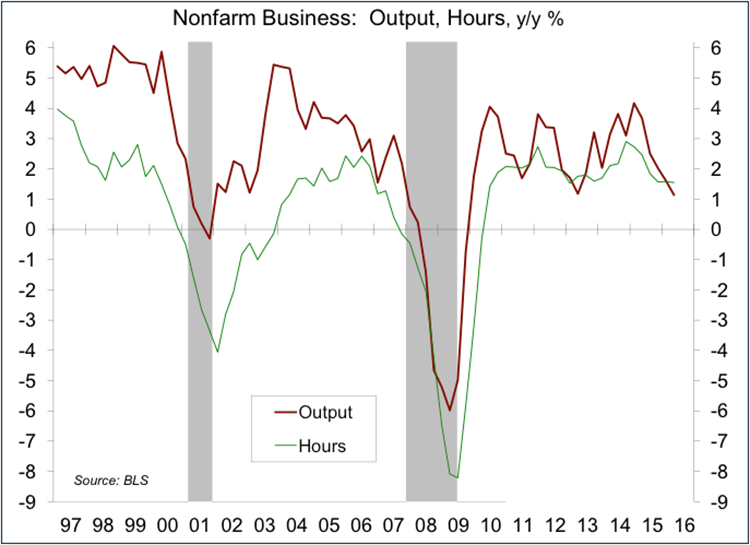

The Bureau of Labor Statistics reported a decline in nonfarm business productivity in the preliminary estimate for 2Q16, with a further increase in unit labor costs. Quarterly figures can be erratic, but the trend in output per worker remains weak – a 0.5% annual rate over the last five years.

Note that productivity growth figures have slowed less for the nonfinancial corporate sector (averaging about 1.0% per year over the last five years), but they’ve still slowed.

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.

Retail sales were about flat in the advance estimate for July, despite a pickup in motor vehicle sales. Ex-autos, sales fell 0.3%. Lower gasoline prices put some downward pressure on the total. Ex-autos and gasoline, sales fell 0.1%. Monthly figures can be choppy and seasonal adjustment is often tricky. Looking at the unadjusted figures for the last three months shows an odd mix. May-July auto sales were up 0.7% y/y, consistent with nearing a long-term sustainable pace (driven largely by replacement needs). Gasoline sales were down 9.9% (lower prices). Electronics fell 4.2% (lower prices, fewer new gadgets). Department store sales fell 4.7% y/y (reflecting a long-standing downward trend). Apparel fell 1.3%. Spending at restaurants and bars rose 5.2% (partly reflecting a long-term trend of taking more meals outside the home, partly reflecting an increase in discretionary income). Sales at nonstore retailers, which include internet sales, rose 13.4% y/y). These data serve to remind us that there is no such thing as “the consumer.” Wage and income growth can vary across the scale, lower gasoline prices won’t benefit those who don’t drive, and higher rents and healthcare expenses affect some households more than others – however, on average, the household sector is in good shape.

Faster productivity growth means that you get more output per worker. Additionally, for any given wage, it means you get more output per dollar spent on labor. A rise in unit labor costs will result in higher consumer price inflation (if firms can pass the increase along) or eat into corporate profit margins (if they don’t have pricing power). Over time, this can have a major impact on some firms and some industries.

It’s unclear why productivity growth has slowed. It could be a measurement issue, but that’s not likely. Low capital spending seems a likely culprit. Some cite federal regulations, but most business regulations are state and local. A slower turnover rate in the economy seems to be factor (as high-productivity jobs are replacing low-productivity jobs at a slower pace). Regardless of the cause, a slower trend in productivity growth would have a significant impact on how we live. Lower spending on research and development (public and private) isn’t going to help.