Global stock markets are selling off hard after Russian military forces attacked a broad range of targets across Ukraine last night while Russian President Putin vowed to replace Ukraine’s government. What does it all mean for stocks and the economy? “Russia invading Ukraine has added to an already tense year, with investors selling first and asking questions later,” explained LPL Financial Chief Market Strategist Ryan Detrick. “But it is important to know that past major geopolitical events were usually short-term market issues, especially if the economy was on solid footing.”

Here we list 11 things you need to know.

• While the market reaction is likely to be more acute than the response to Russia’s illegal annexation of Crimea in 2014, the attack on American interests is less direct than Iraq’s invasion of Kuwait in 1990.

• Speaking of 2014, stocks and bonds in the U.S. both took that event in stride, while European stocks were considerably weaker for several weeks. Interestingly, crude oil spiked initially, then quickly sold off.

Source: LPL Research, StockCharts.com 2/24/2022

All indexes are unmanaged and cannot be invested into directly. Past performance is no guarantee of future results.

• Broader questions of the long-term impact on U.S. and European diplomatic and geopolitical goals, as well as the conflict’s impact on U.S. national interests, are significant but not in themselves market moving.

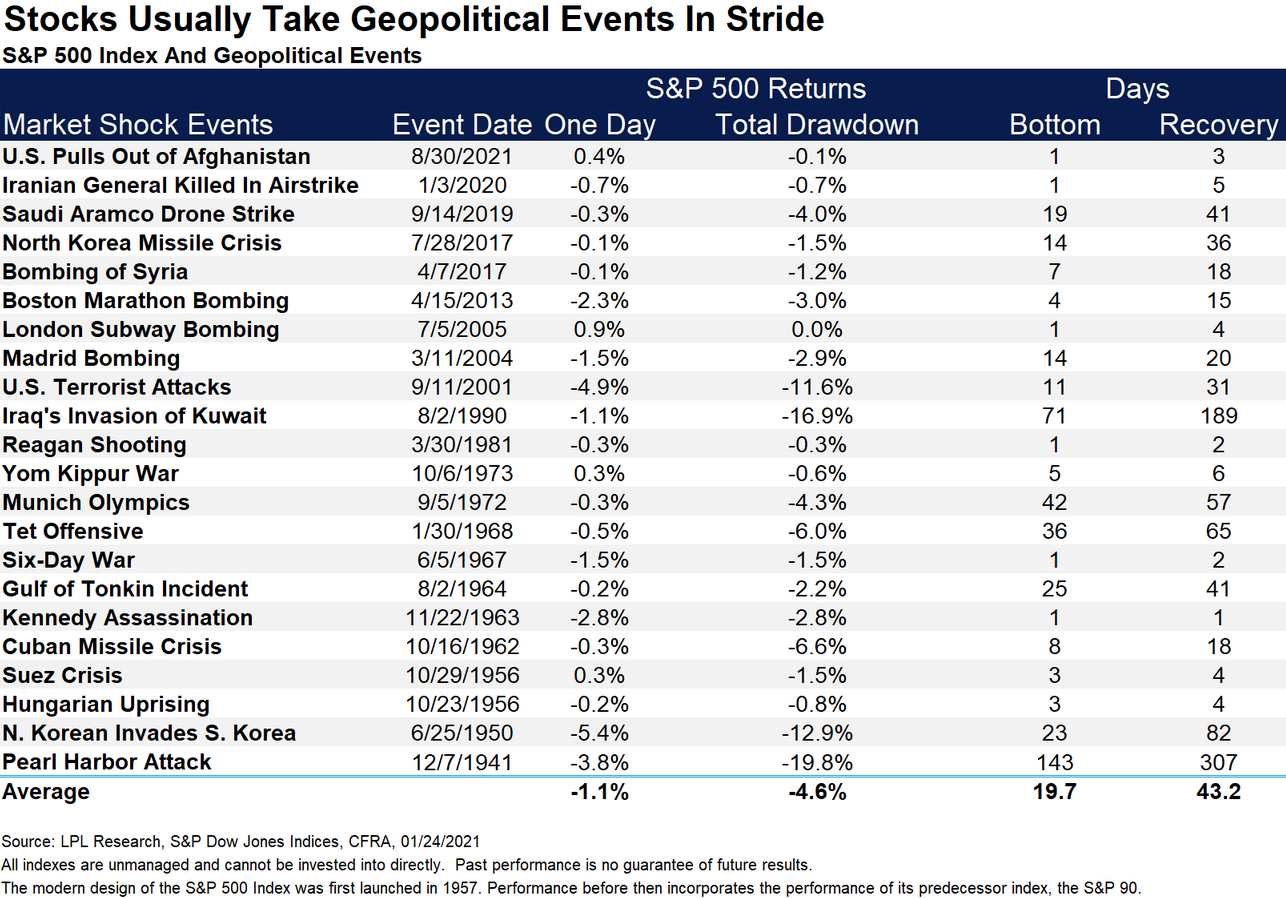

• Stock market drawdowns from geopolitical shocks average about 5% with recovery taking under two months, but larger conflicts in sensitive regions can be deeper and last longer.

• We do expect further market volatility as the situation unfolds and elevated uncertainty may persist for several weeks, but if the conflict is contained, we do not expect long-lasting contagion to broader markets.

• As shown in the LPL Chart of the Day, if the economy avoids a recession after (or during) a major geopolitical event, stocks usually do just fine. “We looked at 37 major historical or geopolitical events since World War II and found that if there is no recession then stocks gain nearly 11% a year later,” explained Ryan Detrick. “The flipside is if there is a recession, stocks are down more than to 11% a year later. Given we simply don’t see a recession on the horizon due to a strong consumer and corporate earnings backdrop, this recent weakness could be an opportunity for investors.”

• Upward pressure on commodity prices, already impacted by Covid-19-related supply chain disruptions, may see a more sustained impact as economic sanctions play out and will probably be the main source of risk for possible broader economic repercussions.

• European equities have done well relative to U.S. counterparts so far this year as U.S. megacaps have stumbled, but the relative performance may stall as the crisis plays out.

• There may be some market opportunities for very active traders during the crisis, but for most investors we believe understanding the typical market response to geopolitical risks and focusing on where we’re likely to be at the end of the year rather than at the end of next week or month is likely the best response.

• Building on the note above, past market corrections of 10-15% have been followed by rather strong future performance.

• From a purely technical perspective, we continue to see near-term opportunities in commodity-exposed equities.

This is a very fluid situation and one that we are watching very closely. Please continue to follow LPL Research for any updates.

Ryan Detrick is chief market strategist for LPL Financial.