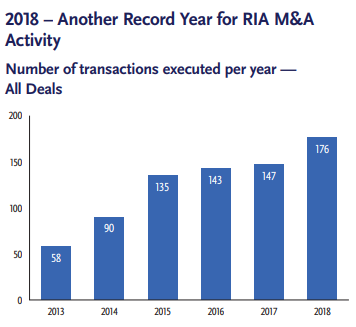

Aided by a strong fourth quarter on the deal-making front, the RIA industry completed 176 mergers and acquisitions in 2018 and marked a fifth consecutive record year of M&A activity, according to a report released Wednesday by DeVoe & Company.

It was a bookend-type year with the record-breaking first and fourth quarters bracketing slight declines during the second and third quarters. The turmoil in the equity market at the end of the year seemed to goose the M&A market. The 54 transactions during the fourth quarter doubled the amount from the year-earlier period.

“The stock market drama creates a new plot twist, potentially impacting valuations and driving many owners to take a hard look at their path to a potential sale,” said Francine Miltenberger, managing director at DeVoe & Company, in the report.

More than half of last year’s 176 transactions entailed established RIAs selling to, or merging with, another RIA firm. The remaining deals involved breakaway advisors—advisors/teams at wirehouses, independent broker-dealers and RIAs—who left their employer to join a RIA.

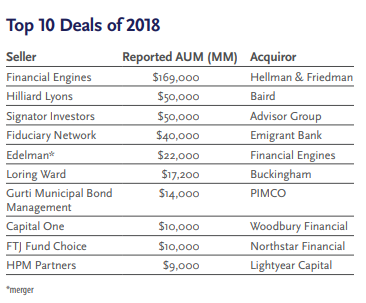

The DeVoe & Company RIA Deal Book report said that M&A transactions last year represented $513 billion in assets under management, fueled by some of the largest deals in recent years. The 10 largest transactions in 2018 involved $391 billion in assets, which was 24 percent greater than the prior year and a whopping 466 percent more than the $69 billion in 2016.

Among last year’s highlights was the April blockbuster deal where private equity firm Hellman & Friedman purchased Financial Engines and combined it with Edelman Financial Services. “The combination of the two technology-savvy advisors expands their geographic footprint, while delivering a broader service offering to the mass affluent and retirement markets,” according to the report.

Consolidators and RIAs combined for 81 percent of total acquisitions of established RIAs. Banks acquired 8 percent of established RIAs, while the “other” category comprised the remainder.

In its report, DeVoe & Company said it expects M&A activity to rise at an accelerating pace during the next five to seven years. But it noted that certain industry demographics and trends—including the aging advisor population and the dearth of written succession plans—could create periods of logjams with more sellers in the market than buyers, which might lower valuations and create periods of lower M&A activity.