Over the past 83 years, dividends have accounted for approximately 40% of the total return for the S&P 500 Index. The importance of dividends has been an often overlooked part of investing, but will continue to come to the forefront as baby-boomers prepare for retirement and look for high- and growing-income generating investments.

There are generally two schools of thought regarding how best to fund expenses in retirement. There are many who believe a total return approach is optimal, whereby an asset allocation and total return is targeted for the portfolio and a portion of the retirement assets is sold periodically to cover expenses. While this approach attempts to provide the growth that retirees need to outpace the effects of inflation, they may also be forced to sell assets at an inopportune time.

The second school of thought follows a high-income approach, whereby the portfolio is comprised of high-yielding income investments in an attempt to generate sufficient current income to cover expenses. This approach can leave a retiree too heavily exposed to fixed-income investments and the ravages of inflation.

In this paper, we will explore a third approach, which is a hybrid of the total return and high-income approaches. We will explore how an investment in stocks of companies that provide both high- and growing-dividend income can benefit a retirement portfolio undergoing the duress of withdrawals. This type of investment strategy can have the potential to provide a growing dividend-income stream as well as capital appreciation needed by retirees.

Understanding Yield

When reviewing income-generating alternatives, retirees often focus on current yield (the current income divided by the current price). This works well for fixed-income investments, which are, essentially, contracts that pay a certain level of income to the bondholder each year and then return the principal amount at maturity. However, for equity investments, where both the income and stock price may appreciate, looking solely at current yield can disguise the growth in the actual dollar amount of the income generated.

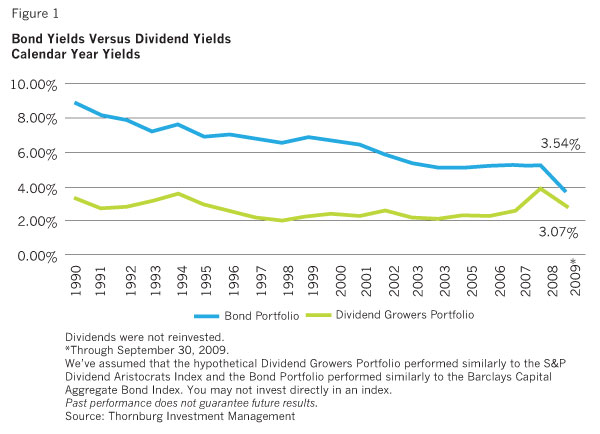

To illustrate this point, Figure 1 shows a comparison of bond yields versus equity yields over calendar years. At first glance, it is obvious that current yields on bonds are higher, but this higher yield comes with little to no potential for growth.

To show the difference between the growth of income provided from bonds versus a dividend-paying equity investment, in Figure 2, we calculated the amount of income generated annually on a hypothetical $1 million investment made in 1990. While the income from the bond investment steadily declined from 1990 to 2009, the amount of dividend income derived from the dividend-focused equity allocation grew steadily. Although beginning at a relatively modest level compared to the bond investment, the dollar amount of dividend income generated surpassed the bond income in eight years and ended at 153% of the bond income by 2009. For this example, it was assumed that the dividends were being used to support expenses and not being reinvested.

Total Return For Dividend Growers

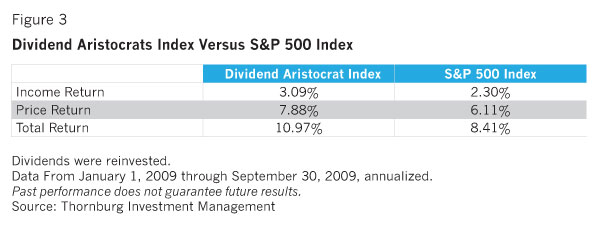

Our analysis assumes that the hypothetical Dividend Growers Portfolio performed similarly to the S&P 500 Dividend Aristocrats Index, a subset of the S&P 500 Index. It is comprised of U.S. companies that have consistently increased their dividends for the past 25 years. Since the Dividend Aristocrats Index began in January 1990, we can compare its returns versus the S&P 500 Index for the period beginning January 1, 1990, to September 30, 2009, to determine its performance in a dividend-focused retirement portfolio, from a total return perspective. For the results, see Figure 3.

What becomes apparent is that the total return for the Dividend Aristocrats Index of 10.97%, as compared to the return for the S&P 500 Index of 8.41% is very attractive.

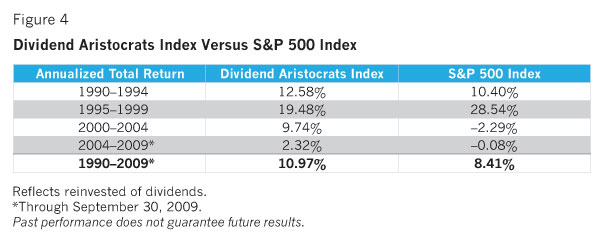

This test period included some very different investment environments, including the banking and real estate crisis of the early 1990s, the "Internet bubble" in the mid- to late-1990s that culminated with the 2000-02 bear market, and the maelstrom in the financial markets that began in late 2007. To determine how the hypothetical Dividend Growers performed during these difficult market scenarios, the 19.5-year period was segmented into five-year periods.

As the analysis in Figure 4 illustrates, the return for the hypothetical Dividend Growers, as represented by the Dividend Aristocrats Index, outperformed in three of the four periods. It only underperformed during 1995-1999, when investors were infatuated with high-growth stocks that fueled the Internet bubble and lead to the 2000-02 bear market. While the Dividend Growers didn't keep pace during this period of "irrational exuberance," they produced an attractive total return of 19.50%.

Dividend Income In Retirement

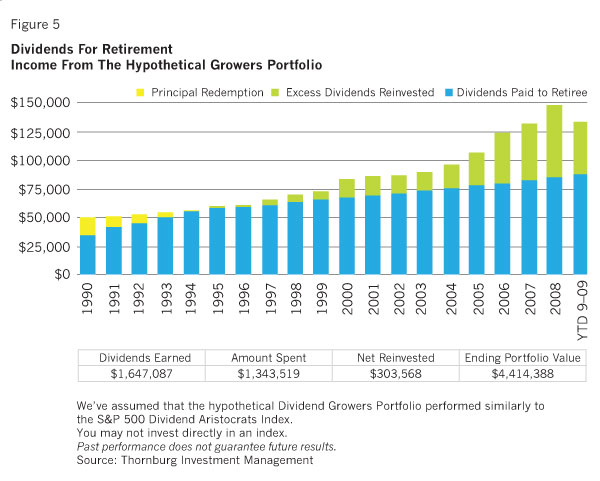

To illustrate how a dividend grower strategy can be used to fund a retiree's expenses, Figure 5 assumes a hypothetical $1 million retirement account invested in January 1990 in a portfolio that performed similarly to the S&P 500 Dividend Aristocrats Index. To calculate the retiree's spending, we assume that 5% or $50,000 will be needed to cover pre-tax expenses in the first year of retirement and then increase that amount annually by a 3% cost of living adjustment to cover inflation. For the early years in retirement, when dividends don't fully support the spending, the retiree will redeem a portion of the investment to cover the shortfall. For the later years, the dividend income beyond what is needed for spending was reinvested in the portfolio.

In this hypothetical, the Dividend Growers Portfolio generated sufficient dividend income to cover 100% of the retiree's spending after five years. Once this 100% coverage was achieved, it never fell below that level and generated excess dividends that could be reinvested into the portfolio. As summarized in the table below the graph in Figure 5, the initial $1 million investment produced $1.65 million in dividends of which $1.34 million was spent and $303,568 reinvested. The portfolio value, as of September 30, 2009, was $4.41 million.

For most retirees, developing a growing dividend-income stream should be an attractive alternative to the total return or high-income approaches described earlier. Having the retirement portfolio generate sufficient income to cover expenses while the portfolio is poised with an opportunity for continued growth should be a goal for every retiree.

Best Practices

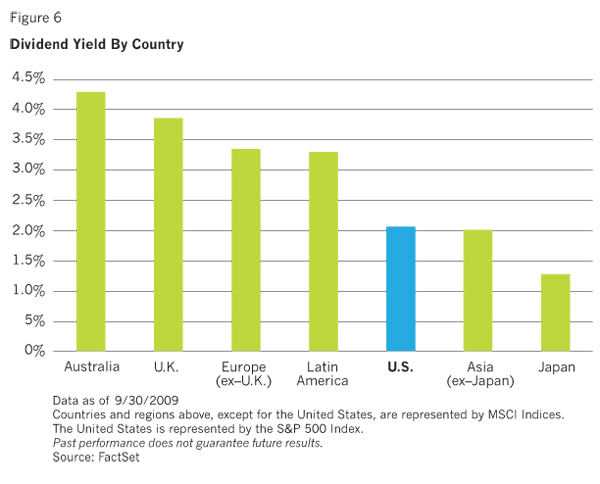

Before implementing a dividend-grower strategy, there are two improvements that should enhance the portfolio's diversification and selection of attractive dividend opportunities. First, looking for companies around the globe that offer both a high and growing dividend, versus limiting the investment universe to just domestic stocks, may improve results. As seen in Figure 6, dividend yields on average, outside the United States, have a tendency to be more attractive, given that culturally dividend growth is seen as a sign of financial strength.

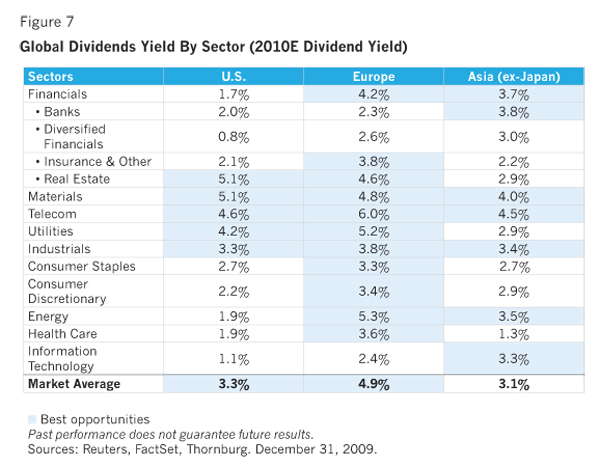

Another benefit from using a global approach is the opportunity to improve the portfolio diversification by industry sector. In the United States where attractive dividends are typically concentrated in real estate and utilities. Outside the United States, dividend opportunities exist in a multitude of sectors, as shown in Figure 7.

The second improvement when implementing this dividend-growers strategy would be to use an active investment management team that chooses investment opportunities based upon fundamental research. The decline of dividends for U.S. companies in the S&P 500 Index during 2008-09 has made the headlines recently, and even the Dividend Growers were not immune. It is important to use an active manager who can analyze both a company's willingness and ability to pay a high and growing dividend as a way to try and navigate around some of the dividend declines seen in the broader market.

As the baby boomer generation progresses on the road of retirement, a dividend grower strategy may be a prudent addition to their equity portfolios, as part of a core investment strategy. Not only can growing dividends help contribute to the retiree's distributions, but the portfolio value may also have the ability to outpace inflation through price appreciation.

Jack Gardner is the president of Thornburg Securities Corp., distributor of the Thornburg family of mutual funds, and a managing director of Thornburg Investment Management, the advisor to the funds. Gardner is a Certified Investment Management Analyst and Accredited Investment Fiduciary Analyst, and holds a B.S. degree in accounting from Stonehill College and an M.S. in computer information Systems from Bentley College. To read Managing Retirement Income: Part II, on spending plans, click here or Managing Retirement Income: Part I, on building cash flow reserves, click here.