Last year, stocks that pay above-average dividends were like the stock market's security blanket. In a choppy, uncertain environment where the assurance of a dependable dividend payout trumped the glamour of growth, they outperformed the rest of the market by attracting yield-starved investors coping with U.S. Treasury bond yields that had sunk below the rate of inflation.

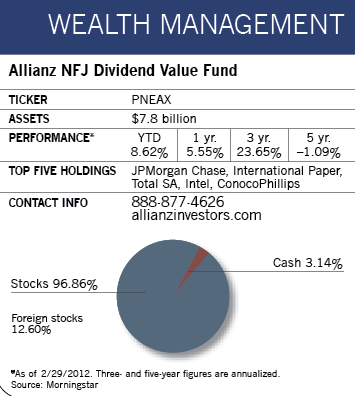

While it's hard to predict whether stocks with above-average dividends will beat the rest of the market this year, Ben Fischer, lead manager of the Allianz NFJ Dividend Value Fund, believes that over the long term dividends will play a more important role in contributing to total return than they have in the past.

"Going back from the early 1900s until today, dividends have contributed to about 45% of total rate of return for stocks," says the 69-year-old manager. "In the future, I believe that number will be significantly higher."

Earlier this year, Andreas Utermann, the global chief investment officer at Allianz Global Investors, elaborated on those sentiments in a report titled "Dividends Set for 1980s-Style Comeback." "We believe the contribution of dividend yields to total equity returns should grow in an environment of modest total returns," he noted. "We could see the contribution of dividend yields to total U.S. equity returns on a 15-year rolling basis double to roughly 60%, or higher, within a decade."

The idea that dividends will account for most of the stock market's returns may seem odd to most investors, who've been reared on the notion that capital gains are its driving force. But Fischer says several facts support the prediction.

For instance, during periods of slow economic growth, which most economists anticipate for at least the next couple of years, dividend payouts have historically been a major component of equity total return.

Next, higher interest rates, which often have a negative impact on dividend-paying stocks because they make bonds relatively more attractive, are unlikely anytime in the near future. With U.S. economic growth still sluggish, the Federal Reserve has already indicated that it intends to keep interest rates low at least until 2014.

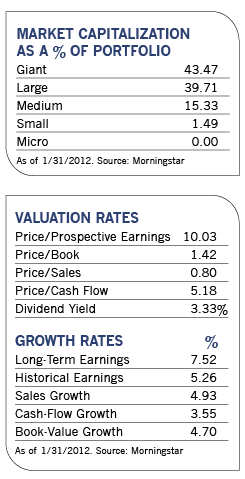

Another positive for dividend stocks is that valuations, which were driven up last year as more investors gravitated to higher-yielding stocks, remain reasonable. While Fischer believes certain sectors have become overvalued, he says overall valuations remain reasonable by historical standards. The dividend value stocks in his fund are trading at roughly 9 times next year's earnings, while stocks in the S&P 500 are trading at 13 to 14 times earnings, he says.

Meanwhile, in an environment of sustained lower interest rates, more investors will begin to bypass bonds and move into riskier investments such as dividend-paying stocks to get some badly needed income.

"There is still some perceived safety and comfort in bonds," Fischer says. "But eventually, people are going to get tired of earning next to nothing in interest and recognize that they have to take some risk in order to get higher yields. So there is pent-up demand that's just beginning to come to the surface."

Many companies have excess cash on their balance sheets as well, and are likely to use it to increase their dividends. Last year, the S&P 500 companies' excess cash allowed them more than $50 billion in dividend increases, surpassing the previous year's increases by more than 82%. Remaining cash reserves offer ample opportunity to grow payments again in 2012.

"If I'm managing a company and just leave cash on the balance sheet, I earn nothing," says Fischer. "If I use it to increase dividends every six to nine months, investors are going to take notice. It's an easy win in this kind of economic environment."

However, investors could run into trouble if taxes go up on dividend income. As part of an effort to bring the nation's debt under control, President Obama in mid-February called for significantly higher taxes on stock dividends in the 2013 budget.

Under that proposal, which would take effect next year, households earning more than $250,000 would see the tax rate on dividends increase from its current 15% to the highest rate on taxable income. Administration officials believe the move would generate some $200 billion over a decade.

Fischer thinks a higher tax rate on dividends might have a negative short-term impact, but points out that dividend-paying stocks did well long before 2003 tax relief legislation lowered the rate on qualified dividends. "The relative advantage of dividend-paying stocks doesn't go away just because the tax rate changes," he says. And of course, he adds, the increase in the dividend tax is by no means certain in Washington's stalemate environment.

Which Dividend Payers Will Pay Off?

Stocks with above-average dividends are a diverse group with different prospects and performance characteristics. They range from slow-growth stalwarts such as electric utilities to industries with better earnings growth prospects, such as information technology.

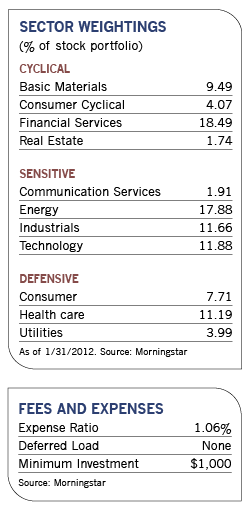

In addition to yields, Fischer also pays close attention to valuations and compares characteristics such as price/earnings ratios. He believes that investors piling into electric and gas utilities, as well as telecommunications companies, aren't considering their lofty prices. As a result, the fund is underweight in those areas relative to its benchmark, the Russell 1000 Value Index.

"These sectors are selling at 15 to 16 times next year's earnings," he says. "They're not areas I would consider to be attractively valued."

Morningstar analyst Katie Rushkewicz Reichart noted in a recent report that an underweight position in utilities hurt the fund last year, when the sector had a strong showing. Fischer also put a dent in performance when he sold some high-yielding telecoms such as CenturyLink after valuations rose to levels he considered unattractive, and moved into lower-yielding but more reasonably priced names such as Freeport-McMoRan.

"Moves like that have made the fund less defensive and more cyclical recently," Rushkewicz Reichart observed. "But they've also kept the fund's P/E and other valuation metrics below the benchmark's and most competitors."

Although the strict value discipline causes the fund to lag from time to time, it has meant strong performance for patient investors. From its inception in 2000 through the end of last year, the fund's 6.33% annualized return, based on net asset value, outperformed its benchmark by nearly 3 percentage points.

Fischer's risk-averse strategy has also prompted him to keep a light presence in the financial sector, which he believes is still susceptible to a sluggish economy. "One of the best examples of ugly is Bank of America," he says.

"Its stock has bounced around all over the place, it still has a lot of exposure to subprime mortgages, and its management isn't at all outstanding. We just can't see the reason to assume all that risk." Instead, he gravitates to companies that are less susceptible to loan losses, such as JP Morgan Chase and Ameriprise Financial.

On the other hand, the fund has an overweight position in established technology companies such as Microsoft, IBM and Intel. "These companies are selling at price-earnings ratios that are about 25% lower than that of the overall market, and they have ample cash flow to pay dividends," he says.

Fischer started buying Intel in 2010 and has paid an average price of around $20 a share. It's currently selling in the high 20s, which is about where it stood at its peak in late 2007.

"People have been bearish on the outlook for regular computers, as opposed to more exciting stuff like iPads," he says. "Intel isn't as exciting as Netflix or Apple, and there's not enough volatility in the stock to interest day traders. But we've made some good money on it, and it has a dividend yield of over 3%."

Fischer also likes energy stocks such as Total, Marathon Oil and Royal Dutch Shell. "These stocks have 4% to 5% dividend yields and are selling at single-digit multiples," he says. "They also have the wind at their backs because of increasing global demand and limited supply. I don't think cheap oil will ever come back."

A less-well-known holding, London-based offshore drilling contractor Ensco International, joined the portfolio late last year. While the company has the youngest and most capable drilling fleet in the group, he says, the stock trades at a discount to other offshore drillers and has a yield of close to 3%, which is above the industry average.

Stocks in the portfolio that have hit some rough patches recently include Whirlpool, which fell after sales growth and profits weakened because of sluggish global demand and elevated materials costs. Fischer says the stock is still attractively valued, and the company remains well positioned to support its 4% dividend yield.

Another fund holding, Chesapeake Energy, has been hurt by falling gas prices, oversupply concerns and large amounts of leverage. However, "the longer-term story for this stock remains intact," says Fischer. "It's selling off a lot of its real estate holdings to pay down debt, and once gas prices rise, the company will be in a more predictable, profitable environment. I'm not sure how long that will take, but as long as the fundamental story remains intact, I have no problem hanging on."