Michael: My father is no different than any powerful man, any man with power, like a president or senator.

Kay Adams: Do you know how naïve you sound, Michael? Presidents and senators don’t have men killed.

Michael: Oh. Who’s being naïve, Kay?

– “The Godfather” (1972)

As Tolstoy famously said, there are only two stories in all of literature: Either a man goes on a journey, or a stranger comes to town. Of the two, we are far more familiar and comfortable with the first in the world of markets and investing, because it’s the subjectively perceived narrative of our individual lives. We learn. We experience. We overcome adversity. We get better. Or so we tell ourselves.

But when the story of our investment age is told many years from now, it won’t be remembered as a Hero’s Journey, but as a classic tale of a Mysterious Stranger. It’s a story as old as humanity itself, and it always ends with the same realization by the Stranger’s foil: what was I thinking when I signed that contract or fell for that line? Why was I so naïve?

The Mysterious Stranger today, of course, is not a single person but is the central banking Mafia apparatus in the US, Europe, Japan, and China. The leaders of these central banks may not be as charismatic as Robert Preston in The Music Man, but they hold us investors in equal rapture. The Music Man uses communication policy and forward guidance to get the good folks of River City to buy band instruments. Central bankers use communication policy and forward guidance to get investors large and small to buy financial assets. It’s a difference in degree and scale, not in kind.

The Mysterious Stranger is NOT a simple or single-dimensional fraud. No, the Mysterious Stranger is a liar, to be sure, but he’s a proper villain, as the Brits would say, and typically he’s quite upfront about his goals and his use of clever words to accomplish those goals. I mean, it’s not like Kay doesn’t know what she’s getting herself into when she marries into the Corleone family. Michael is crystal clear with her, right from the start. But she wants to believe so badly in what Michael is telling her when he suddenly reappears in her life, that she suspends her disbelief in his words and embraces the Narrative of legitimacy he presents. I think Michael actually believed his own words, too, that he would in fact be able to move the Family out of organized crime entirely, just as I’m sure that Yellen believed her own words of tightening and light-at-the-end-of-the-tunnel in the summer of 2014. Ah, well. Events doth make liars of us all.

Draw your own comparisons to this story arc of The Godfather, with investors playing the role of Kay and the Fed playing the role of Michael Corleone. I think it’s a pretty neat fit. It ends poorly for Kay, of course (and not so great for Michael). Let’s see if we can avoid her fate.

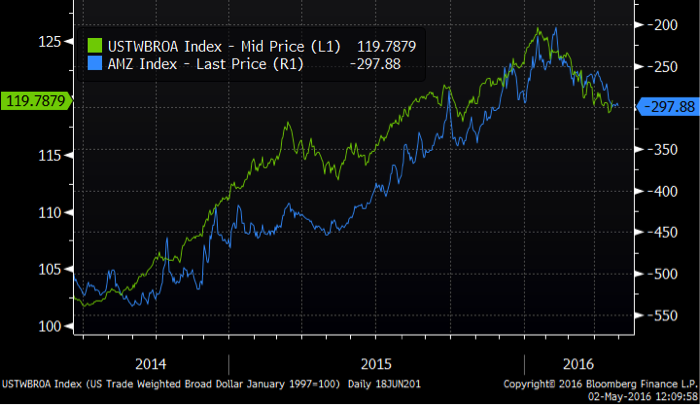

But like Kay, for now we are married to the Mob … err, I mean, the Fed and competitive monetary policies, as reflected in the relative value of the dollar and other currencies. The cold hard fact is that since the summer of 2014 there has been a powerful negative correlation between the trade-weighted dollar and oil, between the trade-weighted dollar and emerging markets, and between the trade-weighted dollar and industrial, manufacturing, and energy stocks. Here’s an example near and dear to the hearts of any energy investor, the trade-weighted dollar shown in green versus the inverted Alerian MLP index (ticker AMZ), a set of 43 midstream energy companies, principally pipelines and infrastructure, shown in blue.

© Bloomberg Finance L.P. as of 05/02/2016. For illustrative purposes only. Past performance does not guarantee future results.

This is a -94% correlation, remarkably strong for any two securities, much less two – pipelines and the dollar – that are not obviously connected in any fundamental or real economy sort of way. But this is always what happens when the Mysterious Stranger comes to town: our traditional behavioral rules (i.e., correlations) go out the window and are replaced with new behavioral rules and correlations as we give ourselves over to his smooth words and promises. Because that’s what a Mysterious Stranger DOES – tell compelling stories, stories that stick fast to whatever it is in our collective brains that craves Narrative and Belief.

There’s nothing particularly new about this phenomenon in markets, as there have always been “story stocks”, especially in the technology, media, and telecom (TMT) sector where you have more than your fair share of charismatic management storytellers and valuation multiples that depend on their efforts.