“Looking ahead, the FOMC expects moderate growth in real GDP, additional strengthening in the labor market, and inflation rising to 2 percent over the next few years. Based on this economic outlook, the FOMC continues to anticipate that gradual increases in the federal funds rate will be appropriate over time to achieve and sustain employment and inflation near our statutory objectives. Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months. Of course, our decisions always depend on the degree to which incoming data continues to confirm the Committee's outlook.”

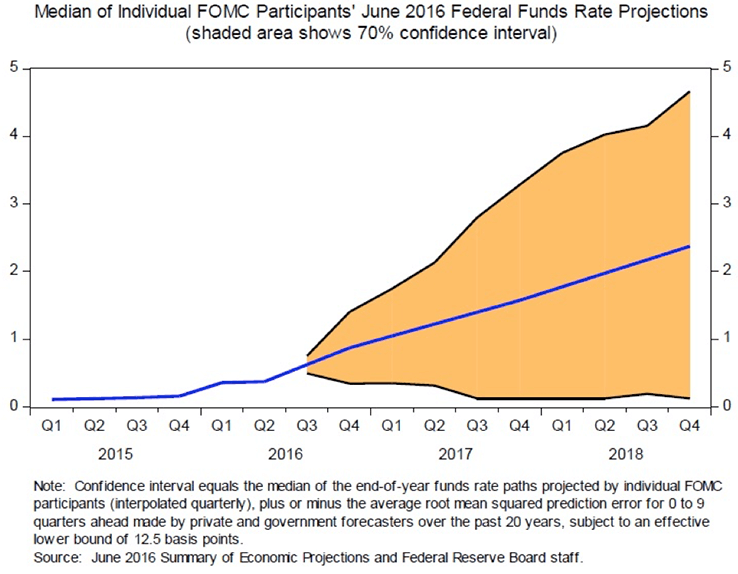

Yellen noted that “as ever, the economic outlook is uncertain, and so monetary policy is not on a preset course. Our ability to predict how the federal funds rate will evolve over time is quite limited because monetary policy will need to respond to whatever disturbances may buffet the economy. In addition, the level of short-term interest rates consistent with the dual mandate varies over time in response to shifts in underlying economic conditions that are often evident only in hindsight.” Fed mid-June officials’ projections of the appropriate path of the federal funds target rate vary widely. Yellen said the wide range is because “the economy is frequently buffeted by shocks and thus rarely evolves as predicted. When shocks occur and the economic outlook changes, monetary policy needs to adjust. What we do know, however, is that we want a policy toolkit that will allow us to respond to a wide range of possible conditions.”

The Fed played a critical role in stabilizing the economy following the financial crisis, but public opinion surrounding the central bank has been decidedly poor (largely reflecting a lack of understanding of what the Fed can do). Monetary policy cannot solve all of the economy’s problems. It is ill-suited to address the slowdown in productivity and the widening in income inequality. There were protests for “a people’s Fed” in Jackson Hole and Fed officials did meet with community activists. A rate hike in September would raise borrowing costs a little, but the Fed would see a greater good in promoting financial stability.

Scott J. Brown, Ph.D., is chief economist at Raymond James & Associates.