Our cyclical baseline forecast through 2017 is for a continuous global economic expansion, mostly supportive monetary and fiscal policies and broadly range-bound markets. However, we are concerned about risks lurking beneath the surface, especially in the context of asset prices that in many cases appear stretched. The recent bout of market volatility that followed sedated summer trading may be a guide to what lies ahead: occasional regime switches between periods of relative calm (supported by benign macroeconomic data and sedative monetary policy) and periods of rising volatility and uncertainty caused by … “whatever.” This is why we favor a more cautious portfolio positioning despite our relatively benign baseline macro outlook, in line with our “Stable But Not Secure” secular theme.

Calmer C’s have arrived, but what’s next?

When PIMCO’s investment professionals gathered earlier this month for our September Cyclical Forum, the macro and market backdrop was very different from the one before our previous Cyclical Forum in March. Back then, recession fears were still lingering after the sell-off in risk assets earlier in the year, a sharp slowing of the U.S. economy, and concerns about China and the emerging market commodity complex. Yet, we decided to dismiss the recession fears and coalesced around a cautiously optimistic cyclical outlook for 2016 (see “Calmer C’s Ahead? China, Commodities and Central Banks Dominate the Global Outlook ”).

Since then, the global economy and markets have broadly followed our script despite a pothole in U.S. growth in the first half of the year and the Brexit shock. More dovish central banks, an orderly rather than disruptive depreciation of the Chinese currency and a stabilization of the dollar on the back of the late February G-20 “Shanghai co-op” have helped maintain the status quo. In short, over the past six months, the global economy and markets arrived in the calmer seas that we anticipated back in March. And looking ahead, the resulting easing in broad financial conditions in the course of this year provides a helpful tailwind for near-term cyclical developments in the remainder of 2016.

Our baseline forecast: Lackluster but longer

Expansions don’t die of old age; they die because something kills them. History suggests that the assassin has usually been the central bank (reacting to an overheating economy), or a major oil price shock, or the bursting of a credit-fueled housing bubble. Our forecast for 2017 is for ongoing growth because we don’t expect “something” will show up – central banks are still fighting the opposite of overheating, oil prices seem capped by more elastic supply and credit and housing are not exactly booming. Hence, global recession risks appear to be contained over our cyclical horizon despite more lackluster trend growth than in previous cycles.

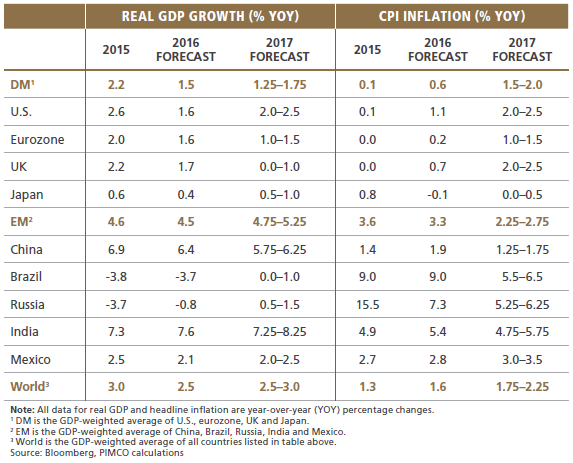

In numbers, we expect world GDP growth to pick up slightly from around 2.5% this year to 2.5%–3.0% in 2017 (see table). With core inflation expected to remain below target in most major developed market (DM) economies, monetary policy will likely remain accommodative overall, and fiscal policy is more likely to ease than tighten over the next year in most countries.

DM: More of the same overall, but mind diverging dynamics

Meanwhile, growth in DM as a whole in 2017 is likely to hover sideways in a range around this year’s 1.5% pace. Yet, growth and policy dynamics within DM should diverge substantially:

• We see U.S. growth returning to a 2%–2.5% channel in 2017, following the 1% soft patch during the past three quarters, helped by an expected end of the inventory correction and a revival of business investment amid ongoing robust consumer spending. With potential GDP growing at only 1%–1.5%, the remaining output gap is likely to disappear in the course of next year and slack in the labor market should erode further. This, together with a rise in headline CPI inflation from 1.1% year-over-year as of August to 2%–2.5% during 2017, will likely allow a data-dependent Federal Reserve to raise rates two or three times between now and the end of 2017, while markets price in only one hike.

• In Japan, we also expect somewhat higher growth of 0.5%–1.0% in 2017, helped by significant fiscal stimulus. With fiscal policy turning expansionary, the chances for monetary policy to find more traction have improved as well, particularly as the Bank of Japan just recalibrated its easing program with a view to minimizing the negative side effects on the financial sector. Still, we expect the quest for 2% inflation to remain elusive also in 2017, not to speak of the Bank of Japan’s newly adopted objective to overshoot the 2% target.

• Eurozone growth momentum should remain broadly unchanged in a 1%–1.5% range in 2017 and thus above potential output growth of at most 1%. Yet, with inflation unlikely to make much progress toward the European Central Bank’s (ECB) “below but close to 2%” objective, we expect a further round of monetary easing in December of this year. It will likely include an extension of quantitative easing (QE) beyond March 2017, some changes in the technical parameters of the program to address the “bund scarcity” problem and potentially a further cut in the deposit rate. Additional easing next year cannot be excluded, and if the ECB were to consider venturing into buying an additional asset class, equities would be the most obvious next choice.

• Our baseline sees UK growth slowing temporarily into a broad 0%–1% range in 2017 as Brexit-related uncertainties damp investment spending and make consumers more cautious. However, easier monetary and fiscal policies as well as the lagged effects of a weaker currency should help to contain the damage. Inflation should pick up toward and above the 2% target in the course of 2017 as the pound’s weakness is likely to feed through into import prices and inflation expectations.

The delta is in EM

A key feature of our 2017 baseline forecast is better prospects in emerging markets (EM), where we see aggregate GDP growth accelerating from some 4.5% this year to between 4.75%–5.25% next year.

External conditions for many EM economies have improved due to the stabilization of commodity prices and the U.S. dollar. Internal conditions are more conducive to growth, too: Inflation has likely peaked, giving central banks room to ease, and several countries are making progress on structural reforms. Also, with the deep recessions in Brazil and Russia now likely to end and give way to a moderate recovery, a major drag on EM aggregate growth should disappear.

Regarding China, our base case is that the ongoing rebalancing from investment to consumption leads to a further gradual slowdown in growth, which continues to be overstated by the official statistics. However, the hard landing in the industrial complex, which is what matters most for global trade and commodities, has already happened in recent years – evidenced by the past decline in commodity prices and dismal growth rates of industrial output, exports and imports. This, together with our expectation that further currency depreciation will be gradual and orderly, suggests that China won’t throw major spanners in the wheels of the global economy and its EM peers over our cyclical horizon.

Benign baseline, but zero room for complacency

While our baseline scenario of ongoing global growth helped by better EM fundamentals and supportive policy is relatively innocuous, there is no room for complacency, for three reasons:

• First, asset markets seem fully priced for a very benign outcome and thus vulnerable to even small negative surprises.

• Second, as we explained in our Secular Outlook in May, we are concerned about longer-term risks that are lurking beneath the surface, such as high debt levels, diminishing returns to monetary easing and the longer-term consequences of rising populism.

• Third, even if these bigger secular risks remain contained, a lot can derail our and the (similar) consensus baseline forecasts even over the cyclical horizon. Therefore, we actually spent more time at the forum discussing the swing factors that could drive left tail or right tail outcomes, rather than the baseline itself.

Enter the three P’s: Productivity, policy and politics

In our view, the most relevant swing factors for the cyclical outlook are productivity, (monetary and fiscal) policy and politics. The simple framework is as follows:

• Productivity drives the supply side of the economy and thus potential output growth;

• Policy is the main determinant of aggregate demand and thus of the fluctuations of actual GDP relative to potential (the “output gap”); while

• Politics enters the forecast equation as the main non-economic source of uncertainty and volatility.

Stronger productivity: Blessing or curse?