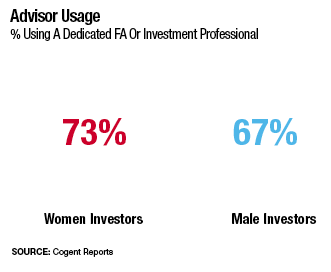

According to a recent study by Cogent Reports, women are more apt than men to rely on financial advisors to map their financial future. Is that a Men Are from Mars, Women Are from Venus thing?

“Perhaps, but I can’t speak to that because that wasn’t part of the scope of the research,” says Julia Johnston-Ketterer, senior director at Cogent Reports and author of the study, Gender Matters: Women and Investing, which evaluated the needs and behaviors of affluent female investors (those with at least $100,000 in investable assets). But what her research found was that households where women are the sole decision-maker or where women and men share the decision-making process are more likely to work with an advisor or investment professional to manage their portfolios than are households where affluent men are the sole decision-makers.

Johnston-Ketterer says her report countered the stereotypes that women are more conservative investors and less engaged in the financial process than men. To her, that underscores the need for a closer look at women investors’ role in the household financial decisions and the impact on future decisions.

“We know for sure that the overall influence these women have in financial decision-making, including choosing and using an advisor, is significant,” she says. “In terms of how advisors should be thinking about how best to serve women investors, one thing to think about is how decisions are being made in the household. If communication is being shared, does the advisor communicate with only one of the two decision-makers? If so, that could impact how decisions are being made and the outcome of how the money is being managed.”

Women Are Financial Advisors’ Friends

November 2014

« Previous Article

| Next Article »

Login in order to post a comment