Last year, stocks that pay above-average dividends were like the stock market's security blanket. In a choppy, uncertain environment where the assurance of a dependable dividend payout trumped the glamour of growth, they outperformed the rest of the market by attracting yield-starved investors coping with U.S. Treasury bond yields that had sunk below the rate of inflation.

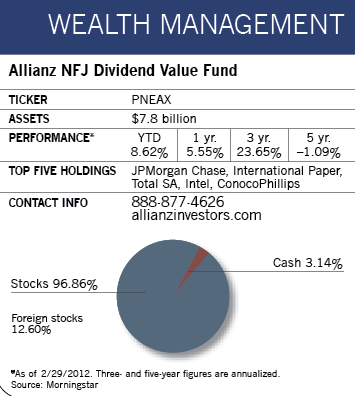

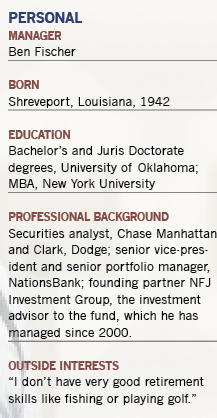

While it's hard to predict whether stocks with above-average dividends will beat the rest of the market this year, Ben Fischer, lead manager of the Allianz NFJ Dividend Value Fund, believes that over the long term dividends will play a more important role in contributing to total return than they have in the past.

"Going back from the early 1900s until today, dividends have contributed to about 45% of total rate of return for stocks," says the 69-year-old manager. "In the future, I believe that number will be significantly higher."

Earlier this year, Andreas Utermann, the global chief investment officer at Allianz Global Investors, elaborated on those sentiments in a report titled "Dividends Set for 1980s-Style Comeback." "We believe the contribution of dividend yields to total equity returns should grow in an environment of modest total returns," he noted. "We could see the contribution of dividend yields to total U.S. equity returns on a 15-year rolling basis double to roughly 60%, or higher, within a decade."

The idea that dividends will account for most of the stock market's returns may seem odd to most investors, who've been reared on the notion that capital gains are its driving force. But Fischer says several facts support the prediction.

For instance, during periods of slow economic growth, which most economists anticipate for at least the next couple of years, dividend payouts have historically been a major component of equity total return.

Next, higher interest rates, which often have a negative impact on dividend-paying stocks because they make bonds relatively more attractive, are unlikely anytime in the near future. With U.S. economic growth still sluggish, the Federal Reserve has already indicated that it intends to keep interest rates low at least until 2014.

Another positive for dividend stocks is that valuations, which were driven up last year as more investors gravitated to higher-yielding stocks, remain reasonable. While Fischer believes certain sectors have become overvalued, he says overall valuations remain reasonable by historical standards. The dividend value stocks in his fund are trading at roughly 9 times next year's earnings, while stocks in the S&P 500 are trading at 13 to 14 times earnings, he says.

Meanwhile, in an environment of sustained lower interest rates, more investors will begin to bypass bonds and move into riskier investments such as dividend-paying stocks to get some badly needed income.

"There is still some perceived safety and comfort in bonds," Fischer says. "But eventually, people are going to get tired of earning next to nothing in interest and recognize that they have to take some risk in order to get higher yields. So there is pent-up demand that's just beginning to come to the surface."

Many companies have excess cash on their balance sheets as well, and are likely to use it to increase their dividends. Last year, the S&P 500 companies' excess cash allowed them more than $50 billion in dividend increases, surpassing the previous year's increases by more than 82%. Remaining cash reserves offer ample opportunity to grow payments again in 2012.

"If I'm managing a company and just leave cash on the balance sheet, I earn nothing," says Fischer. "If I use it to increase dividends every six to nine months, investors are going to take notice. It's an easy win in this kind of economic environment."