Key Points

• Changes in the composition of the bond market over the past decade have changed many bond indices.

• As a result, even a fund tracking a broad “core” bond index like the Barclays U.S. Aggregate Bond Index (Agg) may leave investors more exposed to both interest-rate risk and credit risk than they realize. It may be necessary to hold multiple funds tracking different indices in order to achieve a diversified fixed income portfolio.

• Periods of low volatility can mask underlying risks. Now that the Federal Reserve has begun to raise short-term interest rates, investors may want to consider re-evaluating their fixed income holdings.

Many investors use bond-index-tracking mutual funds or exchange-traded funds (ETFs) for their fixed income allocation. This can be a useful, low-cost way to access the bond markets. However, not all indices are created equal, and even a broad index may not be enough on its own to provide a diversified portfolio of bonds.

For example, the Barclays U.S. Aggregate Bond Index (Agg) is often used for the “core” component of bond portfolios. At Schwab, when we refer to “core” bonds we mean Treasuries, government-related, investment-grade corporate and municipal bonds. These types of bonds generally provide stability and diversification in an overall portfolio because they tend to have low volatility, low default risk and have little or no correlation1 with stocks. Core bonds are an important component of a diversified portfolio, and we suggest investors allocate the majority of their fixed income investments to these types of bonds.

However, in our view, the Agg isn’t always a good substitute for a core bond allocation. It tracks U.S. dollar-denominated, investment-grade, fixed-rate, taxable bonds, but it doesn’t include Treasury inflation-protected securities (TIPS) or floating-rate bonds, which could help reduce overall portfolio volatility if interest rates rise. Nor does it include municipal bonds, which provide income that is often exempt from federal taxes.

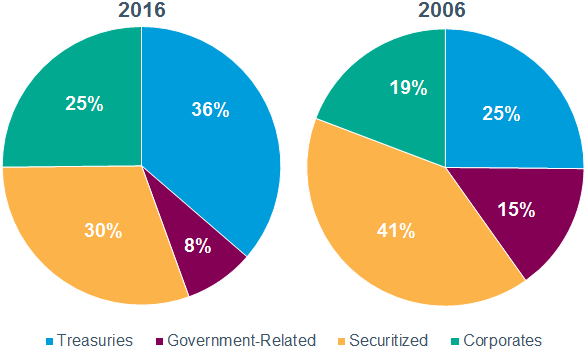

Treasury and corporate bond weightings are up, offsetting the drop in securitized and government-related bonds

Source: Barclays. Data as of 5/13/2016 and 4/30/2006, respectively. Each segment of the pie represents sector weights of the Barclays U.S. Aggregate Bond Index.

Moreover, market changes over the years have changed the risk profile of the Agg. The index now has a higher exposure to Treasury bonds and corporate bonds than it did a decade ago, because issuance in both categories has increased. Moreover, both the duration (a measure of a bond’s sensitivity to interest rate changes) of the index and its exposure to corporate credit risk have increased. The modified duration of the index has gradually headed higher and now stands at 5.5 years, compared with an average of 4.6 years in 2006. In rough terms, that means that a 1% rise in yields of bonds with 5.5-year duration would cause a 5.5% decline in the value of the bonds. With the Federal Reserve beginning to raise short-term interest rates, the higher duration of the index may leave investors exposed to more interest rate risk than they would like.

The Agg’s average duration has drifted higher over the past five years

Note: Duration is a measure of the price of a bond to a change in interest rates. Duration shown in chart is the average modified duration.

Source: Barclays. Monthly data as of 5/13/2016.

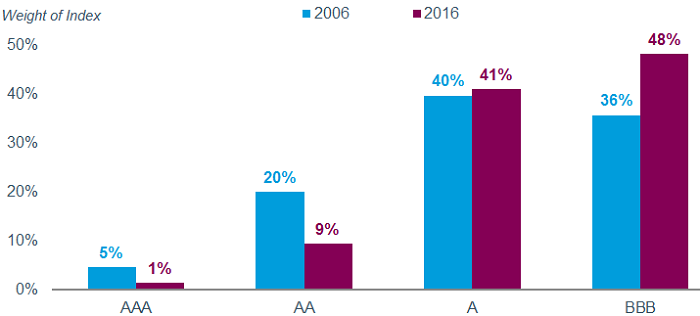

In addition to increased duration, the credit quality of the corporate bond component of the index has declined. Credit ratings for bonds in the investment-grade corporate universe have edged lower since the onset of the last recession. Currently only 1.4% of the corporate bonds in the index are rated AAA, the highest investment-grade rating, compared with 4.6% in 2006. Meanwhile, the percentage of bonds at the lower end of the investment-grade ratings spectrum, BBB, has increased from 35% in 2006 to 48% now. All in all, these changes mean that the Agg is now more interest-rate-sensitive and lower in corporate credit quality than it used to be. That may mean it doesn’t provide as much ballast to an overall portfolio as it did before the last recession.

Corporate credit ratings have deteriorated since the financial crisis

Source: Barclays. Barclays U.S. Corporate Bond Index. Monthly data as of 4/30/2006 and 5/13/2016, respectively.

What to do now

We suggest investors in index-tracking funds or ETFs re-examine the profile of the index to evaluate how much duration, credit and concentration risk they are taking. It may make sense to hold a combination of funds or ETFs that track different indices to provide a more diversified portfolio. We generally suggest holding about 80% of a fixed income portfolio in “core” bonds and allocating the other 20% to more aggressive income investments such as high-yield, international and emerging market bonds and preferred securities. With the prospect of higher short-term interest rates on the horizon, some allocation to bonds that benefit from a rise in rates, such as floating-rate bonds, could make sense as well.

For some investors, a combination of passive and active strategies might be a good alternative. An actively managed fund could provide access to a wider array of securities for greater diversification than an index fund. Also, a professional manager can adjust the duration of the funds’ holdings in response to interest rate changes and monitor the credit risk (however, actively managed funds tend to have higher fees, so that needs to be taken into consideration). For help in choosing mutual funds or ETFs, check out Schwab’s OneSource Select List® For help with your overall fixed income allocation, talk to a Financial Consultant or Schwab Fixed Income Specialist.

1 Correlation is a statistical measure of how two securities move in relation to each other. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random.

Kathy A. Jones is senior vice president and chief fixed-income strategist at the Schwab Center for Financial Research.