The Federal Reserve provides a lot more information than it used to. The central bank issues policy statements, it makes public its economic projections and policy expectations, and the Fed chair holds regular press conferences to explain things. However, despite this added clarity, financial market participants appear to be more confused than ever. Last week was no exception. It’s really rather simple.

In August, the Fed appeared to be well on its way to a September rate increase. Eight of the 12 Federal Reserve district banks were pushing for higher interest rates in late July. In their public comments, most senior Fed officials seemed open to a move. In her Jackson Hole speech, Chair Yellen said that “the case for an increase in the federal funds rate has strengthened.” It doesn’t get much clearer than that. However, she also left herself an out: “of course, our decisions always depend on the degree to which incoming data continues to confirm the FOMC's outlook.”

The economic data arriving since Yellen’s Jackson Hole speech have been mixed, but generally on the soft side of expectations. These data, as we all know, are fuzzy. Figures are based on statistical samples (with their inherent uncertainty) and seasonal adjustment is hard to get precisely right (especially when seasonal patterns are shifting, which they appear to be doing). Numbers bounce around from month to month and quarter to quarter. This makes it difficult to judge whether there is a change in trend or whether we’re just looking at noise. The Fed does not consider economic data alone, but also relies on anecdotal information from around the country.

So why didn’t the Fed raise rates? Chair Yellen said that “our decision does not reflect a lack of confidence in the economy.” The job market is strengthening, and the Fed expects that to continue – and while inflation is low, policymakers are confident that it will move back to the 2% target (as measured by the PCE Price Index). However, with the slack in the labor market being taken up at a somewhat slower pace, and inflation still trending below target, “we chose to wait for further evidence of continued progress toward our objectives.” Yellen also emphasized the asymmetry of policy errors. With rates already close to zero, “we can more effectively respond to surprisingly strong inflation pressures in the future by raising rates than to a weakening labor market and falling inflation by cutting rates.”

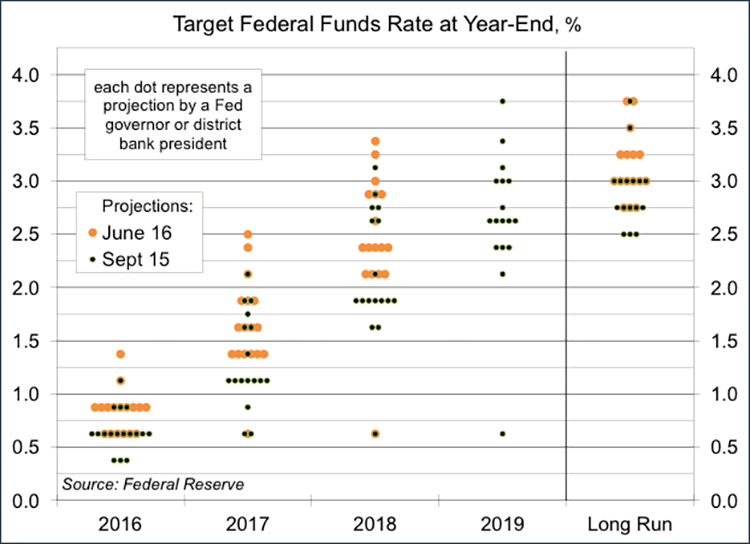

Simply put, the Fed can afford to wait awhile longer. The more interesting outcome from the Fed’s meeting was in the Summary of Economic Projections. At every other Fed policy meeting, senior Fed officials (the five governors and 12 district bank presidents) submit forecasts of growth, unemployment, and inflation. They also submit their expectations of the appropriate year-end level of the federal funds target for each of the next few years (now out to 2019). This is the infamous “dot plot.” The dots in the dot plot were expected to drift lower, much as they have consistently quarter after quarter. However, this time, the shift in the expected glide path of rates was much shallower than anticipated. Fed official remain optimistic about the economy, but they also generally lowered their expectations for future tightening. What gives?

Bear in mind, that the dots in the dot plot are expectations, not an actual plan of action. There is considerable uncertainty surrounding each of the dots. The pace of actual rate increases will almost certainly be faster or slower than expected. This does not mean that the Fed doesn’t know what it is doing. Rather, the outlook for monetary policy reflects the uncertainty in how the economy will evolve in the months and quarters ahead. When the Fed says that future policy decisions will be data-dependent, they mean it. Note that the Fed does not react to the economic data per se. Rather, policymakers react to what the economic data inform them about the future – and the focus remains on the amount of slack in the job market and the likely path of inflation in the months ahead.

The drifting of the dots does reflect a shift in the overall economic outlook. Slower labor force growth (as the job market approaches it long-term equilibrium) combined with a slower trend in productivity growth means that potential GDP growth will be a lot slower (about 2%) than what we grew up with (3.5% or so). That’s simply demographics (two forces propelled GDP growth in the last four decades of the 1900s: the arrival of the baby-boomers and increased female labor force participation).

“I know you think you understand what you thought I said but I'm not sure you realize that what you heard is not what I mean.” – Alan Greenspan

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.