To paraphrase George Bernard Shaw: If all the economists were laid end to end, they’d never reach a conclusion, at least not the same conclusion.

Economists and financial pundits are famous for having strong opinions -- until they are proved wrong. Over the years, some have made mistakes that were whoopers.

GoBankingRates.com, an online financial and educational resource, has compiled some of the worst predictions that have been utttered about finances and the stock market. Following are GoBankingRates.com’s top 10 predictions that were proved glaringly wrong.

10. Jim Cramer’s Call To Bail On Hewlett-Packard

On Nov. 12, 2012, Jim Cramer, the host of “Mad Money” on CNBC, urged his audience to get out of Hewlett-Packard, based on his dim view of its corporate culture and other perceived issues. So what happened? In six months, HP shot up about 100 percent.

9. Marc Faber’s Blundered Call On Obama

As editor of the Gloom, Boom & Doom Report, Marc Faber is known in Wall Street parlance as a “permabear,” the kind of guy who believes that every silver lining has a cloud. As such, he’s made some wrong calls. On Nov. 8, 2012, Faber went for broke, and likely made some investors broke in the process.

On Bloomberg Business, Faber said the market would fall at least 50 percent after President Obama’s re-election, describing the President as a disastor for business. In the next nine months, the S&P 500 shot up by 20 percent.

8. Jim Cramer Failing To Go Bearish On Bear Stearns

On March 11, 2008, Cramer responded to a viewer’s concern over Bear Stearns’ liquidity problem. Three days later, Bear Stearns stock fell 92 percent on news of a federal bailout and $2-a-share takeover by JPMorgan.

7. One Of The Worst Google Predictions Ever

In 2004, hedge fund manager Whitney Tilson predicted Google would be “disappointing” to investors, according to CNBC. Between 2004 and 2013, Google’s stock price skyrocketed by more than 900 percent.

6. Failing To See The Enron Crash Ahead

Many investors got rolled with Enron stock, especially after Fortune magazine voted Enron “America’s Most Innovative Company” for six consecutive years from 1996 to 2001. The final year, Enron succumbed to one of the largest corporate scandals in history. The stock tumbled from $90 a share on Aug. 23, 2000, to 6.2 cents on Dec. 31, 2001, in a span of just 16 months. As late as September 2001, 16 analysts had buy ratings on Enron. Among Wall Street analysts at the time, “there were no sell ratings,” according to Theodore F. Sterling’s book The Enron Scandal.

5. SmartMoney’s Dumb Call on AOL

In December 1999, [the former] SmartMoney magazine, in its year-end predictions, named a number of dot-com stocks as sure winners for the future, and among their picks was AOL. This was right before the dot-com bubble burst, and enthusiasm was high on anything high tech. Iin 2000, AOL entered into a disastrous merger with Time Warner and subsequently lost 70 percent of its stock value.

4. Predicting Dow 36,000

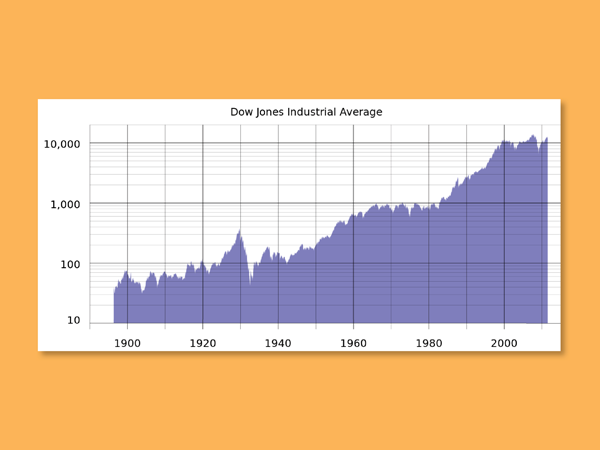

In 2000 Washington Post columnist James Glassman and economist Kevin Hassett published the first edition of Dow 36,000 in which they predicted the Dow Jones Industrial Averge would hit 36,000 within a few years. The main argument was that stocks and bonds should be treated as equally risky -- and that when the market woke up and realized that, stock prices would soar.

3. Forecasting Dow 100,000 By 2020

A year earlier, jourmalist andinvestment strategist Charles W. Kadlec predicted the Dow Jones Industrial Average would hit 100,000 by 2020. That was before the dot-com bubble burst and the Great Recession happened. Although it is still more than two years away, it is unlikely to come true.

2. Ravi Batra Predicting The Great Depression Of 1990 That Never Was

As an economist, author and professor at Southern Methodist University in Dallas, Ravi Batra authored a 1987 book, The Great Depression of 1990 and a followup, Surviving the Great Depression of 1990.

1. Missing The 1929 Stock Market Crash

One of the most infamous predictions in the financial industry takes the top spot. Even though the most devastating stock market crash in American history happened almost a century ago, urban legends of investors leaping out of windows to their deaths still resonate, GoBankingRates.com says. It all began on Oct. 24, 1929, as the market lost 11 percent of its value. Just seven days before, economist Irving Fisher had said stock prices had reached a permanently high plateau and that they would go even higher within a few months.

The full report can be found here.