In general, some of the best investment opportunities come when the following conditions hold: 1) the market is pricing in a pessimistic outlook in the form of lower valuations, 2) earnings estimates are being revised higher and growth is accelerating, and 3) technical analysis indicators suggest an impending rebound.

These three conditions may be in place right now for the energy sector. Though a controversial investment for some, a look at fundamental and technical conditions accompanied by attractive valuations for the sector reveals a potential attractive opportunity.

“It looks like energy stocks still want to go higher,” wrote LPL Chief Equity Strategist Jeffrey Buchbinder. “There’s a healthy dose of pessimism baked into the sector while the fundamental outlook still looks positive overall. The sector’s strong gains since mid-July have encouragingly come without much help from oil prices.”

As shown in the LPL Chart of the Day, perhaps the best reason to consider the sector right now is it’s starting to work. Since August 4, the S&P 500 Energy Sector Index is up over 16% while the S&P 500 is flat.

Let’s dig a little deeper. Here are five reasons to think about initiating or increasing energy sector allocations in your stock portfolios:

1. Improving fundamental outlook. OPEC just told us that they may cut production to support prices due to concerns about global recession. The energy sector has underinvested in recent years—partly due to the political environment and ESG movement. China still has a reopening ahead of it. The latest U.S. inventory data was bullish as U.S. stockpiles fell amid record petroleum exports. And an Iran nuclear deal to clear a path for Iran to sell more oil remains elusive.

2. Technical analysis picture looks good. Improving relative strength after brief period of underperformance points to a potential rebound, as shown in the chart above. A possible return to June relative highs introduces the possibility of 20 percentage points of relative outperformance. The sector, which is only 10% below its all-time high on June 6, is still in a long term uptrend. And breadth is strong, with over 90% of stocks in the sector at 20-day highs as of August 23.

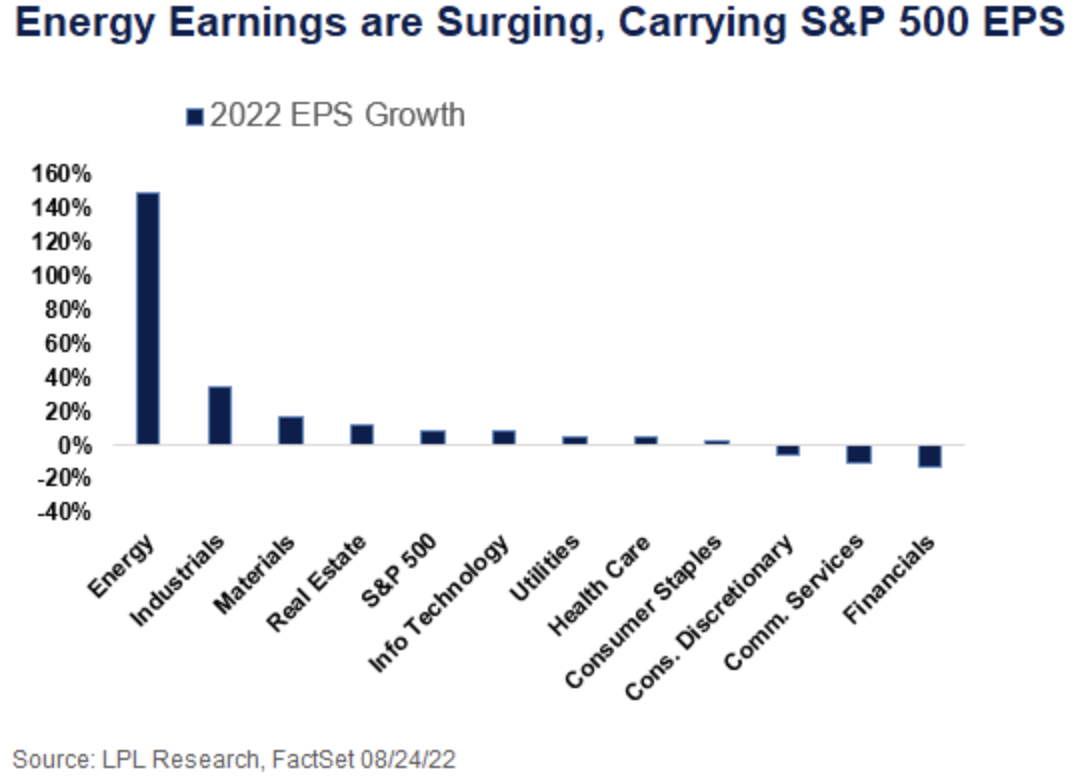

3. Strong earnings momentum. With second quarter earnings season behind us, energy was the clear winner in terms of earnings growth and earnings revisions. Not only did energy generate the most earnings growth by far in the second quarter—and will lead this year as shown in the chart below—but the sector saw the largest upward revision to consensus estimates for 2022 and 2023 among all S&P sectors. Those earnings have increasingly supported dividends and share repurchases.

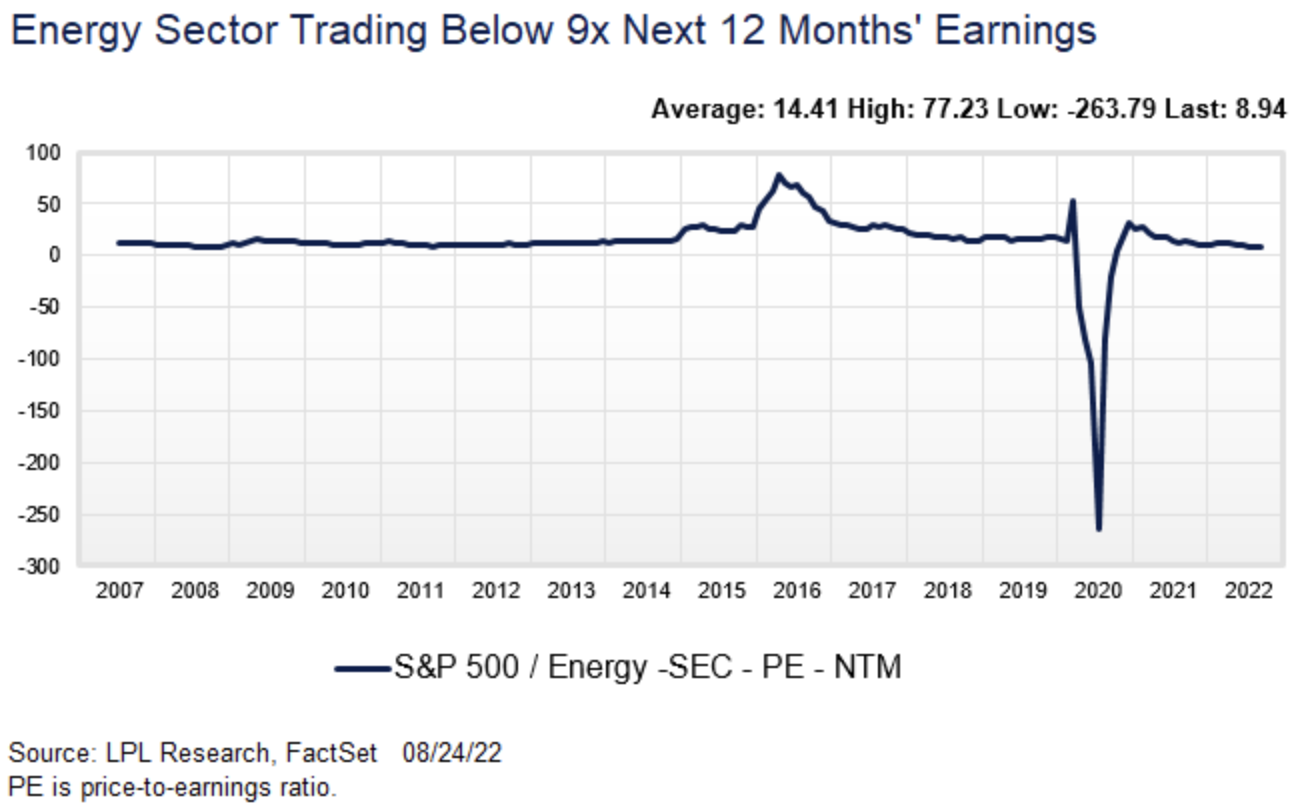

4. Valuations still reflect pessimism. It’s difficult to assess value in the energy space because no one knows where oil and gas prices are going. But if we make the assumption that prices will be stable or higher in the months ahead—a reasonable assumption we think—then energy sector valuations look quite compelling. Forward estimates imply a price-to-earnings ratio below 9, as shown in the chart below, compared to the S&P 500 at 17.5. Cash flow valuations look just as compelling, with free cash flow yields over 10%, more than double S&P 500 levels (free cash flow yield is how much cash is generated after capital expenditures relative to share price). On a price-to-book value basis, the sector’s valuation is not as compelling at 2.4 times, but that is roughly in line with the long-term average and hardly expensive.

5. Follow Warren. Warren Buffett and company (Berkshire Hathaway) have been big buyers in the energy sector recently. In fact, on August 19, Mr. Buffett received approval to purchase up to 50% of Occidental Petroleum (ticker: OXY). Berkshire owns over 20% of the company as of the latest SEC filings and has been aggressively buying. We’re not saying buy OXY, but rather that if Mr. Buffett likes the energy sector that much, we should pay attention.

So there are our five reasons to consider adding energy exposure. We believe the odds favor the sector going higher in the coming months. The energy markets are tight and getting tighter, while valuations look attractive and profits are on the upswing. Finally, being on the same side of a trade as Warren Buffett probably isn’t a bad thing!

Jeffrey Buchbinder, CFA, is chief equity strategist at LPL Financial.