Have you been in the investment advisory business for five years or more? Do you have at least $50 million in assets under management? Do you offer services and financial products that go beyond investing? Are you committed to working with wealthier clients?

If so, it’s entirely possible you could increase your revenue by 21% in 2021.

The reason those with $50 million are in such a good spot is that it’s harder to increase revenue by that much if you’ve got $200 million in assets, when the base is much bigger.

But if you are in the right spot, we find it takes a two-track approach to grow the top line of your business.

1. It means delivering added value to clients: There is often so much more advisors can do for their clients, especially wealthy clients and business owners. Clients with complex money situations and many nuances give you traction to do more for them. When you offer more solutions, especially non-investment products, you can garner more assets, and you also find yourself getting referred to other clients more often.

2. It means offering your value to other professionals: Most financial advisors are not getting many new wealthy investor referrals from other professionals like attorneys and accountants. But those who work on their relationships with influential professionals in other spheres will be able to create a pipeline of wealthier clients.

There is nothing magical about the approach. You have to help other people build their own practices. When you do, they’ll usually help you do the same. It doesn’t mean you have to bring new clients to their doors—many advisors have the wrongheaded notion of reciprocity, that clients can be traded like currency. Instead, what they should be focusing on is helping other professionals build their own careers.

In both these cases, you can supercharge your practice by understanding the needs and wants, the hopes and dreams, the concerns and anxieties of other people, whether it’s clients or the third parties working for them.

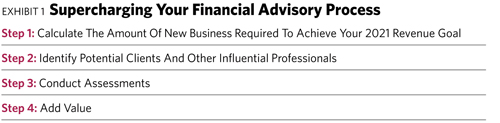

Here are the steps to supercharging your practice:

Step 1: Calculate the new business required to reach your revenue goal. First, specify your revenue goal for 2021. Let’s say you want to generate $2 million in revenue in 2021. Take your current recurring revenues. Then determine how much more you can generate with your current clientele, as well as how many new clients—doing what kind of business—would allow you to get to $2 million.

Your calculation for the year is likely going to be wrong when you look back at it in December. Precision is not the point. But you will get a “feel” for what it’s going to take, and that’s often enough to motivate you. You’re also going to realize that you probably don’t need that much more business from either current clients or new ones to reach the goal. That’s motivating too.

Step 2: Identify potential clients and other professionals who can help your cause. Time is one of your most valuable resources. So you have to focus on those clients and other professionals most likely to help you grow. Create a short list. Narrow down the field to people based on their potential—both the clients and the professionals who have wealthy clients you’re interested in.

Step 3: Conduct assessments. For every client and professional on your list, evaluate the opportunities. Use your empathy here. Think about what these clients on your list are feeling. What do they really want? What is in their self-interest? Ask open-ended questions, things that can’t be answered “yes” or “no” but that lead to other questions.

After that, you can decide if there are opportunities for you to help them, offer them valuable help and seriously increase the potential for your own practice.