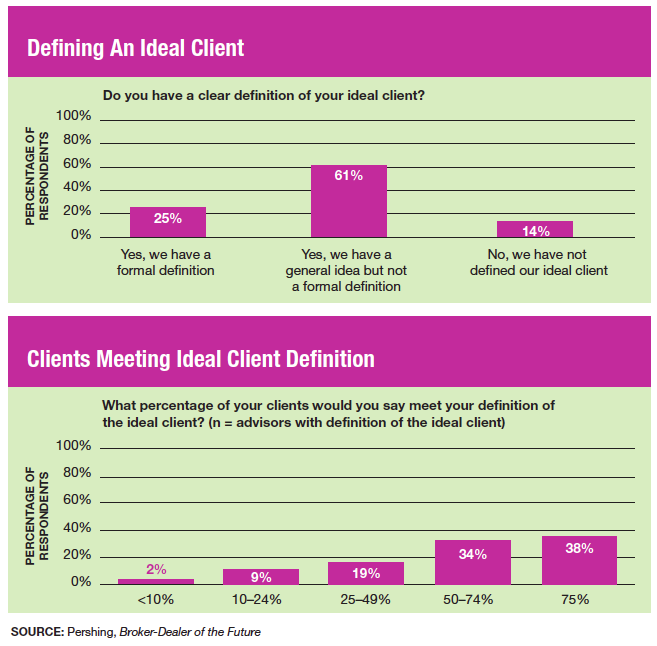

Getting the wrong clients can be a drag––both financially and personally. On the other hand, the right clients can be the ticket to a successful financial advisory practice. Yet only one-quarter of advisors say they have a formal definition of what their ideal client is.

The Financial Planning Association, through its FPA Research and Practice Institute, recently did a study that examined current and future trends for financial advisors related to growing and managing their practices. One of the areas covered was the concept of defining your ideal client. Among the study’s findings is the fact that the largest firms ($500 million-plus) are more likely to have a formal definition and greater success in attracting clients that meet that definition.

Without a clear definition of what makes for an ideal client, concludes the FPA, advisors are more likely to accept clients who aren’t appropriate and/or profitable for their business.