Inflation isn't dead; it just might not be where you think it is.

To find significant price increases, you need only look in the right places. There are many goods and services with rising prices, as well as those without. Together, they tell a fascinating tale about the modern global economy. Understanding the forces driving prices higher -- or not -- is crucial to investors and policy makers alike.

Given that the Federal Reserve has been trying to generate inflation for much of the past decade, the significance of the distribution is both important and telling. Why some prices are rising at twice the median rate of general inflation is worth delving into.

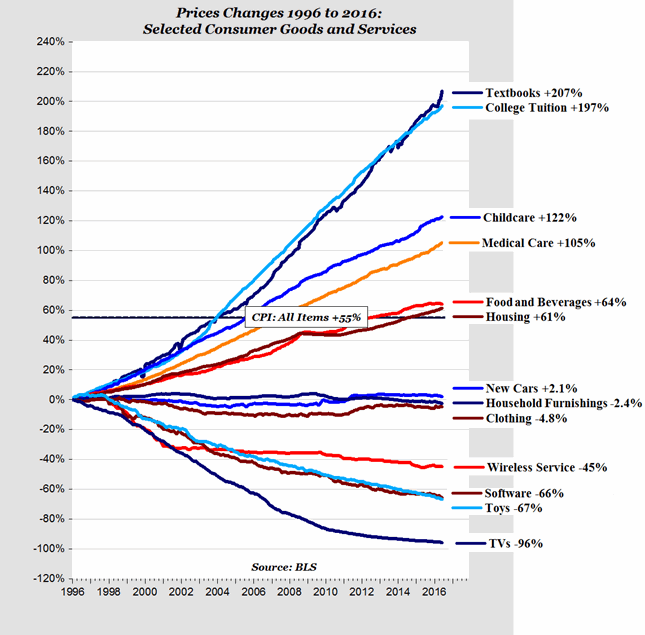

Look at the chart below: it show specific categories of goods and services versus the entire basket of goods and services that makes up the consumer price index.

Source: American Enterprise Institute

Let’s look a little more deeply at each category.

Textbooks: The industry operates as a quasi-monopoly. A student assigned a given text book doesn't have much choice. The rise of used-book exchanges provided some competition, but the publishers merely issue revised editions that are neither new nor improved. Inflation here is a function of rentier capitalism. Note that other kinds of books have fallen in price during the same period.

College Tuition: Blame demographics, guaranteed student loans and administrative bloat. The baby boomers' kids created many more potential college students than there were seats, leading to an imbalance in demand and supply. Responses varied from adding more professors to expanding class sizes to opening new schools.

But most schools responded by raising tuition.

And students paid. The Federal Reserve Bank of New York and the National Bureau of Economic Research looked at increases in student borrowing, funded largely through federal student-loan programs. There is a good argument to be made that this is what has driven much of the increase in college tuition.