For many financial advisors, the aging of clients can be detrimental to their practices. When those older clients die or transfer their wealth to their heirs, the financial advisor typically loses their assets.

In a survey we performed of 489 financial advisors, about one-sixth of them lost $500,000 or more when a client died and the children or spouse inherited (Figure 1). Nearly a third of these financial advisors know peers who lost $500,000 or more when a client died and the children or spouse inherited.

Perspectives Of The Wealth Creators

Many strategies are being employed to maintain management of investable wealth during these transitions. Few are proving successful.

A key contributor to the lack of success is failing to understand the thinking of the wealth creators. To address this knowledge gap, we surveyed 179 wealth creators with investable assets ranging between $1 million and $8 million.

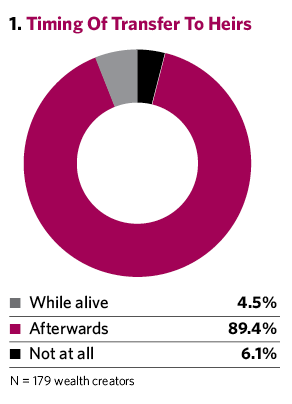

About nine out of 10 of the wealth creators anticipate transferring assets to their heirs when they die. (Figure 1). About 5% expect to transfer their wealth while they are alive. Six percent don’t plan to give to their heirs.

Since the overwhelming majority of wealth creators are giving their money through their estate plans, it’s insightful to realize that fewer than one in five of them has discussed his or her estate plans with heirs. More telling is that nine out of 10 wealth creators believe their heirs do not know the size of their estates.

There are a number of reasons that wealth creators do not discuss their estates with their heirs:

• It’s not a high priority in their family.

• Such discussion would cause problems and arguments.

• It’s not the concern of the heirs.

What is clear is that, according to the wealth creators, many next-generation inheritors have a limited knowledge of what they might very well inherit. This has significant implications for advisors trying to maintain management of the assets as the children inherit them.

Perspectives Of The Inheritors

To better understand the next generation, we conducted an exploratory study of 72 inheritors who received between $500,000 and $2 million. They ranged in age from 26 to 51.

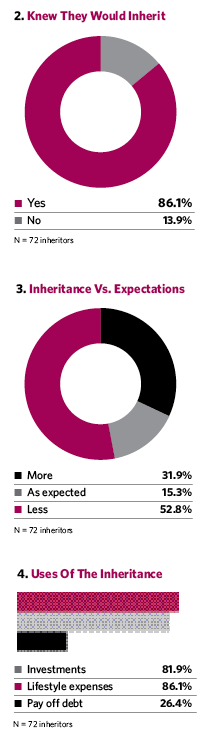

While most of them knew they were going to receive money from their parents (Figure 2), only 15% received what they expected. About 30% inherited more than they expected, while half inherited less (Figure 3).

It’s important to realize that more than a third of these inheritors were approached by the parent’s financial advisor. These approaches could have taken any number of forms. However, the intent of the financial advisor was clearly to build a relationship with the next generation in order to manage its inheritance.

When the next generation inherits, it’s critical to understand how they use the money. Almost nine out of 10 are taking some or all of the funds to finance their lifestyle (Figure 4). This ranges from buying a desperately needed new car to taking family trips to paying for their children’s college tuition. A little more than a quarter of them used their inheritance to pay off debts. Somewhat more than four out of five inheritors invested some or all of their inheritance.

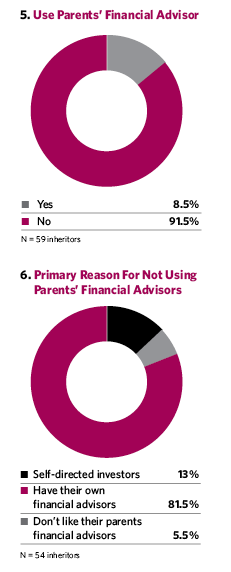

While the parents’ financial advisors approached some inheritors and many of the inheritors would be investing the money they received, few would use their parents’ financial advisors (Figure 5).

Using factor analysis, we identified the primary reason that inheritors do not use their parents’ financial advisors (Figure 6). A large majority had their own financial advisors. Thirteen percent preferred to manage the money themselves. Slightly more than 5% did not like their parents’ financial advisors.

The next generation, to the extent they are investing their inheritance, are not inclined to turn to the financial advisors of their parents. And, as this exploratory study suggests, it doesn’t matter if they were approached before they inherited. Again, these insights are important for financial advisors who want to capture the assets of their affluent clients’ heirs.

Focus On The Wealth Creators To Win Next-Generation Assets

There are a number of strategies financial advisors can use to increase their chances of winning those assets. Going directly to the next generation is relatively ineffective.

Instead, it’s essential that advisors focus on their relationships with wealth creators, with whom their recommendations carry more weight. After assessing the financial potential and scoring the quality of the relationships, advisors can facilitate estate planning by the wealth creators or provide educational programs for the next generation or leverage the strong relationships parents have with some of their children.

Russ Alan Prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.