Financial services leaders and financial advisors are enthusiastic about the coming year and optimistic about growth, yet the majority does not feel confident about addressing their top objectives, according to the annual Beacon industry trends report from global consulting firm North Highland.

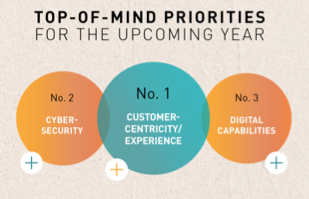

The top cited priorities for 2019 include: 1) client-centricity/experience, 2) cyber security, and 3) digital capabilities. But, only a minority of respondents feels very prepared to address these categories: 16 percent, 42 percent and 14 percent, respectively. Why the low confidence?

For many firms, the muscle that’s used for revenue generation has atrophied after the past several years of focus on cost take-out and regulatory implementation. Now, companies are reimagining growth opportunities through improved client experiences powered by digital capabilities and secured data insights. For financial advisors, this means digital tools to more quickly gather and aggregate client information and capabilities to model real-time scenarios.

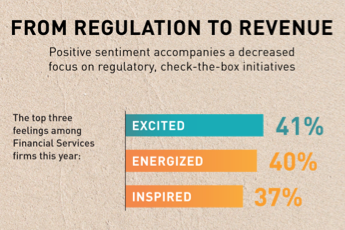

Leaders relayed positive sentiment: 41 percent feel excited, 40 percent energized and 37 percent inspired. This is mostly attributed to decreased focus on check-the-box regulatory initiatives. Although the proposed SEC Best Interest regulation is still unfolding, most firms have put similar standards and operations in place to meet requirements of the DOL Fiduciary Rule. Firms that did so are in a stronger position to embrace growth.

Top Priorities To Drive Growth

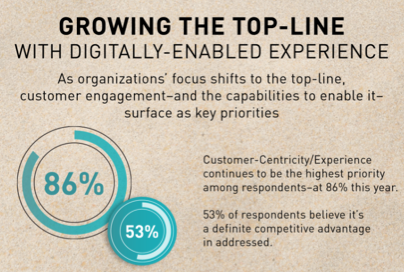

1. Client-Centricity and Experience—For wealth management firms and financial advisors, a profitable and sustainable client relationship is vital to success. While 86 percent of respondents rank this a priority, only 16 percent feel very prepared to address the opportunity. Why the gap?

• First, most firms have not turned themselves inside out. To be client-centric, you must know what your clients and prospects need, want and expect through research/data insights. Assets under management and demographic information are no longer sufficient predictors for a good fit in a practice. Firms and advisors need to understand if client experiences are truly client centric (personalized and flexible) or if they are firm centric (standardized and static). Have you asked your clients recently what they want in a relationship?

• Additionally, even those who have asked clients what they want are uncertain about how to innovate across the end-to-end-client experience. Most firms are still siloed in strategy and operations. For the client experience to be successful, sustainable and profitable, all areas of the firm must align with the same blueprint in a collaborative way. Technology may focus on building data stores and tools, but the business needs to understand how to intelligently use those solutions for more client-centric experiences.

2. Cybersecurity—Trust is paramount with clients, especially when it comes to their personal information. Clients expect that financial advisors and firms will only ask for data relevant to their financial situation and that data is secure from outside and inside threats. Of those surveyed, 42 percent feel very prepared to address cybersecurity concerns. However, with ever-evolving technology and human error threats, the industry cannot afford to become complacent. And while firms may feel confident about cybersecurity, clients in this sector are not as confident. Cybersecurity is a two-sided coin with the coexistence of technology and skilled workforce talent. One breach can immediately erode confidence, and everyone must be prepared for not if, but when a breach will occur.

3. Digital Capabilities—There’s no longer a separate digital strategy; it should be embedded in every strategy. What has changed significantly are client expectations regarding what a firm’s digital tools should deliver.

One can look at robo-advisors as an example of how digital capabilities changed expectations and value propositions. While virtually every financial services firm now has a robo-advisor, most are still figuring out how best to integrate digital advice with financial advisors and call centers. The near future will see digital advice as simply one more offering, integrating with financial planning aggregators, dynamic scenario tools that build what-ifs based on economic, political, sociological factors and more. All these digital capabilities are desired and used across generations and demographics. The industry has certainly evolved beyond thinking that “digital equals millennial.”

Another reason for low confidence is the need for firms to work in a more agile way. Only 16 percent of respondents feel very prepared to address agile ways of working. This requires more collaboration across business lines, different ways of assessing successes and failures, rapid feedback loops, faster deployment of digital tools and evolved ways to reward/recognize the workforce. Agile is not merely a technology process, but an entirely different way of addressing client expectations and changing demands.

How Can The Wealth Management Industry Capitalize On Opportunities At Hand?

1. Gain a thorough understanding of who your clients are and what they need/expect. Go beyond traditional segmentation and use behavioral insights to define and deliver a unique experience that stands out among your competitors. Increasingly, firms are using intelligent automation tools and techniques to make recommendations on answers to questions.

2. Design strategies that tie together the end-to-end client experience across your firm—integrating people, process and technology—to deliver a client engagement that is profitable and cost-effective. The first step is to create a service design blueprint that enables your firm to not only know the ideal client experience, but also serves as a tool for future changes.

3. Assess your workforce to ensure you have skillsets, like experience design and agile product ownership, to bring these strategies to life. Instill a common organizational vision of how new ways of working will be applied. Then, articulate a roadmap to upskill your existing workforce and/or retire and replace with the skills needed for the future.

Yes, 2019 will be the same in some respects. Many of your clients’ goals will remain consistent: they still want to buy homes, send their children to college, retire, take vacations, etc. But, how the wealth management industry and financial advisors respond to client needs will and must change to ensure continued relevancy in their lives—and the pace of the response must be accelerated.

Jill Jacques is Global Financial Services lead for North Highland, a management consulting firm.