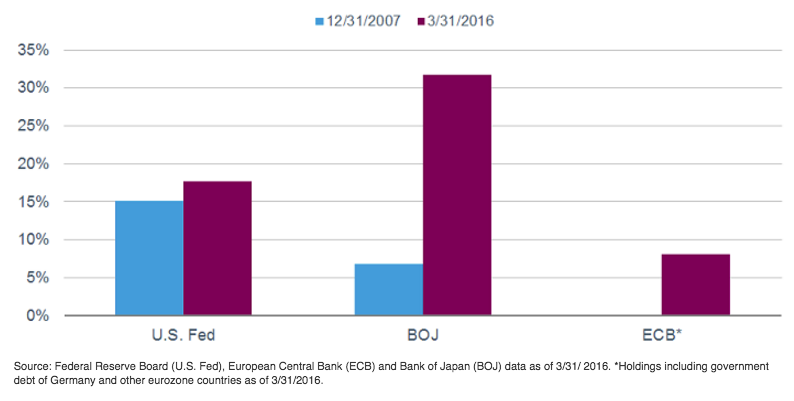

Central banks' holdings of government bonds as share of outstanding debt

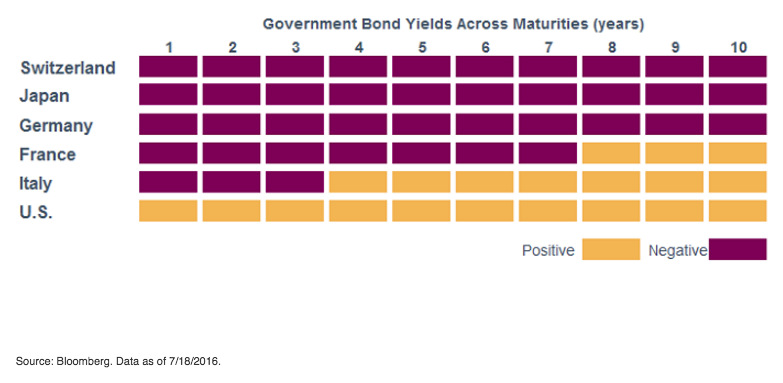

Meanwhile, demand for yield remains strong, especially in countries with aging populations. Pension funds, insurance companies and retirees are all seeking some sort of positive yield to help generate income. With more than $10 trillion bonds priced with negative yields to maturity, investors have driven up the prices of all types of bonds—even the riskiest, such as high-yield corporate and emerging market bonds. As paltry as they are, U.S. bond yields are significantly higher than yields in most other major countries, leading foreign investors desperate for positive yields to the U.S. bond market.

U.S. yields are by far more attractive than yields in other major countries

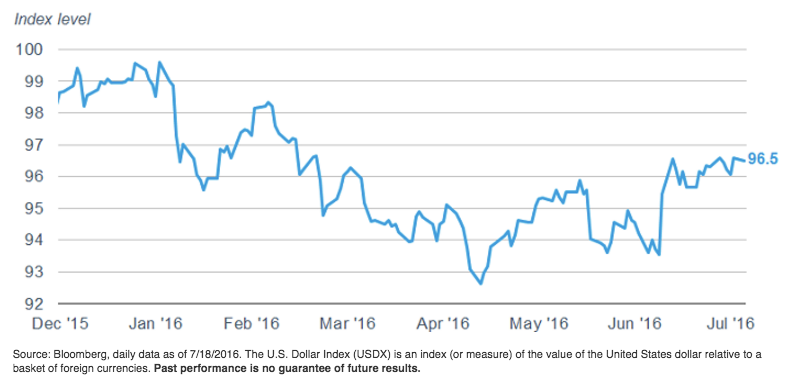

The inflow of foreign capital into the U.S. has boosted the dollar by more than 3% on a trade-weighted basis since the Brexit vote. The biggest increase has been against the British pound, which fell 11% against the dollar, but the euro is down about 3% and even the Chinese yuan is 2% lower. A strengthening dollar tends to hold down growth by making U.S. exports less competitive and reduces inflation because it causes import prices to fall. The trend in the dollar is a key indicator we watch since it often has the same impact as a Fed rate hike—slowing growth and lowering inflation.

The dollar is trying to do the Fed's job for it

What to do now:

We've always believed that the bond bull market would end with a whimper instead of a bang. Yields may have hit generational lows, but it's unlikely they will rise sharply or substantially any time soon. The forces holding yields down—slow growth, deflationary pressure from abroad, a firm dollar and demographic trends—are likely to remain intact for the foreseeable future.

We are concerned that in response to these factors, yield-starved investors are stretching too far into low-quality bonds and/or long maturity bonds without getting compensated for the risks. When evaluating a fixed income portfolio here are a few considerations to take into account and some resources to help:

Start with realistic expectations. We don't expect rates to rise soon, but we also don't expect returns for fixed income investors to be as strong in the next year as they have been in the past year. This article explains why market returns may not be as good in the future.

Match your bond holdings to your investment needs. Treasuries and investment grade bonds tend to add stability to a portfolio, while bonds with more credit risk can add income but carry a higher risk of loss. This article explains how to include an appropriate allocation to each, based on what you want to achieve.

Consider a laddered bond portfolio. Bond ladders—an investment strategy in which you purchase individual bonds with staggered maturities, spreading investments across a particular time horizon—are a way to avoid trying to time interest rate changes. The goal of a ladder is to have bonds maturing at set, but staggered, intervals. Short-term bonds provide stability and create opportunities to reinvest if rates rise, while the longer-term "rungs" of the ladder generate income. This article provides more details on how they work.

See the opportunity. Higher interest rates could spell the end of the bull market, as prices tend to fall when rates rise. But higher interest rates would also be a welcome change for investors seeking income in a low-yield world: Rising interest income would be a boon for investors with a longer time horizon. Consult a Schwab representative to get an evaluation of your current bond holdings and help with constructing a portfolio that meets your needs.

Kathy A. Jones is senior vice president, chief fixed income strategist at Schwab Center for Financial Research.