In markets for which sharing businesses started earlier and have achieved greater scale, the impacts on established companies are already becoming clear:

– Barclays has estimated that car sharing, when combined with autonomous driving technologies, could in time lead to a 40% drop in the demand for cars and a 60% fall in the number of cars on roads globally

– Airbnb – which currently represents 1% of global lodging supply – could grow to 5% of the global market by 2020, according to Credit Suisse

– Peer-to-peer lending and small-and-medium-enterprise crowdfunding remain tiny as a market share (1%–2% of bank lending 6). However, global crowdfunding more than doubled last year to $34 billion7, and The World Bank estimates it will reach $90 billion by 2020

But more sectors may be at risk

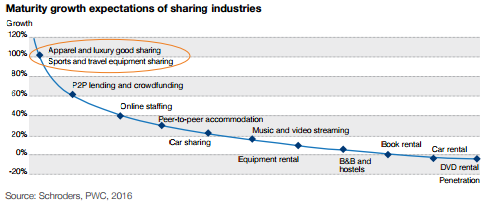

By examining large categories of spending on consumer durable goods with low utilization rates and for which physical sharing is straightforward, we have identified markets we think are likely to face new disruption, circled here in orange:

Sharing businesses are typically based on a kernel of innovation that allows them to undermine the economics of traditional peers. Airbnb uses the scale of an online marketplace to allow home owners to generate a positive return on property and eliminates redundant administrative and service overheads its users don’t require. Uber similarly leverages an online market place to bring together self-employed drivers and passengers. Had existing companies recognized those business model opportunities, they might have more easily stemmed their growth by adapting their own strategies.

Every industry will face different challenges

Companies are starting to find novel ways to adapt. Peer-to-peer insurer Lemonade is apparently looking at ways to leverage behavioral analytics and distributed ledgers (holding records with customers rather than centrally). Others – like Heyguevara, Bought by Many and Friendssurance – are building policy pools that create small “captive insurers” for groups of people or friends, who are likely to try to keep their claims and premiums down. Many established insurers are looking at ways of exploiting ubiquitous smartphone ownership to monitor driving behavior and even patterns of home occupancy. Another strategy is to buy emerging competitors once their business is scalable, although this is typically costly and difficult to execute.

We are monitoring trends to identify winners and losers