Peering into the crystal ball for 2016, WalletHub, a personal financial resource and website, set out to see what the New Year has in store for a number of economic indicators.

For the most part, finances will continue in the current state: a few advances here, a few set backs there and a little trepidation on the part of all the prognosticators.

WalletHub sees 10 important financial developments that will provide challenges and opportunities for people’s pocketbooks and their investments in 2016 based on predictions from a number of leading financial experts. The report is available here. Following is the future as WalletHub sees it, in reverse order of importance:

10. Fannie and Freddie will say farewell to FICO.

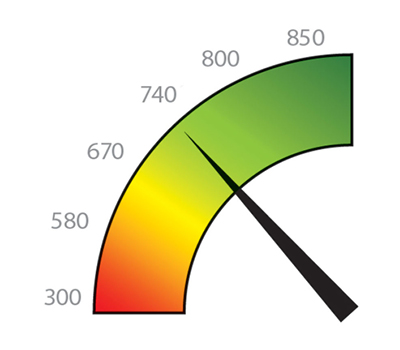

FICO credit scores are outdated. The proposed Credit Score Competition Act of 2015 in Congress would allow Fannie and Freddie to consider alternative credit scoring models. This bill has little chance of passage, but the combination of public pressure, rare bipartisan support and the fact that Fannie and Freddie need to tread carefully with members of Congress will likely result in changes, WalletHub says.

9. Medical records will become an increasingly attractive target for identity thieves.

While consumer concerns remain focused on retail data breaches, identity thieves seem to have moved on. Health-care data appears to be a common target because it contains a wealth of personal information that can be used to file false insurance claims or serve as a building block for seemingly unrelated financial fraud in the future.

8. Credit availability will contract as interest rates and defaults rise.

“I don't expect any major change in the availability of credit for those with good credit scores,” says Ann Dryden Witte, a professor of economics at Wellesley College. “However, families and small businesses with lower scores will likely see some tightening of credit as bankruptcies for high-credit-risk customers are beginning to rise.”

7. The housing market will be marked by slowed growth, higher costs.

The impending rise in interest rates will spur fence-perched potential buyers into signing contracts before costs get too high, but home prices are already projected to grow throughout the year as residential supply dwindles. The confluence of these factors in the context of a somewhat-stagnant economy will ultimately result in reduced robustness from the real estate sector.

6. The Fed will raise rates once in 2016, bringing its median target rate to 0.625 percent.

We foresee a very cautious bump in rates during 2016. This would represent a welcome development for borrowers, in terms of both minimizing the cost of credit card debt and financing major purchases, such as a home or a car—especially with some short-term interest rates already reflecting an expected Fed rate hike, WalletHub says.

5. Oil prices will experience a modest rebound.

“We may be talking about $30 per barrel oil early in 2016,” says Mark Johnson, an assistant professor of finance at Loyola University Maryland. “At some point, oil will rise as the active rig count continues to decrease and production starts to slow. I could see oil finishing 2016 at $40 to $45 per barrel.”

4. The U.S. auto industry will flirt with selling 18 million vehicles.

“If prices stay low for fuel, there will be more money available for other goods,” including cars, says Robert O. Weagley, chair of the personal financial planning department at the University of Missouri. If the auto industry does not break its record for annual vehicle sales – 17.4 million in 2000 – in 2015, that threshold certainly will be surpassed in 2016 as sales stretch to an almost-mythical 18 million vehicles, says WalletHub.

3. The S&P 500 will end the year at 2,188.

The marker will depend “on how many times the Fed raises interest rates,” Heath says. “The Fed doesn’t want to raise rates too high, too fast because that will only further strengthen the dollar as investments in Treasuries increase. Likewise, they don’t want to be too slow if labor market and inflation data indicate the economy is heating up. So, if the Fed hits the Goldilocks pace of rate increases, the stock market will probably dip a bit immediately after the rate hikes, but bounce back fairly quickly. In all cases of rate hikes dating back to 1982, the market dipped but then by a year later, had rebounded.”

2. The U.S. will approach full employment.

“The labor market will continue to be a theme,” says Julie Heath, director of the University of Cincinnati’s Economic Center. “The unemployment rate will drop even further, perhaps down to the mid-4’s, although probably more slowly as the slack in the labor market is taken up. That tightening will result in higher wages, but again, that will happen with a lag and slowly.”

1. U.S. GDP growth will be roughly 2.4 percent, lagging behind the worldwide average of 3 percent.

“I expect the growth to be in the lower end of the range between 2.4 percent to 2.5 percent,” says Donald Atwater, a professor of economics at Pepperdine University. “The reasons are the uncertainties surrounding oil and commodity markets, rising interest rates and disruptions from El Niño, terrorism and the national election.”