Investors think ETFs are fungible. They think that you can take one “large-cap” ETF and replace it with another and you won’t notice the difference.

Sometimes it’s true. The difference between the SPDRs S&P 500 ETF (SPY) and the iShares S&P 500 ETF (IVV) over the past year is 0.15%. Given that the funds are up about 30% each, that’s a rounding error.

Even when funds track different indexes, the differences in return can be small. The iShares Russell 1000 ETF (IWB) doesn’t track the same index as SPY or IVV, but it’s still a large-cap ETF. Over the past year it’s up 30.49%, while IVV is up 29.73%. Chump change.

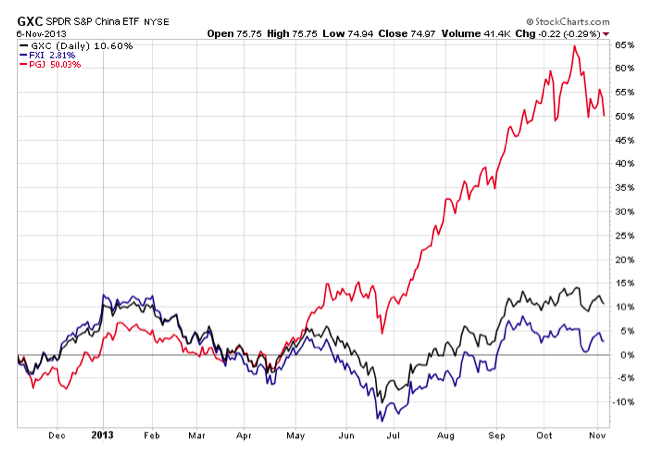

But sometimes, the differences are huge. Consider this chart of three popular China ETFs.

The most popular fund on this chart is the one at the bottom, the iShares FTSE China 25 ETF (FXI). FXI was the first China ETF to launch and has been around since 2004. It owns 25 of the largest, most liquid securities in China. These are mostly formerly government-owned firms such as China Construction Bank (9% of the portfolio), Industrial and Commercial Bank of China (8%) and Bank of China (6%). The fund is dominated by old-line sectors including financials (56%), telecom (16%) and energy (16%), and has just 7% of its portfolio in technology and 3% in consumer stocks.

It's gone nowhere over the past year, posting a meager 2.81% return due to slowing growth in China and mounting concerns about the stability of its financial sector.

Investors have $5.4 billion invested in FXI..

The second line on that chart, the SPDRs S&P China ETF (GXC), is a better fund. It holds a broad-based portfolio of 234 names representing all parts of the Chinese economy. It’s still heavily concentrated in financials (the largest sector, with a 33% weight), but it’s got a huge slug in technology (17%) and more than 13% of its portfolio in the consumer space. It’s even got a smattering of health care holdings (2% of the portfolio), which are utterly absent from FXI.

GXC is a great way to play broad-based China, and that’s why it’s outperformed: While the government sector has suffered, the consumer and tech economies in China are booming.

GXC is the IndexUniverse ETF Analytics Analyst Pick for China, meaning we think it is the best ETF for broad-based exposure. It has $907 million in assets under management, and is up 10.60% on the year.